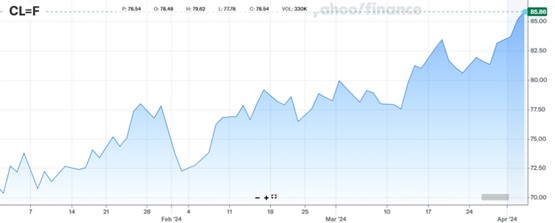

Crude oil is continuing its recent run, briefly topping $86 a barrel in the US and closing in on $90 in global markets. Gold and silver keep climbing, too, with the former briefly topping $2,300 an ounce.

Stocks are mixed after a rough start to the second quarter, while long-term Treasuries are selling off again. The dollar is flat.

What’s driving oil’s 20% year-to-date gain? Several factors on both the demand and supply side. This week, for instance, an American Petroleum Institute (API) report showed US inventories just dropped more than 2 million barrels. Ministers from OPEC and allied producer countries also just said they’d keep current output cuts in place. Those curbs are keeping around 2 million barrels per day of oil off the market.

Crude Oil (YTD Chart)

Source: Yahoo Finance

In other news, the job market picked up last month, at least according to the ADP Research Institute. Private payrolls rose 184,000 in March, topping expectations for a gain of 150,000. That was the biggest gain ADP has reported since July. We’ll get “official” figures from the Labor Department on Friday.

Finally, Taiwan suffered its worst earthquake in a quarter-century – one with a magnitude of 7.4 according to the US Geological Survey. The epicenter was on the east coast of the island near the city of Hualien, though tremors were felt throughout the nation. At least nine people died and hundreds were injured. But stricter building codes and other measures enacted after a deadly 1999 quake likely reduced casualties.