Wall Street has a case of the “Blahs,” with stocks sliding on policymaker comments and disappointing data out of China. Crude oil is notably lower, too, while gold and silver are down a bit along with Treasuries. The dollar is flattish.

Federal Reserve officials are really, REALLY trying to dissuade Wall Street from the idea of “quick, deep” rate cuts. Yesterday it was Fed Governor Christopher Waller’s turn to underscore that policymakers will only cut rates “methodically and carefully.” Stocks slipped in response, though the S&P 500 is still just a little below the flatline so far in 2024.

A deep slowdown. A real estate market collapse. Rising deflation risk. No, it’s not the US circa the Great Financial Crisis. It’s China today! While GDP grew 5.2% in 2023, home prices just fell the most in nine years, housing starts tanked almost 21%, and a price gauge in the GDP report slipped 1.5% in Q4. We’ve now seen outright deflation for three straight quarters, China’s longest streak since 1999.

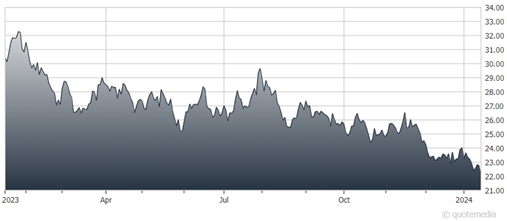

iShares China Large-Cap ETF (FXI)

Not surprisingly, Chinese stocks can’t get off the mat. Hong Kong’s benchmark index dropped almost 4% on the news. Here in the US, the iShares China Large-Cap ETF (FXI) is down 27% in the last 12 months, while the iShares MSCI Hong Kong ETF (EWH) has fallen 23%.

Finally, the pioneering alcohol delivery service Drizly will soon shut down. Long before the COVID-19 pandemic led to an explosion in business for delivery-on-demand services, three Boston College students founded Drizly as a company that would deliver beer, wine, and spirits to thirsty drinkers as needed. Uber Technologies (UBER) acquired the firm for $1.1 billion in 2021, and will now retire the brand and fold its operations into its Uber Eats division.