Stocks and precious metals are looking to start the second quarter with more gains. Crude oil and the dollar are flattish, while Treasuries are selling off and Bitcoin recently slipped back below $70,000.

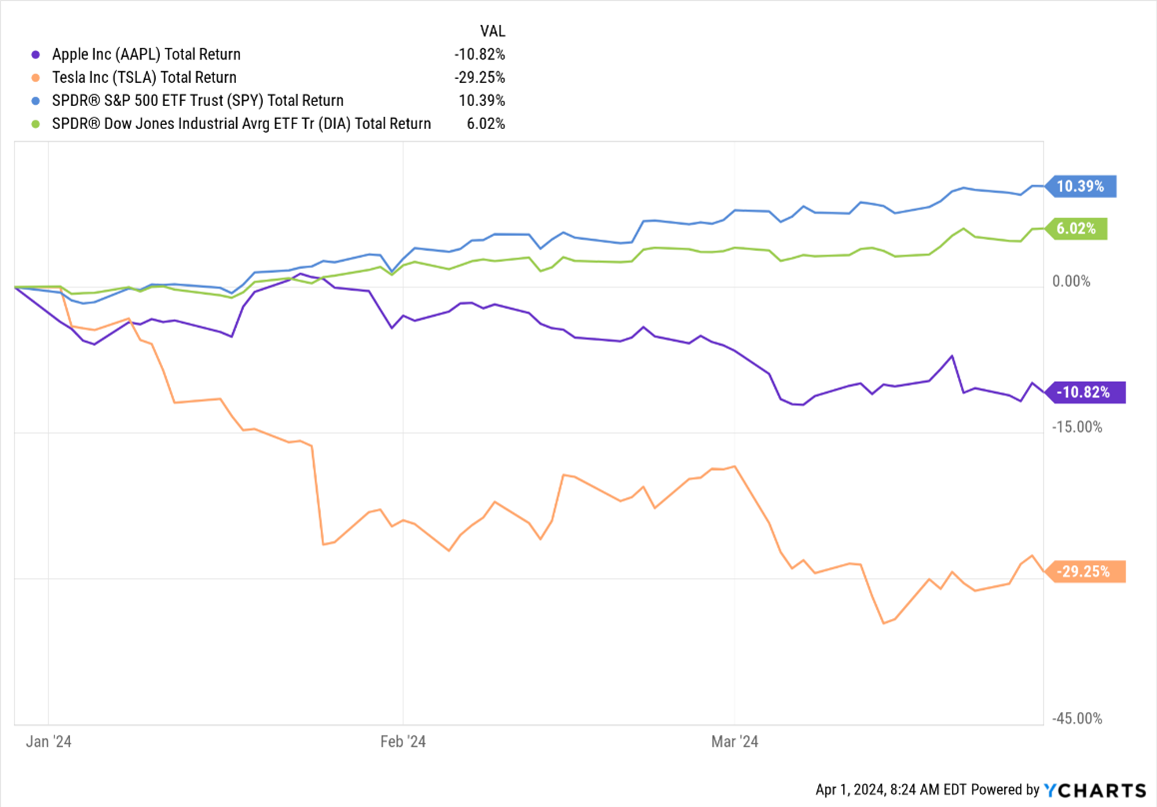

From “Magnificent Seven” to “Fab Four”? That transition is what some of our MoneyShow contributors have discussed for a while – and what the Wall Street Journal covered today. More specifically, the Journal discussed how former Mag 7 names like Apple Inc. (AAPL) and Tesla Inc. (TSLA) have lost ground in 2024, while other stocks and sectors outside of technology have picked up steam.

The result? A stock market that is still rallying nicely despite losing a few leaders. The SPDR S&P 500 ETF (SPY) is up 10.4% year-to-date, while the SPDR Dow Jones Industrial Average ETF (DIA) is up 6%.

Data by YCharts

Meanwhile, gold closed out a dynamite Q1 at the end of last week, and it’s up again sharply to start Q2. Analysts credit confidence in Federal Reserve rate cuts...solid buying demand in China...simmering geopolitical concerns, and more. The recent price of $2,278 an ounce is a fresh record high, and up around 9.5% year-to-date.

Finally, we’re starting to get better economic data from...CHINA? Believe it or not, yes. A benchmark manufacturing index rose for the fifth time in a row, the kind of winning streak the country hasn’t had in more than two years. Separate export reports suggest stronger global trade in Q1 is helping growth there. While the iShares China Large Cap ETF (FXI) is still down almost 16% in the last year, it has rallied almost 7% in the last 60 days.