Stocks were mixed yesterday and they’re mixed again so far today. Crude oil is modestly lower, while gold and silver are modestly higher. Treasuries and the dollar have been volatile in the wake of wholesale inflation data, but were largely unchanged at last check.

We got our first round of key inflation data for April this morning. The headline Producer Price Index (PPI) rose 0.5% last month while the core PPI gained 0.5%. Both numbers easily topped expectations, which were 0.3% and 0.2%, respectively.

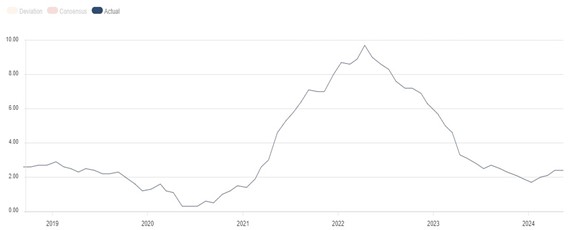

On a year-over-year basis, the core PPI is up 2.4% year-over-year. That’s well off its 9.7% peak from 2022, but up from 1.7% in January of this year – somewhat concerning for the Federal Reserve.

Core Producer Price Index (YOY % Change)

The “red metal” is red hot, with copper futures up 20% this year. With demand strong because of its usage in Electric Vehicles (EVs) and power transmission lines, both governments and private investors are scrambling for control of copper companies and copper supplies.

Anglo American Plc (NGLOY) just announced plans to shed diamond, nickel, and platinum assets to focus on investing in copper mining operations, for instance. Meanwihle, the US and its allies are spending hundreds of millions of dollars to add infrastructure and support investment that would secure US access to copper output in Africa and Asia.

Finally, the meme stock mania is REALLY cranking up. After rallying more than 74% yesterday, shares of GameStop Corp. (GME) doubled from yesterday’s $30.45 close earlier today. AMC Entertainment Holdings Inc. (AMC) jumped 78% yesterday and another 98% this morning. No word yet if Washington is going to unleash another round of “stimmy” checks to crank up the “2021 Stock Market” nostalgia!