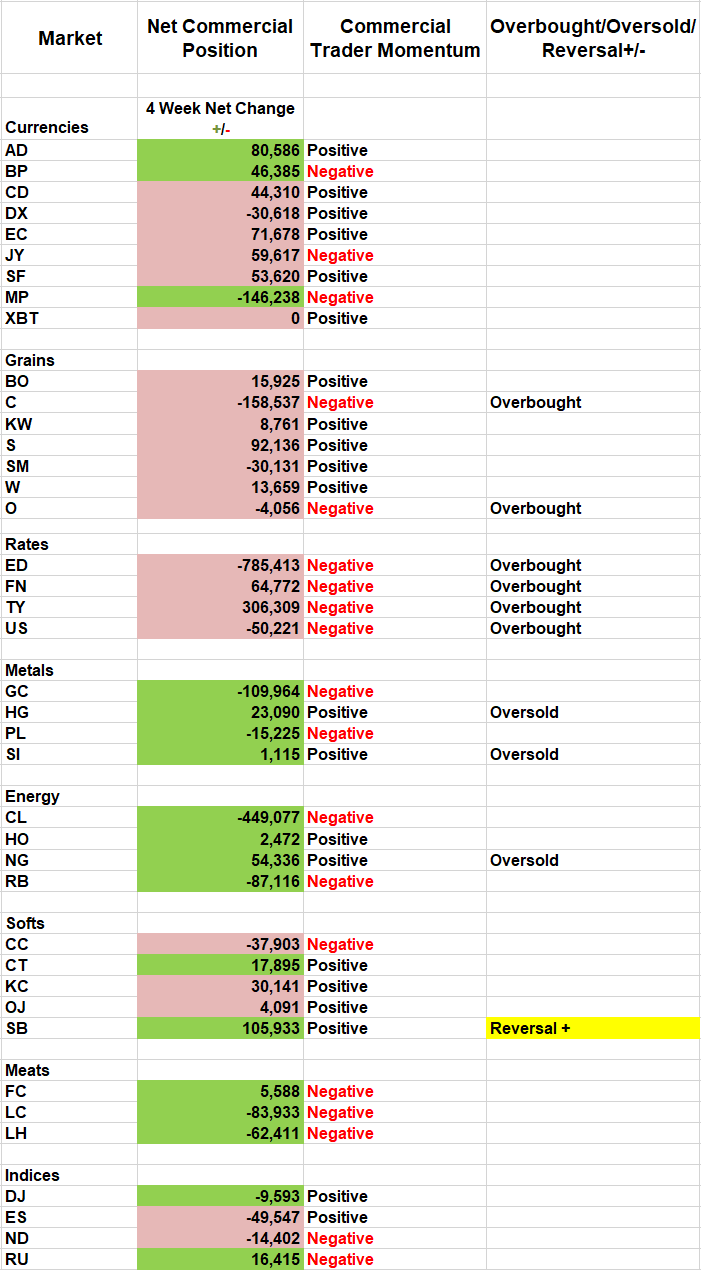

Commercial traders have abandoned their long interest rate position leaving speculators holding the bag, writes Andy Waldock.

Last week we highlighted how the COT Report presented a classic risk-off stance as commercial traders were long the interest rate complex and high levels while shorting stock indexes.

This may have been a strong signal but one that was near its zenith as commercials reversed their position.

We have several points to discuss this week so; we’ll get right to them.

Interest Rates

Last week’s surge in Treasury prices was directly in line with our forecast. However, the commercial traders used last week’s surge in prices to dump enough contracts to reverse their position back to net short; now, at a higher price. Interestingly, these market actions leave the small speculators as the only trading group net long. Our COT ratio indicator shows that the small speculators now hold their most significant long position since February of 2003 in the 30-year Treasury bond futures. The odds are strong that we’re near a top or, a pause in Treasury prices. The small speculators are rarely right. This market is ripe for a COT short sale signal and reversal, lower.

Grains

Commercial traders have sold into the grain market rallies across the board. Commercial momentum has yet to turn negative, due to time, in every market but corn. I expect the other grain markets’ momentum readings will follow corn’s lead and shift into negative territory very shortly. Producers are rapidly locking in forward delivery prices.

Corn

Corn has rallied more than 25% since we published a buy recommendation in our Daily COT signals for trading on May 14. This spike has taken out a considerable amount of the speculative short interest that had built up. Meanwhile, commercial farmers have used this rally to lock in December corn delivery prices above $4 per bushel at a frantic pace.

Farmers’ forward selling has outpaced processors’ buying by a 5:1 margin over the last two weeks, resulting in 324k new short contracts. Their aggressive selling has flipped momentum to the short side. Extremely negative commercial momentum combined with the currently overbought condition of the corn market has us on the lookout for short selling opportunities.

Cocoa

The cocoa market is presenting a classic Commitment of Traders reversal pattern. Cocoa has been trying hard to rally above $2,500 per ton. Speculative traders, afraid of missing a seasonal rally later in the month, have committed to new long positions too early, fearing they’ll miss the breakout. Many of them will be forced to offset recent purchases at a loss before the market regains its footing.

Cocoa has been unable to close above $2,500, and on May 30, we issued a short sale signal to our daily COT subscribers. Cocoa producers used this rally to lock in delivery prices for 30k contracts between $2,400 and the recent high over the last three weeks. More importantly, this leaves only the large and small speculators long; each of whom, have accumulated their most concentrated long positions since last July’s high, a price to which we’ve yet to return.

The speculative position is not far from bailing out of their new holdings. Speculators’ stop loss selling should drive the market lower and allow us to cover our short entry at a favorable price while the market sets up for a seasonal buy signal later this month.

Finally, we follow these trades with updated stop loss levels, targets and their commodity-based ETF equivalents in our weekly COT newsletter. The back issues of which are now available on our site, waldocktrading.com.

Listen to Andy talk about seasonality and the COT Report at the recent TradersEXPO New York