Sponsored Content - Dubbed “The Wealth Development Company,” Caliber was founded on a meaningful opportunity, allowing accredited investors to participate in a world of private-equity real-estate investing that was traditionally reserved for institutions and family offices. Little did we know, 13 years ago when we began building Caliber, that our platform would become a vital support system for one of the most transformative tax-incentives created in the history of the United States—Opportunity Zones (OZ).

For the past 35 years, David Swensen, American investor, endowment-fund manager, and philanthropist, famously proved—year after year—that using non-correlated alternative investments, i.e., direct investment into real-estate funds is a key component to outperforming market benchmarks. Swenson used this investment strategy at Yale through their endowment fund, which became an industry darling and an example for investors throughout the world.

Opportunity Zones allow investors with short- and long-term capital gains to utilize Mr. Swensen’s investment strategy. These non-correlated assets have a tax incentive that functions that in some ways, as a super-charged ROTH IRA with an unlimited investment threshold.

As an investor, if you are selling stocks, businesses, real estate, or anything else that generates capital gains, then you are likely seeking the following three tax benefits from an OZ investment:

- Future Tax Forgiveness

Investors who hold for 10 years (or more, up to 2048 when the program ends) will pay no tax on the growth in the value of their investment;

- Current Capital Gains Reduction

Assuming an investment is made in 2021, investors will pay taxes on 90% of the capital gains they invested, when the taxes are due in 2027;

- Putting Deferred Taxes to Work

Investors are able to invest their entire short- or long-term capital gain, deferring the payment of the tax component until 2027.

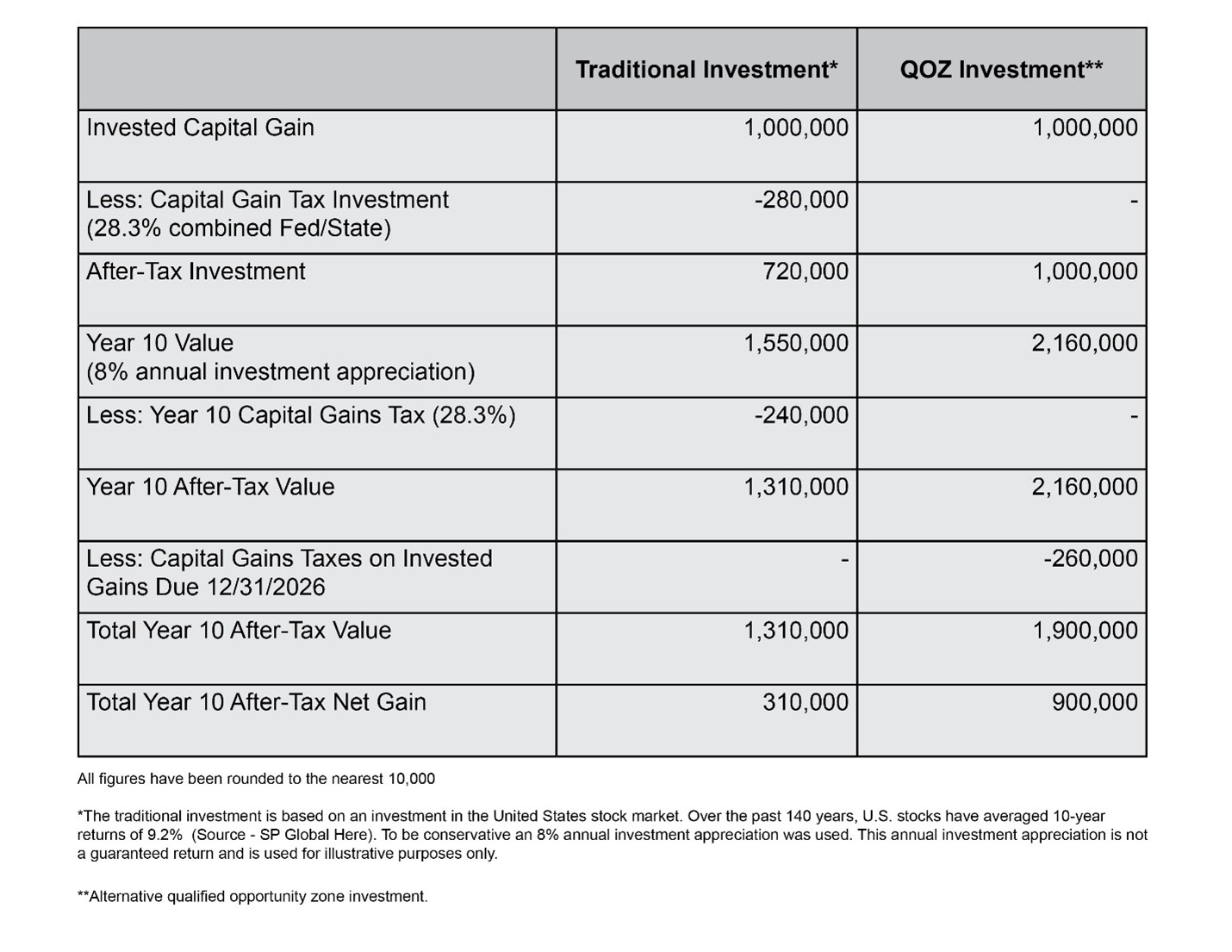

Let us assume we have an Opportunity Zone investment that is generating approximately 8% per year, and we compare that to a non-Opportunity Zone investment earning the same rate of return. The following chart depicts the after-tax return earned by each investment:

It is clear, based on the above data, that an Opportunity Zone fund would earn approximately three times the tax-adjusted net profit on the investment assuming the same rate of return.

Will an investment in a non-correlated real-estate development project, or series of projects, earn the same rate of return as a typical basket of securities purchased between 2021-2031?

The answer is ostensibly yes, even though investment professionals will continue to quibble over the nuances of that question. We at Caliber find it interesting that the stock market continues to reach all-time highs while significant dislocation occurs in real-estate markets throughout the US due to COVID-19.

This could make an investor take pause and wonder which investment would likely be more lucrative and less volatile over the next 10 years. Maybe it is not an either/or scenario, perhaps taking gains from the equity markets and redirecting them into a dislocated real-estate market could be considered a wise move in a decade’s time.

To be effective investors, we should understand the landscape of Opportunity Zone fund sponsors and their approach to the market. The question to ask is, what is a winning strategy for Opportunity Zone investing? While the answer might be thoroughly depicted in a white paper, we found three critical components:

- The fund sponsor combines institutional-grade investment structure, management, accounting, tax, financial reporting and administration with an entrepreneurial investment platform.

Why? The tax incentive requires complex decision-making and structure to keep the fund and fund investors compliant and the program itself requires sponsors to focus on smaller projects in the middle-market ($5-$50m) space.

- The sponsor must see regular and consistent deal-flow and have the ability to secure those projects while formulating capital.

Why? Investors experience capital gains at various times throughout the year and must invest within (typically) six months of realizing the gains. Sponsors are required to deploy invested capital within six months of receipt into projects that can be completed within 31 months of deployment. Execution is the name of the game.

- Diversification still reigns supreme and sponsors must be able to offer a solution to asset class and market concentration risk.

Why? A 10-year investment in a single asset in a single market is always risky. No one saw the Amazon HQ2 deal in New York imploding over the comments of local politicians, and yet, it did. Investors making early bets in the adjacent Opportunity Zone may have been hurt by that turn of events. Diversification solves for unpredictable risk over a 10-year horizon and investors would be wise to follow that plan.

Caliber offers all three of these key strategic investment opportunities to investors in our diversified Opportunity Zone Fund. Specifically, our sponsor entity has completed the equivalent of a mini-IPO via Reg A+, which provides the power of a publicly traded company that oversees Caliber’s funds and manages the fund compliance complexities. Since inception, we have strategically raised capital and deployed proceeds as the economic and investing landscapes dictated, versus a fixed traditional fundraising and deployment strategy. We believe this has been a vital component to our success, which allows us to pivot on a moment's notice.

This is proving to be critical in effectively managing the many timing challenges inherent with Opportunity Zone investors and fund managers. As one of the few diversified funds in the country, we actively manage risk through in-house asset management and recycling initiatives that allow us to identify the best timing for buying or selling a real-estate asset.

One example of this is our recent sale of Treehouse Apartments. We acquired this asset for $4.8 million in 2014, invested $7.9 million in 2017 to improve the asset and raise the underlying NOI (net operating income). As a result, we sold this property to a multi-family operator for $23 million in February.

Caliber is doing a lot of exciting things to live up to the reputation as “The Wealth Development Company.” On behalf of everyone at Caliber, we invite you to learn more about our funds and investment opportunities at www.caliberco.com and www.caliberfunds.co.

Currently, we are wrapping up our Reg A+ offering that will close on February 26, 2021. We have raised over $4 million, which allows accredited and non-accredited investors to participate in this exciting new investment.

(Caliber is offering securities through the use of an Offering Statement that has been qualified by the Securities and Exchange Commission under Tier II of Regulation A. A copy of the Final Offering Circular that forms a part of the Offering Statement may be obtained from: Caliber: https://www.seedinvest.com/calibercos)