Commercial traders are long bonds & short equities; a sign of risk aversions says Andy Waldock in this week’s COT analysis.

There’s a clear “risk-off” behavior pattern building in the financial and commodity markets that runs counter to the commercial traders’ standard practices.

Commercial traders are typically negative feedback traders. In short, this means they’re actions are inversely proportional to the market’s movements up to the point that their businesses’ needs are met. Once their needs are met, they’ll step aside and let the market do what the market is going to do.

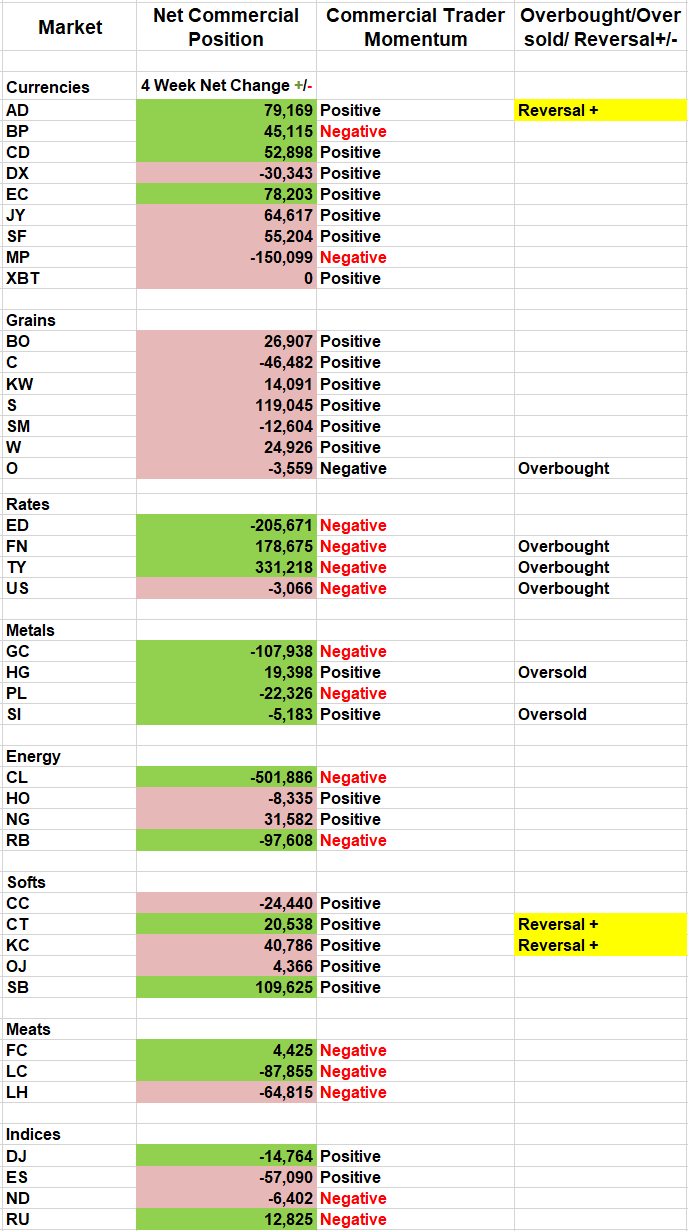

The commercial traders’ collective actions over the last several weeks have run counter to this model in both the interest rate and stock index futures markets see table below). The commercial traders have been net buyers in the interest rate complex as Treasury prices have climbed and yields have declined since early April. The commercial traders are collectively net long the five-year Treasury note, 10-year Treasury note and 30-year Treasury bond contracts, leaving the three-month Eurodollar interest rate future as the only outright short position.

What makes the commercial trader shift in sentiment is even more extraordinary is that they are adding to new long positions at the highest Treasury prices we’ve traded since the September of 2017 bounce. This effectively places the commercial traders growing, net long position in the breakout strategy category.

Buying Treasuries is a classic risk-off move. This is becoming more alarming because the commercial traders have also been sellers in the S&P 500, which is by far the largest stock index futures market with a total value of approximately $353 billion based on the market at 2830 X $50 point value X 2,500,000 open interest.

Commercial selling in the stock indices is used to hedge underlying stock portfolios. This helps alleviate having to offset individual stock positions within a portfolio, potentially creating more tax liabilities than protection. This also helps portfolio managers work around short sale issues and technicalities like uptick rules.

We could speculate that the precarious balance of the collective positions is due to trade wars. We could say the rally is growing long in the tooth. We could say they’re afraid of the triple top formed by the highs from February and September of 2018 and this month’s high.

The Russell 2000 hasn’t recovered its September of 2018 highs and sold off into the long-term moving averages. The Nasdaq’s recent high generated a much lower momentum reading, and thus created a bearish divergence. Typically, these two indices lead the market. This could force the S&P 500 towards its averages another 6% lower while still maintaining a bullish trend.

There are two more pieces to this picture. The commercial traders’ currency positions are becoming bearish towards the U.S. dollar and friendly towards the euro, as we mentioned last week. Again, we don’t know the specific answers behind the commercial traders’ actions, but tracking their trades can help put the big picture in perspective. Another noteworthy point is that the dollar is typically strong through the early summer as the American economy thaws out, and our northern citizens get moving, again. Yet, the commercial traders are selling into this seasonal tendency.

The last piece in this puzzle is the record long position by the commercial traders in the silver market. This market is historically dominated by silver miners’ selling forward production. This is only interrupted by the occasional rally, which they gladly sell, lower. Commercial traders have been net buyers in eight of the last eleven weeks. Now, I understand that owning silver and Treasuries is counterintuitive, but these are the actions of the world’s largest traders in the world’s deepest futures markets. Collectively, it presents a very shaky outlook on the domestic economy and stock market.

Listen to Andy talk about seasonality and the COT Report at the recent TradersEXPO New York