ADVERTORIAL – Many investment strategies and money managers are starting to think that the market is once again ignoring too much of the bad news and Frank J. Tirado, VP at The Options Industry Council, provides you with strategies for insuring your portfolio against a downturn in the market.

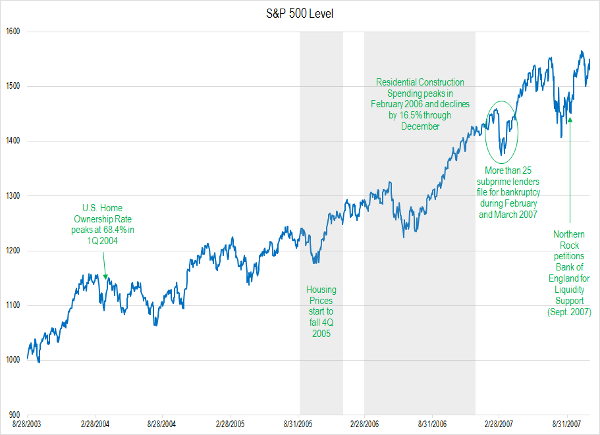

Remember 2007? The U.S. economy had been giving advisors and investors plenty of warning, but the equity market had managed to “climb a wall of worry” and ignore those economic warnings all as the equity market continued to climb upward.

S&P 500 Index August 2003 to August 2007

Strategists and pundits claimed that there was no need for worry. “It’s different this time,” they said. Anyone in the markets at that time remembers how this movie ended and it wasn’t pretty.

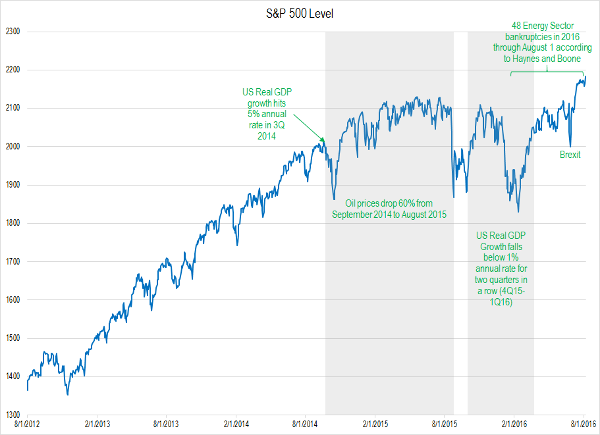

Compare this historical vignette to what is going on in the world today. We can see the evidence of social, economic, and political strife across the globe and some experienced money managers and economists are starting to sound the warning that the market is again ignoring too much of the bad news.

S&P 500 Index August 2012 to August 2016

Some of those same economists and money managers are now asking “have I seen this movie before?”

And if they have, they may be asking “how do we insure ourselves against catastrophic losses?” Or in other words, how can we change the script so the movie has a better ending?

Simple ETF Portfolio Protection

While no one can change the course of the market, tools exist that can allow advisors to help investors limit losses on ETFs in their portfolios– tools called exchange-listed options.

Exchange-listed options on ETFs are directional instruments that can allow an advisor to tailor exposure to an underlying security’s upside or downside potential. You may think that you don’t know anything about options, but in fact, everyone understands options perfectly well from their experience with home, life and car insurance.

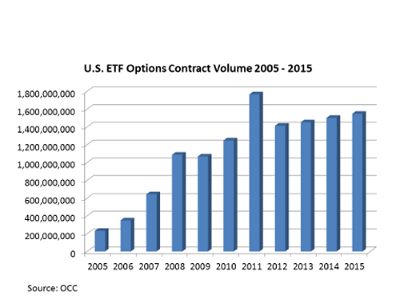

Options on ETFs have grown from more than 231 million contracts cleared at OCC in 2005 to more than 1.5 billion contracts in 2015. This growth trend continues as options on ETFs represented 41 percent of total U.S. options volume the first half of 2016.

When you buy insurance, you have a few choices to make. Specifically, you have to identify the thing you want to insure, the deductible you’re willing to pay, and the term over which you want to insure. Buying protection for an investment portfolio is no different – we’ll walk step-by-step through an actual case as an example.

Step 1 – Specify the Asset to Insure

ETFs allow an investor to have exposure to such a wide choice of indices, sectors, and asset classes. If you or a client has a particularly large exposure to a single sector, for instance, you can likely find an ETF that is a fairly close match to that exposure. For the following example, we’ll assume that the investor has exposure to a broad range of equities that generally moves with the overall index and select an ETF that offers the same sort of exposure.

Step 2 – Figure Out Your Deductible

In the insurance world, we’re used to thinking about deductibles in terms of dollar amounts (e.g., “a $500 deductible”). When protecting an ETF portfolio, it’s easier to think about deductibles in terms of percentage amounts. In other words, select your deductible by thinking about how large of a percentage drop you are willing to bear before you are completely protected (e.g., 10% drop, 15% drop).

Let’s say that your index ETF is trading for around $215 per share and that you are willing to “self-insure” a drop of 10%. In this case, you would be looking to buy a put option whose protection starts at (90% * $215 =) $193.50. The level at which protection starts is called the strike price of the option. If a strike price of $193.50 is not available, you could pick a little lower deductible (e.g., a strike price of $195.00) or a little higher one (e.g., a strike price of $192.50).

When you overlay the put option on your ETF, you completely remove economic exposure to a price drop below the strike price, just as you do when you buy insurance on your car. There are other combinations of options that can be used for hedging strategies, but we’ll keep it simple for the purposes of this article by just showing a protective put.

Step 3 – Decide On the Term of Your Insurance

Car insurance expires and so does ETF portfolio protection. Figuring out what expiration to select when using a portfolio protection strategy takes some experimentation, but there are a few things to consider:

- On a price-per-day basis, long-dated options are cheaper than short-dated ones.

- On an absolute basis, short-dated options are less expensive than long-dated ones. The price-per-day is higher, but the total price tag is less because you’re buying less days of protection.

Luckily, put options can be purchased in weekly, monthly, quarterly, and even longer durations, and you can combine and adjust the mix of the insurance contracts you own as your view about the market changes. Also, if the cost of insuring your ETF portfolio is too expensive for you, then you can build an options strategy called the protective collar that combines the protective put with the covered call to help pay for protection.

So now you know that you don’t need to sit passively watching a re-run of a bad movie, but you have a powerful tool that can change the ending with exchange-listed options.

DISCLAIMER: OPTIONS INVOLVE RISK AND ARE NOT SUITABLE FOR ALL INVESTORS. INDIVIDUALS SHOULD NOT ENTER INTO OPTIONS TRANSACTIONS UNTIL THEY HAVE READ AND UNDERSTOOD THE RISK DISCLOSURE DOCUMENT CHARACTERISTICS AND RISKS OF STANDARDIZED OPTIONS AVAILABLE BY VISITING WWW.OPTIONSEDUCATION.ORG.

ANY STRATEGIES DISCUSSED, INCLUDING EXAMPLES USING ACTUAL SECURITIES AND PRICE DATA, ARE STRICTLY FOR ILLUSTRATIVE AND EDUCATIONAL PURPOSES ONLY AND ARE NOT TO BE CONSTRUED AS AN ENDORSEMENT, RECOMMENDATION OR SOLICITATION TO BUY OR SELL SECURITIES. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS. COPYRIGHT © 2016 THE OPTIONS INDUSTRY COUNCIL. ALL RIGHTS RESERVED.