Near record commercial position in corn grow and interest rate complex remain overbought, reports Andy Waldock.

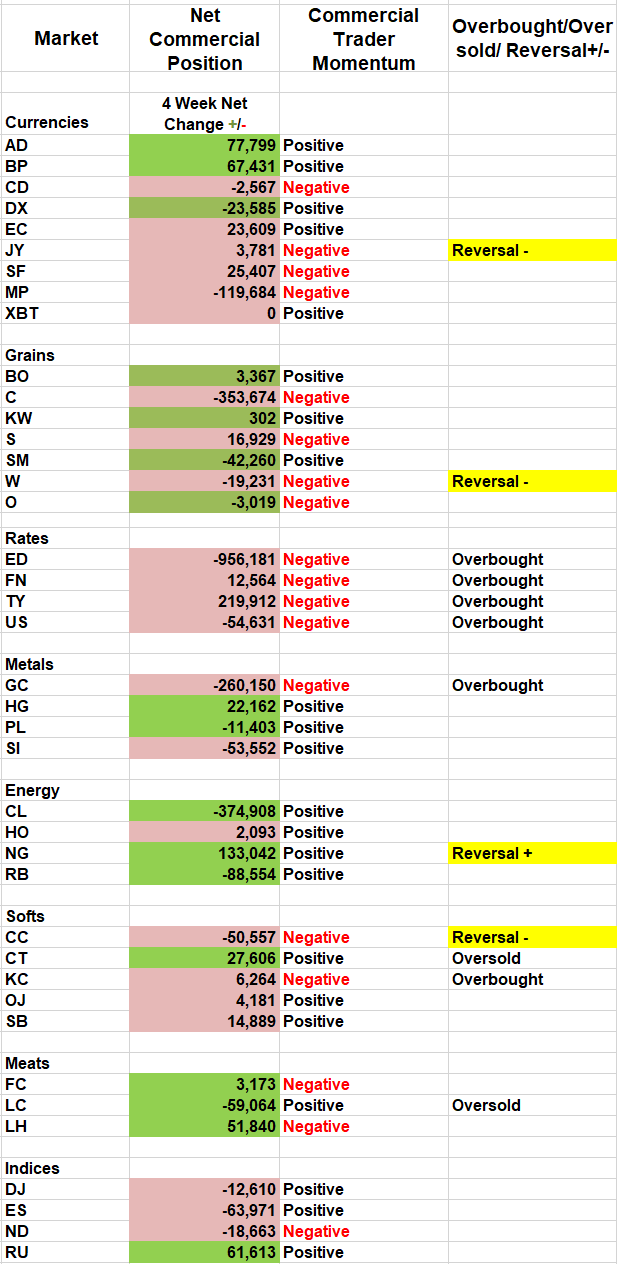

This Week’s Commodity Futures Trading Commission’s Commitments of Traders Report (COT) indicate negative reversals is wheat. Cocoa and the Japanese yen, and a positive reversal in natural gas thanks to the late arrival of summer (see table).

With all the weather issues this spring, the grain sector remains the most interesting.

Grains

Following up on last week’s corn commentary, commercial traders have continued to sell December corn (this year’s crop) at a breakneck pace. This was essential news as it stated the farmers’ expectations ahead of Friday’s U.S. Department of Agriculture acreage report.

Commercial traders sold nearly 100k contracts over the last three weeks as acreage questions grew along with the speculative bid. U.S. farmers took full advantage of speculative greed. Farmers contracting to deliver corn this year have pushed their net position to new 52-week lows in each of the last three weeks. Forward selling has forced commercial traders’ net short position to its most bearish level since June of 2011. Furthermore, the pace of their recent selling is more than two standard deviations beyond the net position average movement for the last year. The point is corn traders feel they can make delivery at $4.50 whether they grow it themselves or, buy it elsewhere.

Here are the last four times the commercial trader behavior produced these statistics: Jul 24, 2015, June 17, 2106, July 14, 2017 and March 16, 2018. Look up the market action following these dates, and you’ll grasp the gravity of the current readings that I’ll be presenting at TradersEXPO Chicago on July 23.

I expect December corn to fill through the gap it left over Memorial Day weekend between $4.20 and $4.225 and find near-term support between $4.00 and $4.15. We’ll re-evaluate the market once short position profits are taken.

Farmers were less bearish on soybeans than the expected acreage shift led one to believe. Farmers have been patient as beans put a little more time on their side. While they’re definitely on the sell side, they’ve just now set a new net short position low since last April. We’ll look for accelerated forward selling pressure on any rising prices.

Lastly, we’ll touch on the wheat market. The COT short sale signal comes against strong technical resistance; $5.75 per bushel has been the line in the sand for quite a while. Commercial traders still have quite a bit more selling power left to apply in this market. We think the $5.57 high in the September contract will hold, making this a viable short sale opportunity in line with the dominant trend, lower.

Platinum

Our seasonal program issued and was stopped out of a short trade for last Friday’s trading, in spite of both seasonality and the Commitment of Traders report reinforcing the forecast for lower prices. Even though we were stopped out of the position, the current market imbalance remains worth keeping on your radar, as an implosion could be vacuous.

First, the small speculators just set a new net long record of nearly 9,500 contracts.

Secondly, their concentration of positions, long almost 4:1 is beyond the 95th percentile over the last 20 years. Finally, the October contract’s low was $782 made last August. A breach of this level will encourage a wave of trend-following, breakout short selling by the large commodity funds who are currently neutrally positioned in the platinum market.

Japanese Yen

Commercial traders in the Japanese yen are currently exhibiting the same behavior they did in March of 2018. They’ve set a new net short low for the year and picked up the pace of their selling dramatically enough over the last three weeks to make their current behavior far more meaningful than their average behavior over the last year. This combination suggests that commercial traders expect the yen to test the support between .8850 and .9015.

Andy is presenting at the TradersEXPO Chicago on July 23. Here is what Andy had to say about seasonality and the COT Report at the recent TradersEXPO New York.

Visit Andy Waldock Trading to learn more. Register and see our daily and weekly signals archive for entries and stop loss levels sent to our subscribers.