Marvin Appel provides his State of the market commentary.

Stocks have recovered from their March 22 drop, making new highs this week before pulling back on April 9. Mixed signals from the bond markets have also resolved in bullish directions, with most corporate high yield and floating rate bond funds making new total return highs since our most recent buy signals. Meanwhile, 10-year Treasury note yields have recovered to 2.5%. All of this is consistent with waning recession fears (for now), confirmed by the strong April jobs report.

One other piece of good news is that the adage to “sell in May and go away” may be less prognostic of market weakness than it used to be. We are testing new strategies with the goal of identifying when we should bet on further gains past the traditional May 1 deadline. Preliminary results suggest that 2019 should see a more bullish period post-May 1 than average.

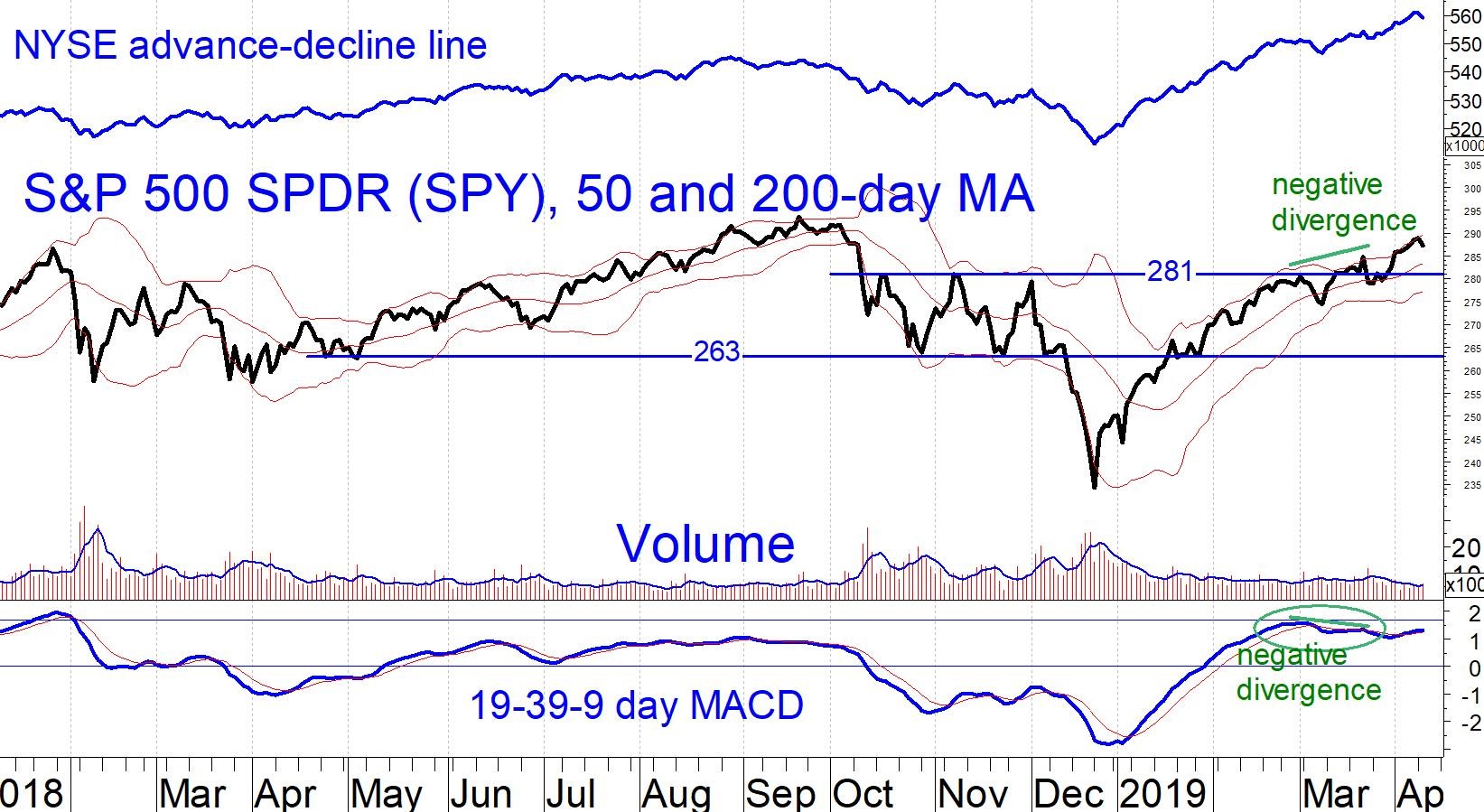

Market breadth has been so strong that even without incorporating any new research on seasonality, it looks like our intermediate-term U.S. equity model will remain on a buy signal past May 1. For example, the SPY chart (below) shows that the daily A-D line has reached a new all-time high, while the S&P 500 Index itself has been moved mostly sideways since early 2018.

If SPY does pull back, the next support area should be 281-283; 281 is the former resistance level from October-November and March 1, while 283 is the area just below the middle Bollinger band.

Should you invest in foreign equities?

Our foreign equity model also remains on a buy signal. However, I do not recommend foreign over U.S. equities at this time. In the last issue I noted that we would be alert for a new signal from our EEM vs SPY relative strength model that would indicate a switch from SPY to EEM. That switch has not occurred yet but remains potentially close and is quite possible by the end of April.

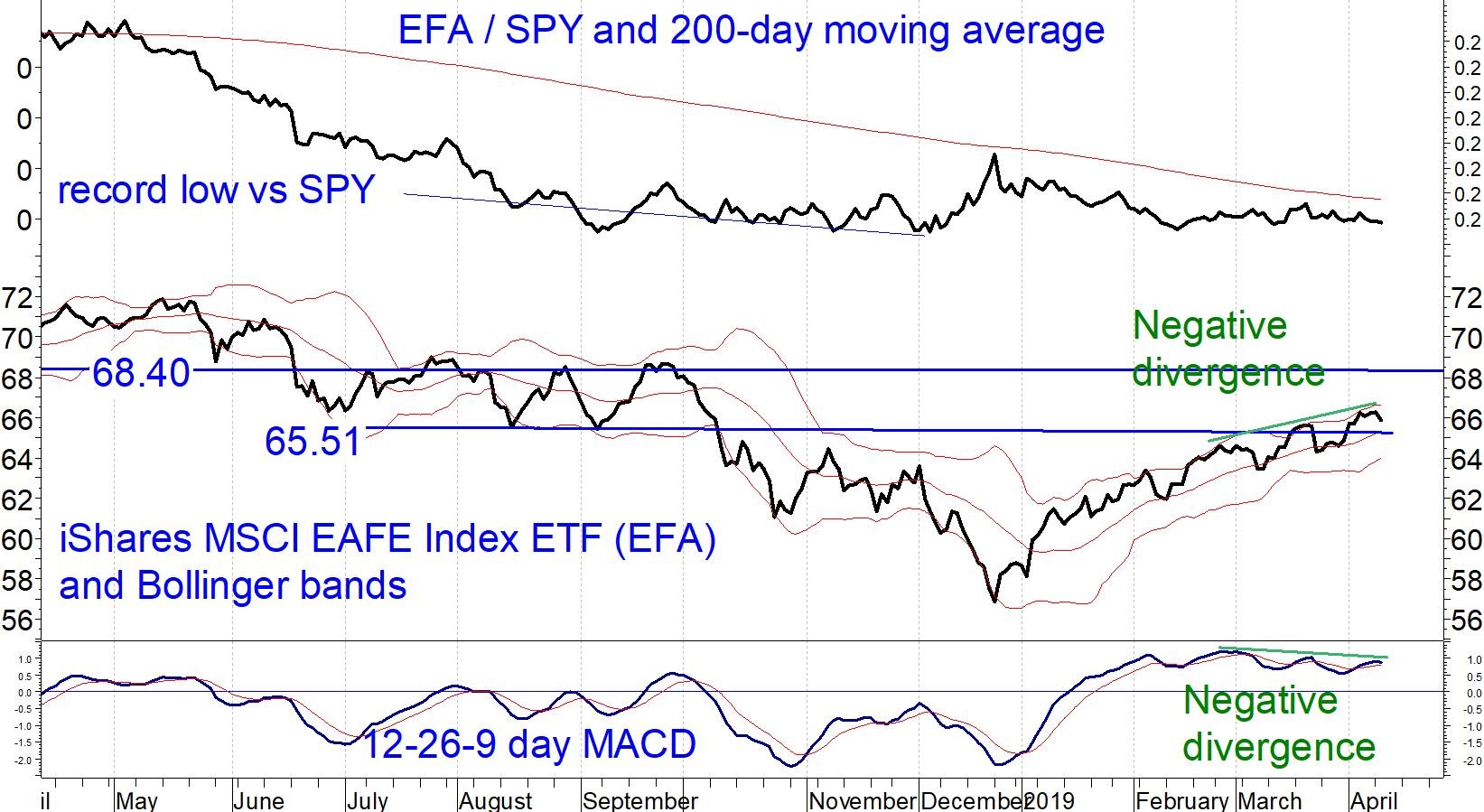

Foreign developed-country stocks have been weaker than emerging markets this year. For example, while the ratio EEM/SPY (an indicator of relative strength in emerging market versus the S&P 500) has repeatedly touched its 200-day moving average for the past four months, the ratio EFA/SPY has been consistently below its own 200-day average since last May. (See chart below). EFA is the iShares MSCI EAFE Index ETF, a measure of developed-country stocks outside of North America, mostly Western Europe and Japan.

I heard a presentation from George Noble, the first portfolio manager of the Fidelity Overseas Fund. Surprisingly, he expressed an opinion that I have held for years: U.S. investors can no longer expect to benefit from diversification if they maintain permanent allocations to foreign stocks. The world’s markets are now too correlated with one another for foreign equity diversification to improve long term risk-adjusted returns. The implication is that U.S. investors should utilize foreign equity ETFs and mutual funds only when tactical opportunities present themselves.