We expect to see a surge of new speculative buying in both gold and crude oil, writes Andy Waldock.

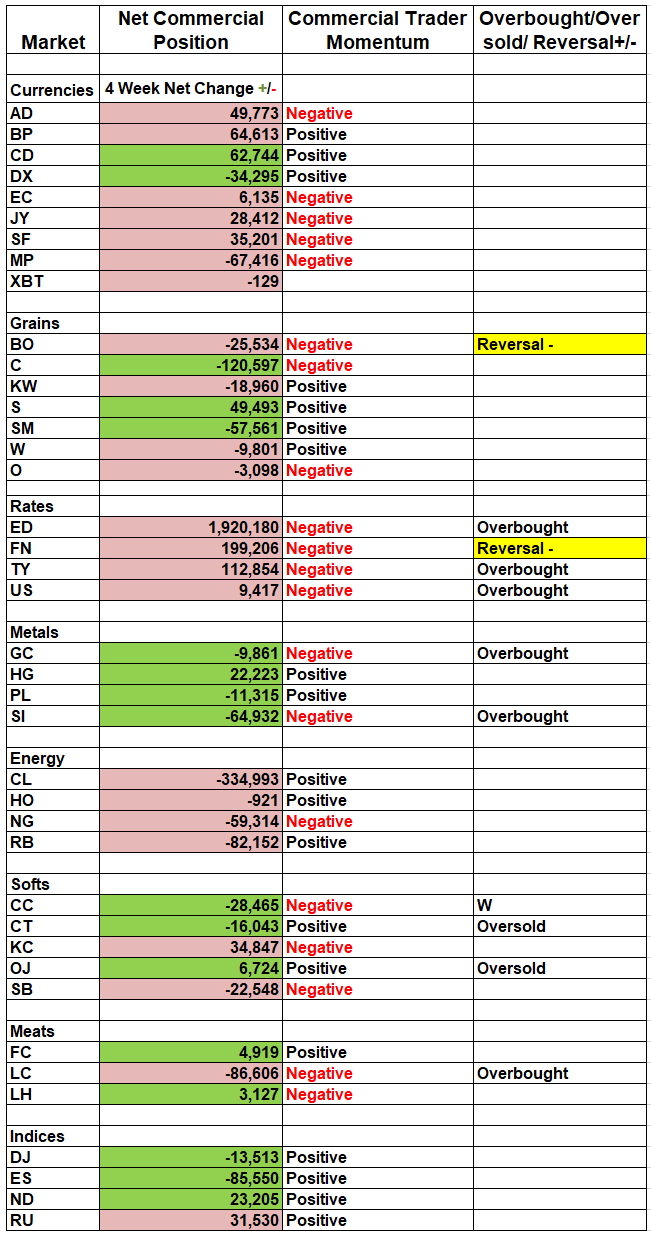

The Commodity Futures Trading Commission continues to get caught up on their Commitments of Traders (COT) data, and some of the new data points are particularly interesting. We’ll first examine setups in crude oil and gold before touching on the actual signals generated in both soybean oil and the five-year Treasury note futures.

The battle between the commercial and speculative trade occurs along the front of support and resistance. The speculators have pushed both gold and crude oil above their recent resistance levels. We expect to see a surge of new speculative buying as the market gains ground, and this is precisely what’s happening in both gold and crude oil.

The commercial traders are anticipatory, thinking through long-term scenarios. Their recent selling in the gold market is in response to the purchases they made in October and November when the market was trading below $1,200 per ounce. We published our last Weekly COT buy signal in gold on Oct. 12. The weekly COT signals and the Seasonal program, which has been long gold since Feb. 7 are good ways to add precious metal exposure through exchange traded fund’s (ETF) like SPDR Gold Shares (GLD) or leveraged ETF’s like ProShares. While our trading focuses solely on highly leveraged futures products, we recognize the correlation between the commodity-based ETF’s and their underlying commodity futures counterparts.

The gold market’s breakout above $1,325 should signal the last of the near-term strength. We expect gold to run out of gas near month-end somewhere between $1,330- $1,350 before a spring pause.

Crude oil is exhibiting the same behavior as gold, driven by last week’s technically bullish, outside bar, higher. Crude oil’s climb above $56 per barrel could be short-lived as technical resistance and commercial selling cap resistance short of $65 per barrel before the post-Memorial day pause in energy prices between cold weather and summer travel.

Finally, we have two clear-cut trading signals for this week. We want to short sell May soybean oil and June 5-year Treasury Notes.

May soybean oil typically peaks towards month-end. However, last week’s price action looks like a reversal lower, which is in line with our overall expectations. While we missed the short signal on our daily service due to the government shutdown, we can still catch the weekly signal by short-selling May soybean oil and placing a protective buy stop above last week’s high at 31.01. There should be room to make $2 for every $1 in risk without the market having to create a new low.

The June five-year T-notes are consolidating in what could be an imminent failure of momentum. Place a sell stop to create a new short position at 114-03. If the market can reverse and get us short on the way down over the next week, we’ll take the position and place a corresponding protective buy stop at 115-02.

Finally, cancel the OJ orders, as the trade never materialized.