In the end, the Dow Industrials couldn’t CLOSE above 40,000 yesterday. But the index did try its “Dow 40K” hat on for size intraday. This morning, stocks are flattish along with crude oil and Treasuries. Gold and silver are up a bit, as is the dollar.

If you’ve been reading, watching, and listening to my work here at MoneyShow, you know I’ve been advocating a “Be Bold” investment approach since Q1 2023. Today, the Wall Street Journal noted how being long a wide variety of assets and markets is paying off – in aces and spades!

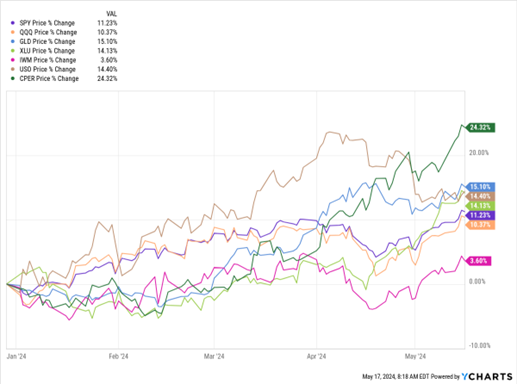

The piece doesn’t just cover why and how the Dow is trying to punch through 40,000. It also notes the strong and/or solid rallies in copper, tech stocks, gold, small caps, utilities, crude oil, and high-yield bonds (See the chart below for the performance of ETFs that track many of those assets).

I’m glad to have been able to help you profit from some (or hopefully all?) of those moves. And I know the many MoneyShow expert contributors who shared their bullish recommendations at our live and virtual conferences over the past 18 months feel the same way.

SPY, QQQ, GLD, XLU, IWM, USO, CPER (YTD % Return)

Data by YCharts

Meanwhile, China has experienced an even bigger bubble and bust in its real estate markets than we did here in the US in the mid-2000s. Now, the Chinese government is trying to bail out homeowners, developers, and the broader economy.

It’s cutting down payment requirements, eliminating a nationwide mortgage rate floor, and working with the central bank to fund $42 billion-plus worth of property purchases. The government will take those units off the hands of beleaguered builders and turn them into affordable housing.

Chinese real estate stocks surged on the news. And interestingly enough, after UNDERperforming many US-focused ETFs for a long time, the iShares China Large-Cap ETF (FXI) is OUTperforming now. It’s up around 21% year-to-date, almost double the 11% return of the SPDR S&P 500 ETF Trust (SPY).