Stocks are continuing to climb back toward their all-time highs from March. Crude oil is modestly higher along with Treasuries, while gold and silver are mixed. The dollar is a bit lower.

Inflation data will take center stage this week, with the Producer Price Index (PPI) for April due out Wednesday and the Consumer Price Index (CPI) set to be released a day later. Economists are expecting a 0.2% rise in the core PPI and a 0.3% gain in the core CPI.

Any significant variation one way or the other could alter current thinking about Federal Reserve policy. Rate futures markets are pricing in virtually no chance of a rate cut at the next meeting that concludes June 12, and only a one-in-four chance of a cut at the July 31 gathering. Odds for a cut in September are around 50-50.

The “Big Mining” battle involving BHP Group Ltd. (BHP) and Anglo American Plc (NGLOY) continues to heat up. Anglo rejected both an initial and a sweetened offer from BHP, raising the possibility someone else could come out of the woodwork and make a play for the $46 billion miner. One rumored name was Rio Tinto Plc (RIO), the iron ore giant based in London but with operations concentrated in North America and Australia.

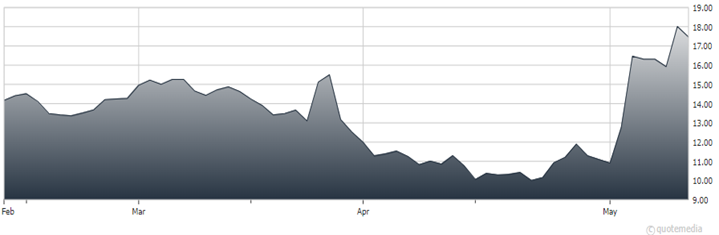

GameStop Corp. (GME)