Both stocks and bonds surged this morning on cooler-than-expected inflation data, though the rallies are easing back a bit now. The dollar is lower along with crude oil, while gold and silver are flattish.

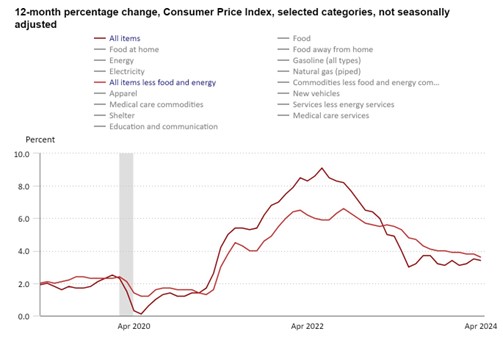

How about that? We got some GOOD news on inflation for a change. Both the headline and core Consumer Price Index (CPI) rose 0.3% in April. The headline number was a bit weaker than the 0.4% gain forecast, while the core number was in line. More importantly, the year-over-year inflation rates sank to 3.4% (headline) and 3.6% (core). That was the slowest for the latter since April 2021.

Source: Bureau of Labor Statistics

While the news is good for Wall Street, Main Street is still worried about pricing pressures. Consumer sentiment fell in May in part because of inflation concerns, while polling tied to the presidential election continually shows Americans are worried about their paychecks not going as far as they used to. Perhaps because of weaker sentiment, retail sales were unchanged in April – much worse than the 0.4% rise economists expected.

If meme stock traders are going to give you an opening, you might as well take it, right? That’s what AMC Entertainment Holdings Inc. (AMC) just did. The struggling movie chain announced a deal to swap $164 million of debt for 23.3 million newly issued shares. It wouldn’t have gotten those kinds of terms if the stock price hadn’t quadrupled from low to high in just a couple of days on aggressive retail buying.