Stocks gave up some ground late yesterday, though the S&P 500 still managed to close in the green. Equities are up slightly amid mixed economic data and a big earnings disappointment in the tech sector. Crude oil is higher, while gold, silver, and the dollar are mostly flat. Treasuries are up a bit.

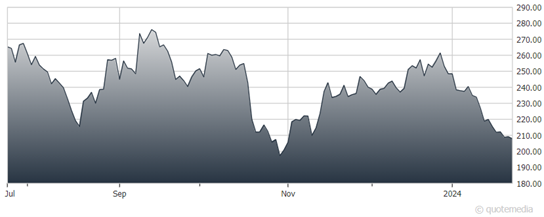

Turns out one of the “Magnificent Seven” isn’t so “magnificent”! Shares of the electric vehicle (EV) giant Tesla (TSLA) were already lagging other brand-name technology stocks, and they’re slumping again today after disappointing Q4 2023 results. Adjusted earnings per share missed estimates at 71 cents, as did revenue of $25.2 billion.

Tesla (TSLA)

Not only that, but CEO Elon Musk also warned that full-year 2024 production would miss Wall Street targets. Plus, operating margins are slipping as the firm cuts prices to spur sales – and Musk warned about potentially stiff competition from Chinese brands if they’re allowed to export to the US without tariffs.

On the economic front, we learned GDP rose 3.3% in Q4, well ahead of the 2% average estimate. A key “core” inflation number in the report was right in line with forecasts at +2%. Meanwhile, durable goods orders for December were unchanged – far below the +1.1% estimate – and initial jobless claims for the week were roughly in line with forecasts.

The fallout from this month’s 737 Max 9 airplane fiasco is spreading. Alaska Air Group (ALK) said flight capacity would miss targets this year and that it would lose $150 million from grounding Boeing (BA) jets. United Airlines Holdings (UAL) also warned recently that it would lose money this quarter due to similar costs.

The groundings followed a fuselage panel blowout on Jan. 5 that fortunately resulted in no loss of life. The Federal Aviation Administration (FAA) has required stepped up inspections of Max 9 jets to ensure they don’t have the same issues as the one that failed.