Sponsored Content - In the past 25 years, I’ve spoken to an awful lot of people about gold. Most of them say the right things. They are buying gold as wealth insurance. They are buying gold as an inflation hedge. They are buying gold just in case, says Rich Checkan, president & COO, Asset Strategies International.

But the moment the gold price ticks down, they turn frantic. They say, “What’s going on?” They say, “I’m losing money.” They say, “I can make more money with stocks or crypto.”

If they truly got gold—if they truly understood its role—they would never say such things.

Wrongheaded Mentality

Many people look at gold the wrong way, and I understand why.

Investors are fed all sorts of information. They are conditioned to look for profits always. They expect whatever they buy to go up in value always.

This is a stock mentality. You buy stocks to grow wealth. The growth can be steady or speculative, but you want and expect growth.

Further, you measure that growth in your stocks or your crypto speculations in euro, or yen, or dollars. As long as the price is going up, you “see” growth, and you are happy.

In this “Everything Bubble” the Federal Reserve has created the valuations of virtually every growth-oriented or speculative investment have been climbing. That breeds greed and Fear of Missing Out (FOMO).

That greed fuels further investment.

What’s Really Happening?

Let’s face it. These companies aren’t suddenly more valuable or productive or profitable.

It all comes down to how we measure wealth…and it is flawed.

Any measuring device should be consistent.

- A 12-inch ruler should always measure exactly 12 inches.

- A watch must always keep accurate time.

- A thermometer should always produce the same temperature reading at the same temperature.

You get the picture. To be trusted, measuring devices cannot fluctuate.

But when we measure value, we do so with euro and yen and dollars and…all of these are fiat currencies. All of them are mismanaged. All of them lose value through mismanagement in the long run.

There are no exceptions.

Take the US dollar. This is the world’s reserve currency. It is used throughout the world to assign value to products, services, commodities—everything. Yet the US dollar has lost 99% of its purchasing power since the creation of the Federal Reserve in 1913. In a little over 100 years, 99% loss of purchasing power!

Is this really a consistent measuring device? Is this really the best option we have for measuring value or worth? Can this really be trusted?

Of course not, but we continue to use it.

There’s a Better Option

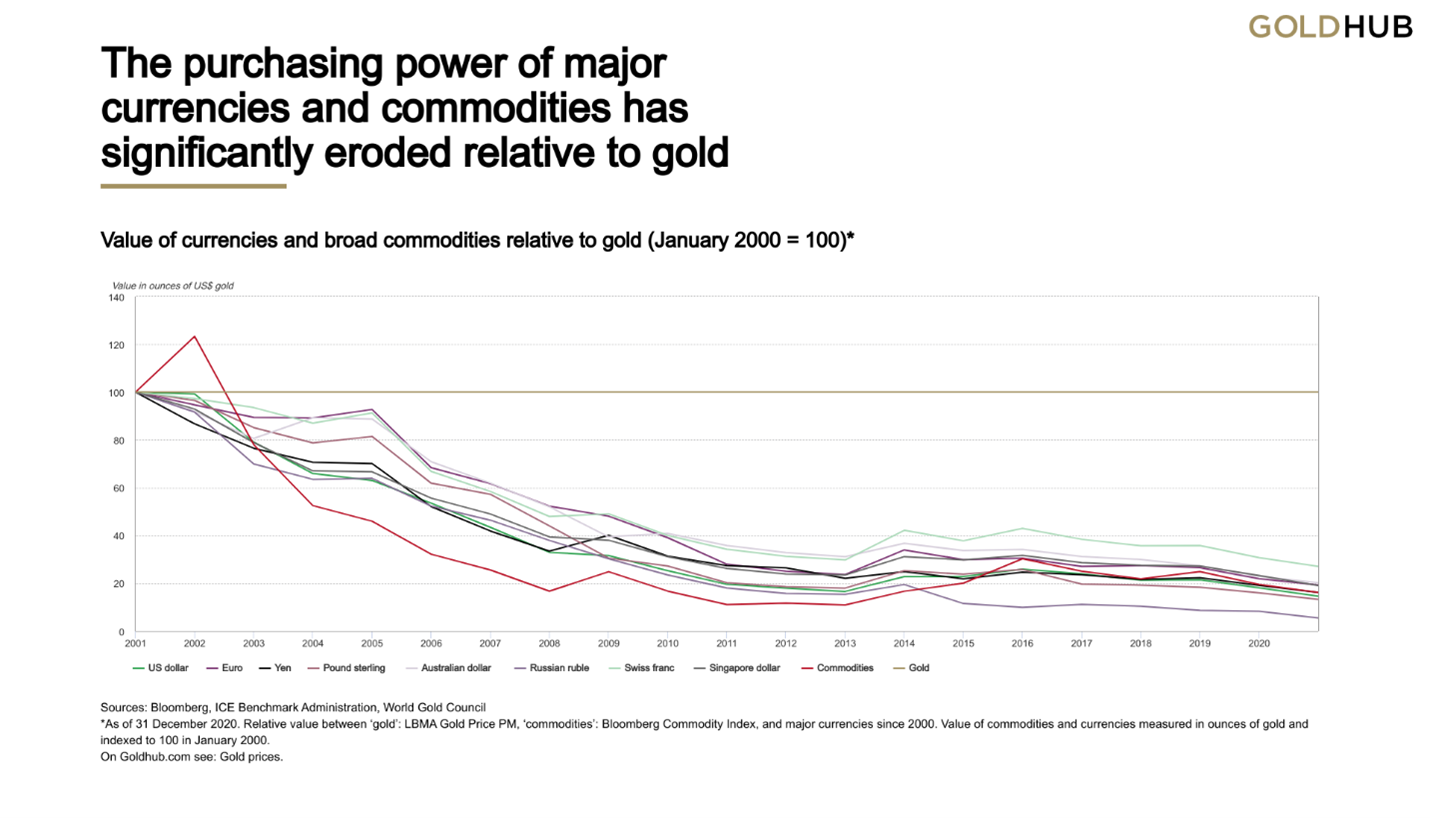

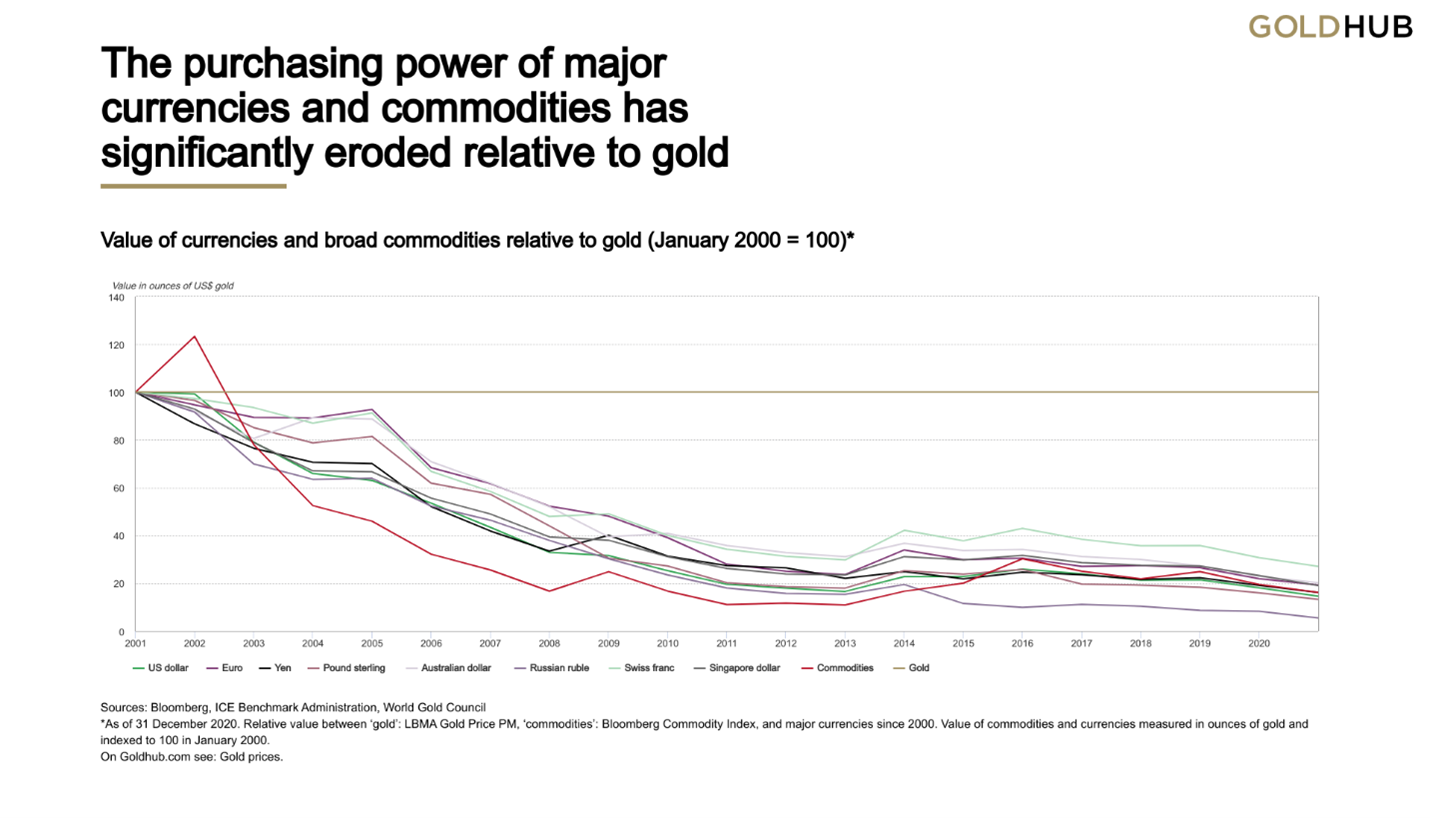

Consider the two charts below…courtesy of the World Gold Council.

The first chart shows gold versus major currencies. Spoiler alert—gold massively out-performed them all in the long run.

Is gold getting that much more valuable over time? No. The fiat currencies are getting that much weaker over time while gold preserves its purchasing power.

The second chart shows the gold price versus the increase in the US dollar money supply over time. Spoiler alert—as the money supply increases, the price of gold goes higher. They track each other perfectly.

The reason why is simple. As more dollars are created out of thin air and circulated in the economy, they are all chasing after the same, finite number of goods and services. The net effect is for the price of all those goods and services to climb higher.

Your gold coin, therefore, is not suddenly more valuable. Rather, the dollars you measure its value with are “worth-less.”

If you ask me, we should be measuring the value of everything in gold.

Gold’s purchasing power has been a constant for millennia. Consider this…

- In Roman times, the toga (the business suit of the day) could be purchased for one ounce of gold.

- In 1913, a new business suit could be purchased for $18…the price of one ounce of gold.

- Today, you can purchase a nice new business suit for $1,750…the price of one ounce of gold.

- You cannot purchase a nice new business suit for $18.

Gold is a much-better measuring device for value or worth than anything else known to man.

Cryogenically Freezing Purchasing Power

This is gold’s role.

A good friend and business associate always used to say, “When buying gold for the right reason, there is no such thing as the wrong time or the wrong price.”

I couldn’t agree more.

That “right reason” to buy gold is not speculation. That “right reason” to buy gold is not profit or income.

The “right reason” to buy gold is as wealth insurance. It is a store of purchasing power, in a liquid form, for a potential financial crisis you hope you never have.

You buy it. You hold it. You never touch it…unless you have a financial crisis. If you do have a crisis, you sell it immediately and meet your financial obligations. Then, as soon as possible afterward, you buy more gold to fill your wealth insurance allocation for the next financial crisis you hope you never have.

This is not a “get rich quick” scheme. This is not something you look to purchase once you are in trouble. This is not something you can put off until tomorrow.

We all need wealth insurance all the time. We buy it, and we hope the price stays put or even drops. If so, the majority of your portfolio is no doubt doing fine.

Fear Versus FOMO

As stated earlier, right now, FOMO rules. Investors see the ability to profit, and they are greedy to get their fair share.

But as with any bubble, that greed will give way to fear. That bubble will pop.

It is coming. All bubbles eventually pop.

Buying gold before the bubble pops is the best way I know to Keep What’s Yours!

Good investing…

Visit Asset Strategies International to learn more about investing in precious metals and other alternative asset classes.