Stocks are under a BIT of selling pressure because inflation figures came in a BIT hot. More in a minute. As for other markets, crude oil is modestly higher along with the dollar. Treasuries are selling off modestly, while gold and silver are flat.

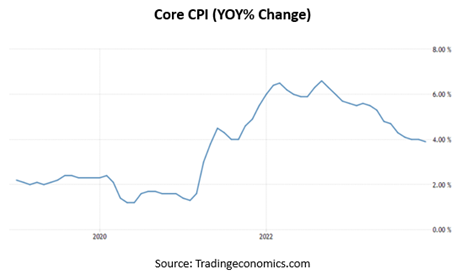

Today’s markets are all about INFLATION, with the latest Consumer Price Index report hitting the tape this morning. Economists expected a 0.2% rise on the headline CPI and a 0.3% rise on the core. Both figures came in at +0.3%. Year-over-year inflation is now running at 3.4% overall and 3.9% on the core.

Those readings are a BIT hotter than expected. But the core inflation rate is now at its lowest level since June 2021. Moreover, housing inflation is a “sticky”, lagging component of the CPI that is expected to come down. That’s because it takes a while for government stats to capture the decline in rent hikes many tenants and analysts are seeing in real time.

Who cares most about all this? The FED, that’s who! The more inflation moderates toward the Fed’s long-term target of 2%, the more the Fed can cut rates this year. The current federal funds rate target is 5.25% to 5.5% -- its highest since 2001. Rate futures markets are looking for as many as six 25-point cuts through the end of 2024.

In other news, the SEC did what many analysts expected and approved 11 “spot” bitcoin ETFs. They will begin trading today, something that will boost investment in cryptocurrencies by mainstream investors. ETF sponsors like BlackRock (BLK), Fidelity Investments, and WisdomTree (WT) should benefit as money flows to their products, as should custodial and crypto exchange firms like Coinbase Global (COIN).

Finally, we’re seeing a wave of layoffs hit companies like Alphabet (GOOGL) and Amazon (AMZN) as even cash-rich “Magnificent Seven” companies look to cut costs. Google is letting workers go in its digital assistant and engineering groups, while Amazon is focusing on trimming positions in the Prime Video and Amazon Studios businesses.