Yesterday was another mixed day for equity markets, with pretty impressive intraday ranges to boot. Stocks are a little weaker this morning along with crude oil and precious metals. Treasuries and the dollar are mostly flat.

Wall Street can’t seem to figure out what it wants right now. Is “bad news” (weaker data) on the economy actually “good news” because it means the Federal Reserve will cut rates sooner? Or is bad news “bad news” because it means corporate earnings growth will slow?

We seem to be in a transitionary period where investors can’t figure out what they want, which is leading to more intraday, daily, and weekly market volatility. This Friday’s May jobs report and how markets react to stronger or weaker data will help provide more clues about what investors really want to see.

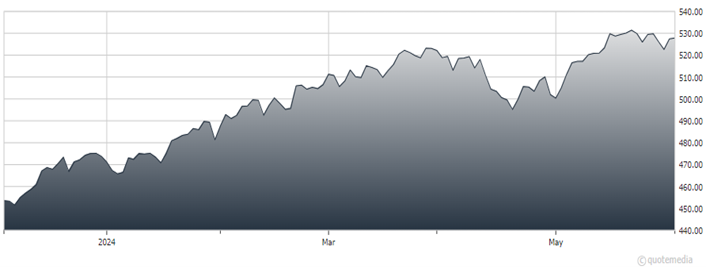

S&P 500 ETF Trust (SPY)

Are consumers in worse financial shape than many think due to “Phantom Debt?” More retailers and lenders are offering and funding “Buy Now, Play Later” payment plans, which allow customers to buy products they otherwise couldn’t afford. But the financial obligations racked up by paying for big-ticket items in a handful of installments over time aren’t reported to credit ratings agencies.

Analysts estimate global consumers will take on $700 billion in phantom debt by 2028. Separate data from a Bloomberg/Harris Poll study showed 43% of BNPL borrowers were behind on their payments. That makes this trend worth watching.

Finally, state and federal regulators in Massachusetts and Washington are reportedly looking into whether “Roaring Kitty” Keith Gill engaged in stock manipulation with his recent social media posts and associated trading activity. Meanwhile, the Wall Street Journal said his brokerage firm E*Trade and corporate owner Morgan Stanley (MS) are reportedly concerned about the operational and/or reputational issues raised by his extremely vocal investing style in stocks like GameStop Corp. (GME).