April has indeed been the cruelest month for investors, with the S&P 500 and Nasdaq Composite both down around 5% three weeks in. Stocks are flattish in the early going today, though, along with the dollar, gold, and silver. Crude oil is a bit lower, while bonds are modestly higher.

In the end, Israel appears to have responded to international diplomatic pressure and counterattacked Iran in only a limited fashion overnight. Explosions were reported in a couple of Iranian locations, most notably a military base near the city of Isfahan. But both Israel and Iran look to be stepping back from the brink, and markets are responding by breathing a sigh of relief.

That said, concerns are growing about the US dollar’s recent resurgence – particularly against the Japanese yen. Expectations of stronger US growth and fewer Federal Reserve interest rate cuts have pushed the dollar higher in recent weeks.

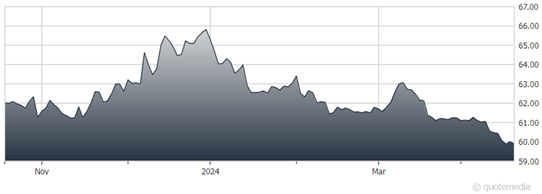

Invesco CurrencyShares Japanese Yen Trust (FXY)

One dollar now buys roughly 154 yen, the most in 34 years. That may be putting pressure on US Treasury prices by making it more expensive for Japanese investors to buy our debt. It’s also boosting speculation Japanese policymakers will intervene to support the currency. The Invesco CurrencyShares Japanese Yen Trust (FXY) allows US investors to buy and hold the yen, and it’s down 9% in 2024.

Finally, it looks like consumers did NOT leave home without “it” – it being their American Express Co. (AXP) cards! The credit card and financial services giant reported a 6% rise to $367 billion in AmEx card and payment product volume in Q1, helping it beat Wall Street profit estimates. AXP shares have risen around 16% year-to-date.