Stocks were mixed yesterday ahead of key inflation data, and they’re modestly higher today now that the numbers are out. Gold and silver are lower along with Treasuries, while crude oil is flattish along with the dollar.

Inflation reports have taken on a LOT more significance in the past year. Markets and economists are trying to figure out how much inflation is slowing, and if the slowdown is enough to get the Federal Reserve to start cutting interest rates soon.

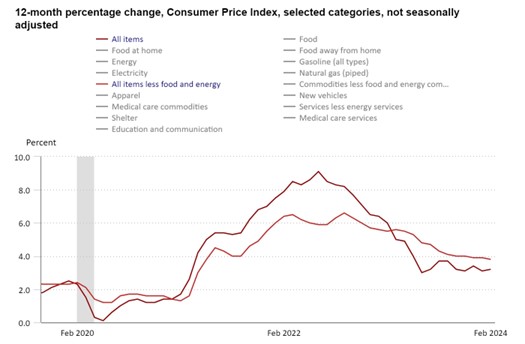

Today, we learned that the Consumer Price Index rose 0.4% on the headline and 0.4% on the core in February. That compared to estimates of +0.4% and +0.3%. On a year-over-year basis, inflation came to 3.2% on the headline and 3.8% on the core last month. All in all, inflation was a BIT hotter than expected – and that initially caused stocks to drop, before they popped right back. The sanguine response is likely a “Eh? Coulda been worse” reaction in markets.

Source: BLS

Meanwhile, the Biden administration revealed its latest budget proposal, a $7.3 trillion plan that calls for higher taxes on wealthier individuals and US corporations. The goal is to help reduce the deficit and pay for things like homeowner-targeted tax credits and prescription drug benefits. But as is usual with initial proposals, especially when the president’s political party doesn’t control both houses of Congress, this one is just a starting point for lengthy negotiations. Last year’s plan essentially went nowhere.

Finally, in earnings-related news, shares of database software giant Oracle (ORCL) are jumping thanks to strong fiscal third-quarter results. The database and cloud computing giant had inked a deal with Nvidia (NVDA) to boost demand for its services, and that paid off with a 25% jump in cloud revenue.