Stocks are continuing to mark time amid concerns about inflation, geopolitical risks, and interest rates. Crude oil is a bit lower, gold and silver are mixed, Treasuries are higher, and the dollar is flat.

Interest rate cuts in 2024? Not so fast! Or at least that was the message coming from Federal Reserve Chairman Jay Powell during a Washington event yesterday.

Speaking on inflation and whether it was coming down to the Fed’s satisfaction, Powell said: “The recent data have clearly not given us greater confidence and instead indicate that it is likely to take longer than expected to achieve that confidence.” Or in plain English, while the Fed WANTS to cut rates, it CAN’T until the numbers show more progress on the pricing front.

Tesla Inc. (TSLA) shares are down 37% year-to-date. Demand for its vehicles is waning. The firm is cutting 10% of its workforce. But the firm’s board is once again asking shareholders to approve a $56 billion compensation package for CEO Elon Musk...even as a January decision from Delaware’s Chancery Court voided the previous offer.

Big banks have been shafting depositors for years, offering yields of as little as 0.01% on traditional savings and checking accounts despite the biggest round of Fed rate hikes in decades. But more and more customers are saying “we’re done” – and moving cash to money market funds, Certificates of Deposit, and other higher-yielding instruments.

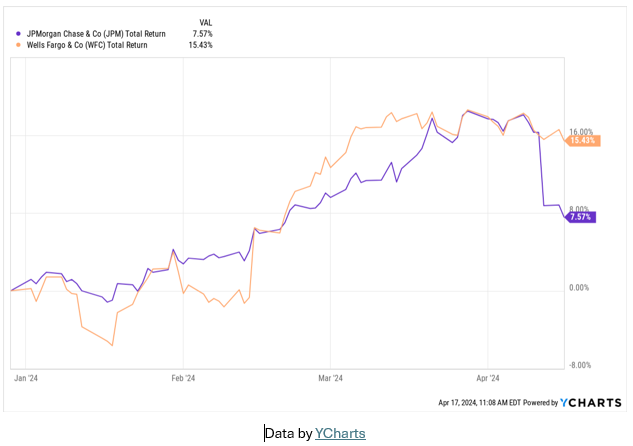

Now, banks like JPMorgan Chase & Co. (JPM) and Wells Fargo & Co. (WFC) are being forced to compete by raising yields. That’s narrowing the spread between what banks are paying out to depositors and earning from borrowers, pressuring Net Interest Income (NII). After a big run that started in November 2023, both JPM and WFC shares slumped in the wake of disappointing Q1 earnings reports.