The Japanese yen spiked to .9458 the first week of the year, and the commercial traders couldn’t yell, “SOLD!” fast enough, writes Andy Waldock. Andy will be presenting at the TradersEXPO New York on March 10-12.

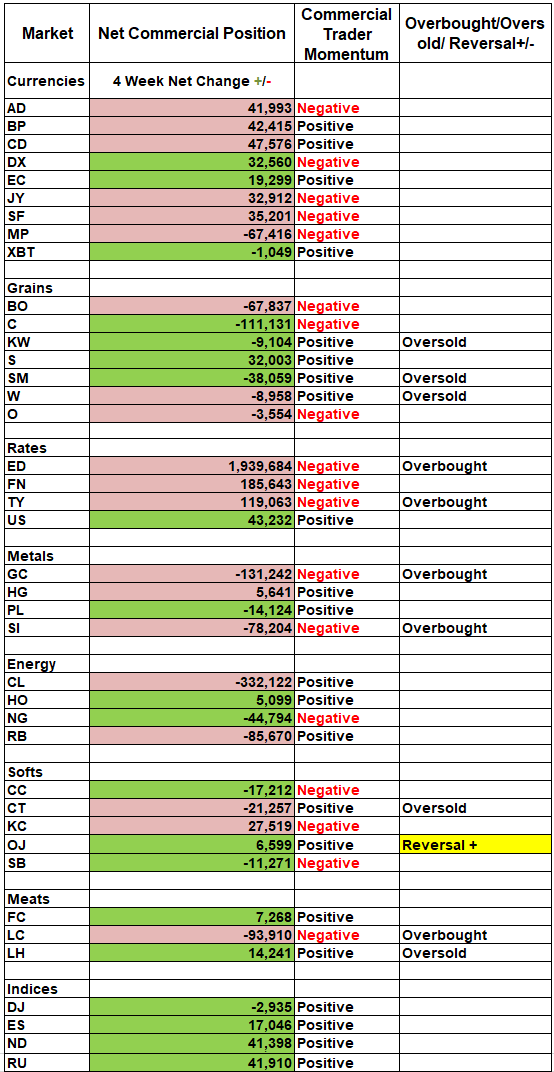

The Commodity Futures Trading Commission (CFTC) is getting caught up on their commitment of traders (COT) data, and it’s beginning to provide some interesting setups. We’ll start with a recap of last week’s calls, before looking at the Japanese yen, silver and the S&P 500.

Commercial traders added 40k new short soybean oil positions over the last week. The short position we suggested last week is still in play. We will look to add to the short position if it trades below 29.60¢ per lb. this week while leaving our protective buy stop at 31¢.

The five-year Treasury-note trade never materialized last week. Commercial traders have been significant sellers on the short end of the curve and buyers on the long end. This has pushed commercial traders’ momentum into positive territory in the 30-year Treasury bond futures. Consolidation typically means continuation. We’ll wait for short-term rates to fall and prices to rise before looking at the short side of the trade, again.

Japanese yen

The Japanese yen spiked to .9458 the first week of the year, and the commercial traders couldn’t yell, “SOLD!” fast enough. Commercial traders sold about 80k contracts the first two weeks of this year. For comparison, commercial traders sold about 75k in two weeks this past March, when the yen made the year’s high. Considering the price spike also rocketed through but, failed to hold our long-term averages, we see the yen running back to the lows around .8850. Finally, the speculative position has been halved as the reality of another failed yen rally sets in among the speculators. Odds are, the specs will come back to the market on the short side as the market falls. This trade would be a good candidate for a leveraged index fund like ProShares Japanese Yen 2X leveraged ETF (YCS).

Precious Metals

Moving to the silver market, we have many more tradable products. Two important things to keep in mind are, make sure you find an ETF focused on bullion rather than processing or, mining. We are only predicting the price of silver, not anyone’s business plan. Second, we expect silver prices to fall. Therefore, you’ll need an inverse ETF like ProShares UltraShort Silver 2X leveraged inverse fund (ZSL) or, VelocityShares 3X inverse Silver ETN (DSLV).

Last week, we nailed the gold call pretty well. This week, we’re looking at the speculative position in the silver market. Currently, both the small and large specs are near bubble territory in my COT ratio indicator, which I’ll fully disclose at the TradersEXPO New York in two weeks. The last time my COT ratios had similar readings was mid-November of last year. The market fell more than $1 per ounce in the next three weeks. Our daily COT signal triggered a short sale last Thursday, while our weekly signal has yet to trigger. Watch for opportunities to sell a breakout lower or, sell against overhead resistance up to $16.85. The trade should not be held above this point and should only serve as an initial disaster stop.

Finally, the S&P 500 is having one its expiration volume blowups. Money managers use the S&P 500 futures and options to adjust the leverage and risk within the portfolios they manage. Frequently, this involves covered executions involving both futures and options. This has placed the commercial traders in their most bullish position since August of 2017. The March 15 expiration date should be watched closely as these events typically prove to be inflection points for several months to come. We’ll update this position once we have price action confirmation.