Stocks diverged yesterday, with the Dow giving up some recent gains but the Nasdaq rallying. Equities are flat in the early going today along with Treasuries and the dollar. Meanwhile, crude oil, gold, and silver are retreating a bit.

One reason the Nasdaq had such a strong day Monday: We’re about to get earnings from chipmaking giant Nvidia Corp. (NVDA) and some investors are jumping the gun and buying. NVDA shares are up more than 87% year-to-date, and options markets are pricing in a potential big move after it reports fiscal first quarter results tomorrow after the bell – just under 9% in either direction. In dollars and cents, that equates to a possible loss (or gain) of a whopping $200 BILLION in market cap. Buckle up!

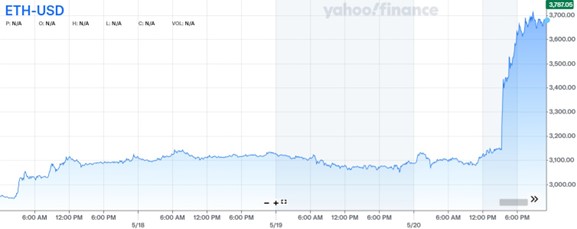

Meanwhile, cryptocurrencies are in the spotlight again, jumping in value over the last 24 hours amid expectations the Securities and Exchange Commission (SEC) will approve spot Ether ETFs. Ether surged more than 21% to $3,769, mimicking the big rally we saw in Bitcoin a few months ago ahead of the SEC’s approval of Bitcoin ETFs for trading.

Several large fund sponsors like BlackRock, Invesco, and VanEck are hoping to roll products out, and the SEC reportedly asked for updated regulatory filings – a potential pre-cursor to approval. Worth noting: The Grayscale Ethereum Trust (ETHE) was one of Safe Money Report Editor Nilus Mattive’s best ideas in our 2024 Top Picks report. It’s now up more than 51% year-to-date!

Ethereum (ETH)

Source: Yahoo Finance

Meanwhile, several MoneyShow contributors have talked about utility stocks as a “backdoor” way to capitalize on the Artificial Intelligence (AI) boom. After all, the enormous data centers, servers, and other advanced tech that power AI have to run on something (and it’s not Dunkin’ coffee!).

The Wall Street Journal ran with a story on the trend today. The S&P 500 Utilities sector is the third-best performer of the index’s 11 groups YTD, up more than 13%.