Stocks were mixed yesterday amid strength in tech and weakness elsewhere. Today, we’re seeing more downside pressure amid rising rates. Gold and silver are mixed, while the dollar is mostly flat. Crude oil is a bit higher.

The oil patch has been alive with the sounds of M&A, and today is no exception. ConocoPhillips (COP) said it would buy Marathon Oil Corp. (MRO) for $17 billion in stock. The deal will add 2 billion barrels of oil to reserves as well as productive land in places like Texas and North Dakota. It follows several other “Big Oil” buyouts with price tags as high as $62 billion.

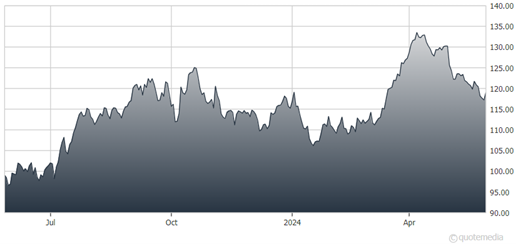

ConocoPhillips (COP)

Don’t look now, but interest rates are on the rise again following the Memorial Day holiday. A series of lousy Treasury debt auctions where demand proved lackluster helped drive the yield on the 10-year Treasury Note above 4.5%. Rate futures traders have also been pushing out expectations for when the Federal Reserve will start cutting rates amid hawkish commentary from policymakers. We’re still about 20 basis points below the peak yield levels we saw in April, though.

Finally, the thing about predictions in this business is that it’s tough to nail both a LEVEL and a TIMEFRAME. That’s true whether you’re talking about an individual stock, a particular commodity, or a major index. This story chronicles the case of David Elias, the author of the 1999 book Dow 40,000 Strategies for Profiting from the Greatest Bull Market in History.

As we all know, 1999 wasn’t the best time to go “all in” on stocks. And his prediction of 40K by 2016 didn’t pan out. But this month it finally did, and as a result, a friend sent David a bundle of “Dow 40,000” baseball caps. So all’s well that ends well.