When to allow exercise or roll your options? Alan Ellman provides guidance.

As options contract expiration nears, we must have a plan to manage our in-the-money (ITM) cash-secured puts. Assuming we initially sold an out-of-the-money (OTM) put which is now ITM, share price has declined. We can assume that by following the Blue Collar Investor guidelines for position management, the current stock price is not more than 3% below the strike price. This means that the current status of the trade may represent a small loss to a small gain.

Management choices with the ITM strike

- Buy back the short put and move on to another put trade the following Monday

- Roll the put option to the following contract month

- Allow exercise of the put and sell covered calls on the newly-acquired shares the following week (the call leg of the put-call-put (PCP) strategy.

Buy back the short put and move on to another put trade the following Monday

- We use the management approach if the underlying security no longer meets system criteria, if there is an earnings report due out the following month or if the calculations do not meet our stated goals

Roll the put option to the following contract month

- We favor this approach if the stock still meets system criteria but overall market conditions lean bearish and selling OTM covered call will not benefit us

Allow exercise of the put and sell covered calls on the newly-acquired shares the following week (the call leg of the PCP strategy).

- In favorable market conditions we can choose to allow exercise and have the shares “put” to us and then write an OTM covered call. This will allow us the potential for two income streams, one from the options premium and the other from share appreciation from current market value up to the OTM call strike.

Real-life rolling calculations with Intel Corp. (INTC)

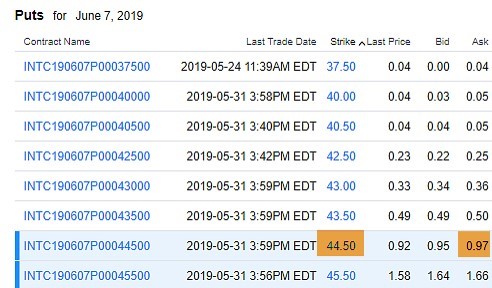

Buy-to-close the original $44.50 put

INTC: Option Chain to Close current short Put

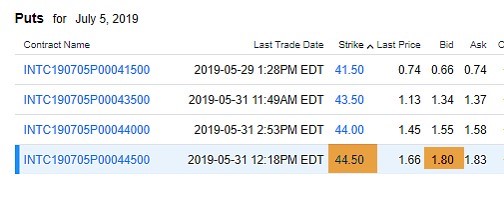

Sell-to-open the next month $44.50 put

INTC: Sell-To-Open the Next Month $44.50 Strike Option Chain

Initial rolling calculations

Let’s assume we sold the original $44.50 put for $1.00 making our cost-basis $44.50 – $1.00 or $4,350 per contract. Our net option credit is ($180.00 – $97.00) per-contract. Our initial one-month rolling return is ($1.80 – $0.97)/$4,350 = 1.91%. If this falls into our stated initial time-value return target range, rolling the put should be given consideration.

Discussion

Management of ITM puts when utilizing the PCP strategy includes closing the short put and using the cash to secure a put on a different stock or exchange traded fund (ETF), rolling the put to the next contract month or allowing exercise and selling a covered call. These decisions are based on overall market assessment, calculation returns and trade adherence to system criteria.

Use the multiple tab of the Ellman Calculator to calculate initial option returns (ROO), upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). The breakeven price point is also calculated. For more information on the PCP strategy and put-selling trade management click here and here.