Stocks finished Friday on a strong note, but they’re giving back some ground this morning amid renewed rate concerns. Gold and silver are lower along with Treasuries, while crude oil is flat, and the dollar is higher.

Federal Reserve Chairman Jay Powell followed up the latest policy meeting with a 60 Minutes television interview on Sunday. His message? The Fed wants more evidence that “continues to confirm that inflation is moving down to 2% in a sustainable way.”

That’s basically “Fed-Speak” for “We’re not going to cut rates at the March meeting”...and the interest rate futures markets appear to be getting the message. They’re pricing in just a 15% chance of a 25-basis point rate cut at the meeting that ends March 20. That’s down from 64% a month ago.

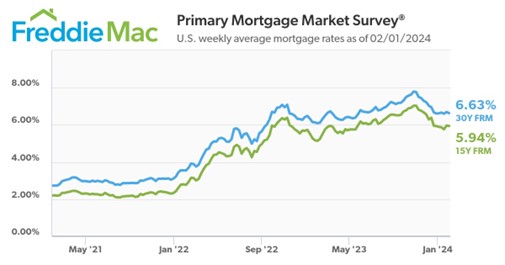

Still, longer-term interest rates have been drifting lower for weeks in response to easing inflation concerns. That’s giving the housing market a helping hand. Home showings jumped 10% between the beginning and the end of January as 30-year mortgage rates drifted down to 6.6%, according to Zillow Group (Z). Applications for home-purchase mortgages also just hit the highest since April 2023.

Finally, many in the Middle East are waiting anxiously to see if a cease fire proposal between Israel and Hamas will prove acceptable to both sides. The parameters of a deal were recently hammered out by negotiators with the US, Egypt, and Qatar, but Hamas is said to still be considering the terms today.