Yesterday was a mixed day behind the scenes, but the S&P 500 managed a modest new high regardless. Stocks are up again in the early going here along with long-term Treasuries, gold, silver, and crude oil. The dollar is taking a hit.

The 2024 presidential election is increasingly looking like it’ll feature a rematch between President Joe Biden and former President Donald Trump. That’s the takeaway after Trump beat Nikki Haley by around 11 percentage points in the New Hampshire primary. It remains to be seen if or when Haley will drop out of the race, but she is polling far behind Trump in South Carolina. That is the state she used to lead as governor and residents there will vote on Feb. 24.

Source: Wall Street Journal

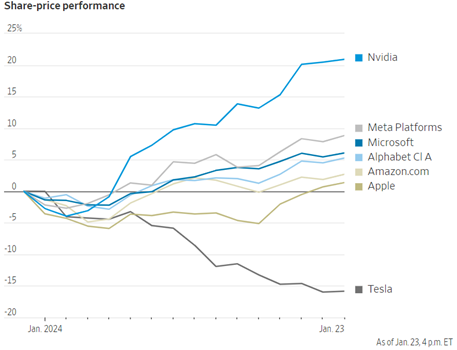

Meanwhile in the markets, the “Magnificent Seven” are back to their old tricks. The big-name tech giants – Alphabet (GOOGL), Amazon.com (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA) – are returning roughly twice as much as the S&P 500 so far in January. Investors, in turn, have shoveled $4 billion into technology-focused funds since the start of the year. We haven’t seen inflows that strong since last August.

TSLA has been the one laggard. We’ll see if that changes after the bell today when the electric vehicle (EV) maker reports its latest quarterly results. Analysts are forecasting adjusted earnings per share of 73 cents on revenue of $25.9 billion.

Lastly, China announced new stimulus measures overnight following a dramatic stock and real estate market slump. The People’s Bank of China (PBOC) said it’s cutting the reserve requirement ratio for the nation’s banks, something designed to increase liquidity in the financial sector. The move comes after reports yesterday that $278 billion in state money could be thrown at the markets to help prop them up. Chinese stocks rallied on the news.