A few weeks back, I kicked off the Intelligent Investor Series as part of my weekly commentaries. Through this series, I plan to share with you the immense investing wisdom of Benjamin Graham. Today: Graham’s five investment principles, writes Steve Pomeranz Thursday.

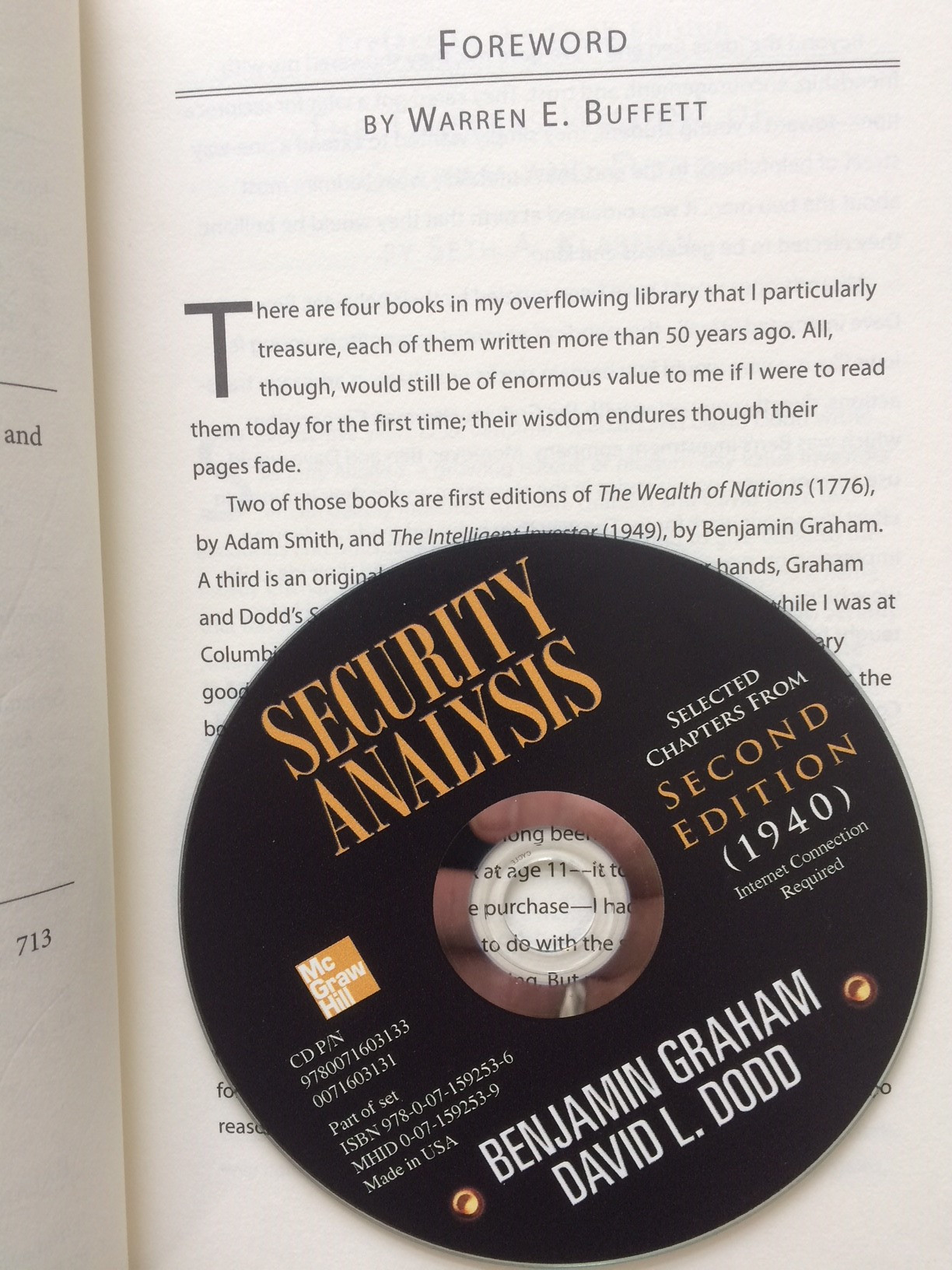

Graham is widely respected as the “father of value investing”, and his books, Security Analysis, and its follow-up, The Intelligent Investor, are seminal investment classics.

While his first book, Security Analysis, gets into the dense details of valuing stocks, his second book, The Intelligent Investor, focuses on investment principles and investors’ attitudes.

It’s this latter book, The Intelligent Investor, that I cover in this series, sharing Graham’s pearls of wisdom with you, chapter by chapter, and quoting from his book verbatim where I feel it makes sense.

Graham’s core investment principles

Graham was a master at researching stocks and harvesting bargains.

Through his academic background, profound common sense, and vast experience, Graham developed core investment principles that are as valid today as they were during his time as an active investor in the first half of the 20th century.

Here are his five key tenets on investing:

1. A stock is not just a ticker symbol or an electronic blip; it is an ownership interest in an actual business, with an underlying value that does not depend on its share price.

This is why Warren Buffett insists on analyzing stock purchase and sell decisions as if you were buying or selling the whole company. As a buyer, the long-term performance of your shares is linked to the company’s long-term performance. So, focus on that, and don’t get swayed by short-term ups and downs in share price.

2. The market is a pendulum that forever swings between unsustainable optimism (which makes stocks too expensive) and unjustified pessimism (which makes them too cheap).

The intelligent investor is a realist who sells to optimists and buys from pessimists.

This second tenet reminds me of the bubbles and busts we saw in the market in 2001 and then again in the 2007 to early 2009 timeframe, where overwhelming optimism gave way to excessive pessimism. Folks who saw through the doom and gloom and bought stock or index funds in the 2008-2009 timeframe should pat themselves on the back for making an intelligent investor move.

3. The future value of every investment is a function of the price you pay.

The higher the price you pay, the lower your return will eventually be and vice versa.

4. No matter how careful you are, the one risk no investor can ever eliminate is the risk of being wrong.

To minimize this risk, Graham insisted on having a “margin of safety” on all his investments by never overpaying, no matter how exciting the investment opportunity may seem.

If you buy when prices are extremely high relative to the company’s real value, you do not have Graham’s margin of safety built into your purchase and are exposing yourself to potential losses and lower returns. So carefully consider the price at which you buy. I know it’s impossible to perfectly time the market to buy at its low but, generally speaking, amp up your margin of safety and rate of return analysis if you’re looking to buy in an already high market.

And heed what Graham says on not getting too excited about an investment and overpaying for it because you are simply increasing your risk of loss.

#4 reminds me of the recent bitcoin (BTC-USD) craze where some investors ignored margin of safety, got carried away by the excitement, and are now sitting on sizable losses.

If you buy high, your returns may be lower or even negative; so, no matter how exciting the opportunity is, always analyze your investment choices carefully.

5. The secret to your financial success is inside yourself.

This is really important and often leads to our own undoing as investors.

If you become a critical thinker who takes no Wall Street supposed “fact” on faith, and you invest patiently with confidence, you may be able to take advantage of even the worst bear markets. By developing your discipline and courage, you can refuse to let other people’s mood swings govern your financial destiny. In the end, how your investments behave is much less important than how you behave.

Graham’s fifth tenet reminds us to ignore the daily noise and drumbeat of market news, to pay little attention to the herd mentality that exists in the market, and to be disciplined critical thinkers who ignore market swings and, instead, focus on the underlying company’s performance and long-term prospects. This discipline should help you take advantage of bear markets, keep you from selling for frivolous reasons, and potentially boost your stock returns.

Moving on, Graham reiterates the difference between investing and speculating. By speculating, you lower your odds of building wealth and raise someone else’s. With every trade you make, no matter whether you win or lose, your broker definitely makes money.

Confusing speculation with investment, Graham warns, is always a mistake. For instance, at the height of the dot-com boom, the test of a hot investment technique was simply whether people made money with it, no matter how dangerous or dumb their tactics.

The techniques that were all the rage in the late 1990s—day-trading, ignoring diversification, flipping hot stocks, and following stock picking “systems”—had a low chance of prevailing in the long run. I just recently read an article where a high school student stayed home from the prom testing out new trading techniques. I wish him luck, but my advice to him would only be to stay home reading The Intelligent Investor. I think the outcome may be much better for him over the years.

Finally, with all this, the fault isn’t all yours. Wall Street and the financial media have done a lot to encourage speculation by sensationalizing every trivial bit of news and turning stocks into blips of data on a screen, decoupled from the performance of their underlying companies.

If the blips are moving up, nothing else matters. Increasingly, the stock market looks like a video game, where the public feels more knowledgeable about the markets than ever before and doesn’t stop to think about core investment principles.

But I want you to keep this in mind: irrational new-fangled trading strategy ultimately may not be above Graham’s laws. So, as a reader of The Intelligent Investor, don’t worry about being temporarily right. Instead, focus on being sustainably and reliably right so you reach your long-term goals while protecting your capital.

I’ll stop here for now and will see you next time with Graham’s thoughts on inflation and your portfolio on “The Intelligent Investor Series.”

You can reach me at StevePomeranz.com