Stocks tanked late yesterday thanks to disappointing news on the monetary policy front. But a modest bounceback is under way in the early going. Gold and silver are lower, crude oil is higher along with the dollar, while Treasuries are flat.

On the last day of January, Federal Reserve Chairman Jay Powell made some waves. While the Fed shifted its policy “bias” to a neutral stance that favors cuts later at the meeting that concluded yesterday, Powell also said at a post-meeting press conference that the first cut probably wouldn’t come in March. That’s when the Fed next meets. The news sent stocks tumbling late in the day.

But all that shifted was the timing of the first cut in rate futures markets. They’re still pricing in multiple 25-point cuts this year, just with the highest likelihood of them starting at the May meeting instead.

Another thing markets didn’t like: The meltdown at New York Community Bancorp (NYCB). The bank’s shares plunged by a record 38% after the regional bank jacked up loan loss reserves and slashed its dividend.

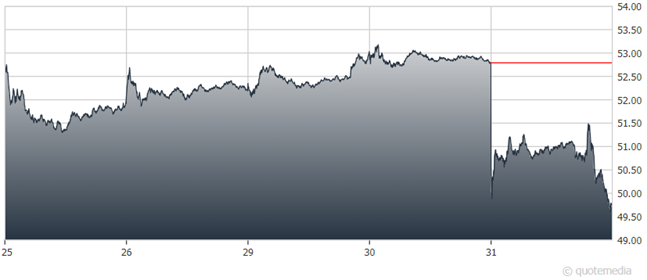

SPDR S&P Regional Banking ETF (KRE)

The surprise moves stemmed from exposure to commercial real estate. It helped re-ignite concerns about the exposure smaller lenders have to falling property values, rising vacancies, and loan defaults, prompted in part by the shift to hybrid work and reduced demand for office space. The SPDR S&P Regional Banking ETF (KRE) dropped almost 6% on the day.

Finally, Tesla (TSLA) may shift its incorporation to Texas from Delaware. The catalyst? A Delaware court ruling that voided a $56 BILLION pay package for CEO Elon Musk. No American company had ever offered so much pay to its chief executive when it was granted in 2018. A Chancery Court judge found the company’s board of directors failed to prove the plan was “fair.”