Wall Street is roaring thanks to bullish economic and earnings data. Gold and silver are mixed, Treasuries are higher, and the dollar is dropping sharply.

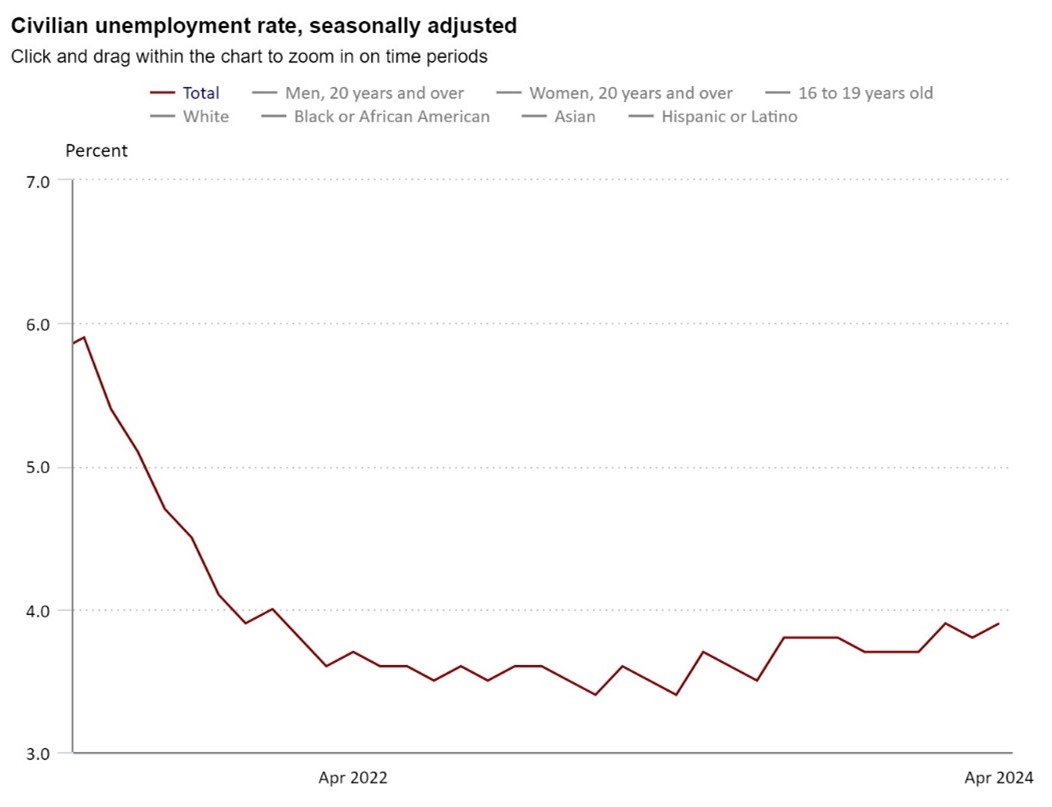

If you’re a bull on stocks, you couldn’t ask for a better batch of “Goldilocks” data than what the Labor Department released this morning. The April employment report showed the economy created 175,000 jobs (forecast = 243,000), unemployment ticked up to 3.9% (forecast = 3.8%), and average hourly earnings rose 0.2% (forecast = +0.3%).

Those figures show the labor market cooling, without turning ice cold. They also suggest upward pressure on inflation from wage growth is easing. That’s the kind of “soft landing” data Wall Street loves, in part because it increases the chance the Federal Reserve will ease back on interest rates before long.

Unemployment Rate Climbing, But Not Soaring

Source: Bureau of Labor Statistics

After lagging the rest of its “Magnificent Seven” brethren, Apple Inc. (AAPL) is firing on all cylinders this morning. The technology giant reported better-than-expected profit and sales in Q1, with EPS of $1.53 on $90.8 billion in revenue topping estimates of $1.50 and $90.3 billion. Apple also announced a $110 billion stock buyback – the largest in US history – and a 4% hike in its quarterly dividend to 25 cents per share.

Furthermore, services revenue hit an all-time high. And CEO Tim Cook talked up the company’s Artificial Intelligence (AI) investments, saying AAPL had “advantages that will differentiate us in this new era.” That gave investors hope that Apple will catch up to rivals like Microsoft Corp. (MSFT) and Amazon.com Inc. (AMZN), who have announced several AI-related efforts.

Lastly, could the anti-obesity drug wars be heating up even more? Amgen Inc. (AMGN) is running clinical trials of a drug called MariTide, and it reported encouraging interim data. That caused AMGN shares to surge in early trading. But Novo Nordisk A/S (NVO) stock slumped after it reported Wegovy sales of $1.4 billion in Q1, missing lofty targets from analysts.