After a delay in CFTC COT reporting due to the government shutdown, Andy Waldock is breaking down the most recent data. Andy will be presenting at the TradersEXPO New York.

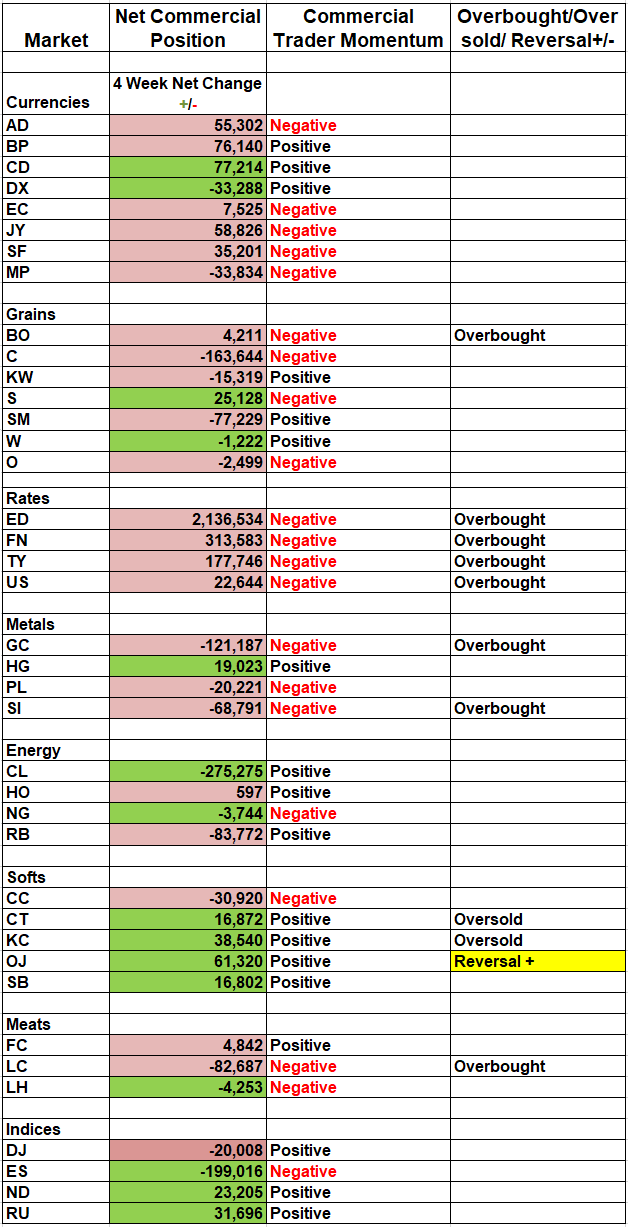

We’re back to analyzing Commitments of Traders (COT) data now that the Commodity Futures Trading Commission is once again reporting it. Even if it’s a bit old until the CFTC gets caught up. Thankfully, the data is providing us with no less than 10 markets to watch for reversals and an eleventh, ready to trade.

The weekly COT analysis here at the MoneyShow is designed to provide timely alerts to futures and commodity-based exchange traded fund (ETF) traders in markets that commercial (smart money) is piling in against the current speculative trade. This research focuses on creating reversal trading opportunities and is a valuable tool for locking in profits near the end of a given trend. We provide these signals on both a daily basis and, beginning in March, a weekly basis.

The Frozen Concentrate Orange Juice futures tripped their daily signal one week ago, and have consolidated in a bull flag formation over this past week. The March orange juice futures still have about two and a half weeks to first notice day. Given the market’s protracted downward trend, we can’t help but see the current formation as a reversal higher as the speculators cover their overextended short position heading into expiration.

Orange juice is a thinly traded momentum market. This makes entry difficult. Typically, I’d suggest a resting buy stop to get long if the market moves above $1.22 per lb. Unfortunately, this one may require some finesse by yourself or, your broker to eliminate possibly substantial slippage. That being said, longs above 122 should risk the position down to the March contract’s low of 115.90. Orange juice is $150 per point (cent). Therefore, we’ll be risking about $900 per contract. We expect the market to run toward 135 before to bumping into resistance and expiration constraints.

Interest Rates

Next, we want to look at the interest rate sector. Commercial traders have been heavy Treasury buyers around the 140 level in the 30-year Treasury bond. Commercial traders doubled down on the long side when the lows were made in October and November. The recent move higher in Treasury prices shows that the commercial traders have been bailing out of their long position post haste. They apparently don’t believe relatively dovish comments by the FOMC will keep rates this low for very long, and are rapidly positioning themselves on the short side of the market as they expect interest rates to move higher (prices lower) into summer and perhaps, beyond. Many of these trades will trigger on the daily COT signals first, but we’ll update the action here so you can follow along.

Finally, a quick look at metals shows that copper rallied substantially, in line with our last signal. Now, silver and gold have rallied into resistance levels and are beginning to look top-heavy. However, our COT ratio indicator doesn’t show the overabundance of speculative exuberance we usually associate with a reversal. Therefore, we’ll keep silver and gold on our watch list and see what happens as the data catches up and the formation develops.