It was looking like an average day for the stock market Friday...until the last 15 minutes of trading when the Dow went vertical. This morning, stocks are mixed while gold, silver, and the dollar are flat. Treasuries are higher, while crude oil is lower.

The OPEC+ nations agreed on Sunday to keep their 3.66 million barrel-per-day production cuts in place through 2025. Eight countries in the oil-producing cartel will also stick to voluntary, additional cuts of 2.2 million BPD for now – though those could be dialed back depending on market conditions. US crude oil futures are up more than 6% year-to-date, and producers want to see those gains mostly stick as 2024 unfolds.

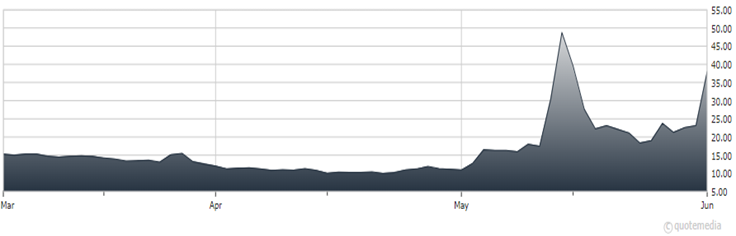

GameStop Corp. (GME)

Another day, another “Meme Stock Mania” move! This time, it’s shares of GameStop Corp. (GME) that more than doubled before pulling back thanks to a weekend posting on a Reddit social media account affiliated with Keith Gill. The unverified account screenshot showed a five-million-share position in GME at a cost basis of $21.27. It also showed 120,000 call options with a strike price of $20 per share. Ostensibly, the combination of those positions would make Gill the fourth-largest shareholder in GME.

Also known as “Roaring Kitty,” Gill helped lead an “army” of retail traders in 2021 that would buy up shares of heavily shorted stocks to generate profits on the backs of short-sellers. The process worked for a while, though GME, AMC Entertainment Holdings Inc. (AMC), and other meme stocks ultimately plunged in value.

Finally, Wall Street’s eyes will turn to Washington and the Labor Department on Friday. That’s when May job growth and unemployment rate figures will be released. Economists estimate the US created 190,000 jobs last month and that the unemployment rate held steady at 3.9%. Any deviation from forecasts could lead to big moves in interest rates and stocks given the implications for Federal Reserve policy.