Is the stock market about to crash? The question is certainly coming up a lot these days, writes Joe Duarte.

While doing an interview this weekend at the MoneyShow in Orlando, host Hillary Kramer asked me if I thought there would be a crash in the stock market; to which I responded that anything was possible in the world at the moment due to the developing situation with the Coronavirus and the overwhelming presence of trading algorithms in the stock market.

At the same time I also noted that it would be difficult to see the Federal Reserve reversing its current “non-QE” anytime soon, and since the algos just read headlines and follow instructions it was a tough call on what the market would do in the short term.

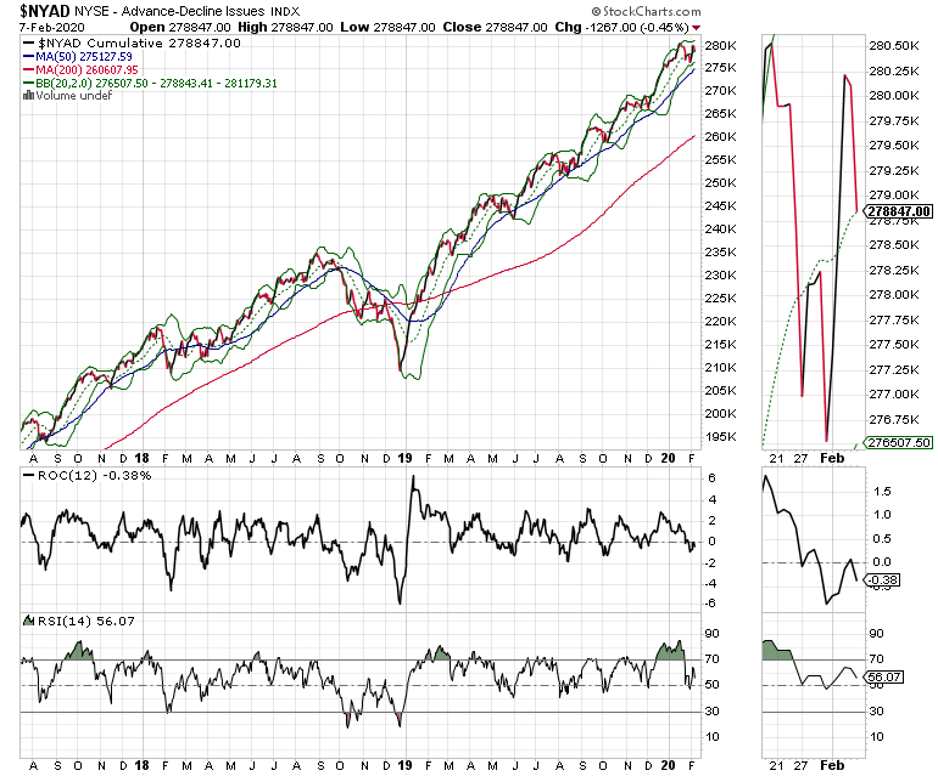

Nevertheless, and as I pointed out during my presentation on Friday morning at the MoneyShow, the New York Stock Exchange advance decline line (NYAD) may be in the early stages of a technical divergence, which is very worrisome if not reversed. I will have more details on this below. Just the same, however, the bottom line is that we are now truly trading at the edge of Chaos, where events are very fluid and where one false move can lead to disastrous consequences or riches beyond our wildest dreams.

Accordingly, the problem for investors is that if this divergence in NYAD becomes fully operational, we are likely to have a significant and perhaps very rapid decline in the stock market, which regardless of the fundamentals for sectors or individual stocks, there will be pain felt throughout the Markets-Economy-Life (MEL) ecosystem. That’s because when the real selling starts, the algos usually just walk away and there are no buyers left to absorb the waves of selling. Of course, where there is risk, there is also opportunity, as I will describe below in the section regarding Gilead Sciences (GILD).

As a result, the effects of a market decline could work their way to 401 (k) plans, the pillar of the current wealth effect. If 401 (k) plans suffer then people’s financial decisions, such as home buying, vacations, new cars, may be put on hold further decreasing economic activity. This in turn would make its way to corporate earnings and fuel more selling in the market.

Thus, we may be staring into a difficult abyss in the not-too-distant future unless something positive happens, especially in relation to the Coronavirus situation. That said, it’s tough to know when things will unravel because there is so much at play politically. Furthermore, the Federal Reserve has a well-founded fear of a full blown global recession gathering steam, which will likely keep the easy money taps open.

Bonds and Spilled Coffee

Ultimately, a good way to visualize the relationship between MEL and easy money is that it’s akin to a worker that’s been working overtime for a long time but is still getting good mileage out of drinking strong coffee – easy money. However, if that worker is reaching the point of exhaustion then you might as well just pour the coffee down the drain because at some point the worker is going to need a break.

In other words, if the worker falls asleep, then production will falter. And that’s what the divergence of the NYAD may be signaling, that heavy caffeination isn’t going to be enough to keep MEL rocking and rolling.

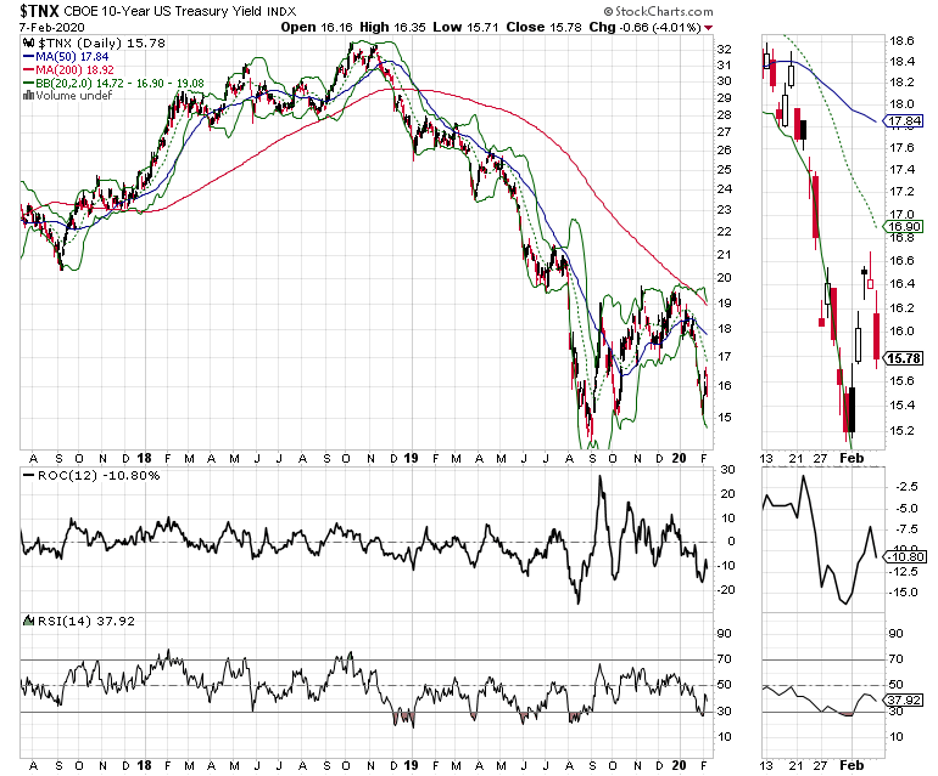

The bond market is betting on exhaustion as the U.S. 10-year note yield (TNX) closed last week below 1.6% and seems poised to test the recent lows (see chart).

Coronavirus Wildcard

A lot of the market angst stems from worry over the Coronavirus and its effect on energy demand among other sectors. Preliminary studies indicate that biotech antiviral giant Gilead Sciences (GILD), may have a potential remedy for Coronavirus available soon, which is currently being tested in China.

This story is developing and there are no guarantees, however, this could have a major impact on global equity markets in general and GILD specifically (tomorrow we will discuss the GILD opportunity in greater detail).

NYAD May be Signaling Weakness

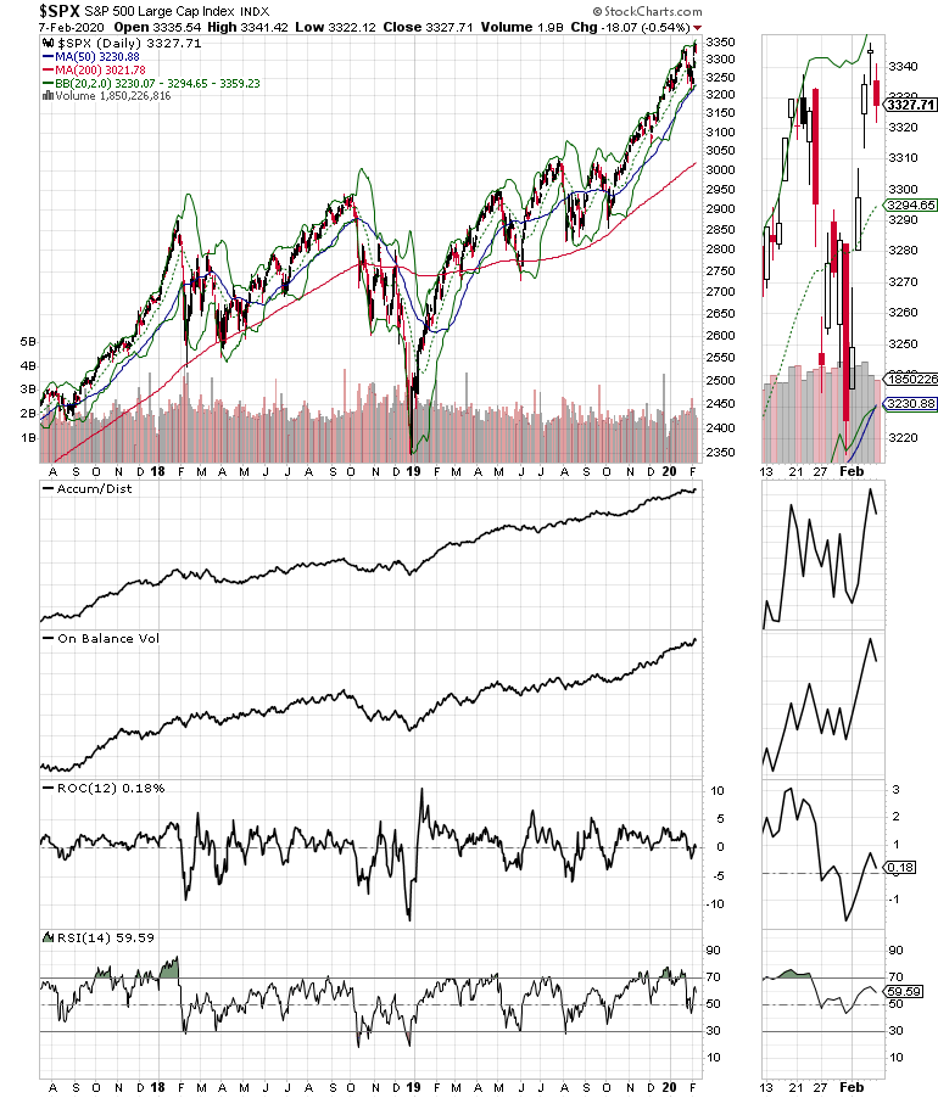

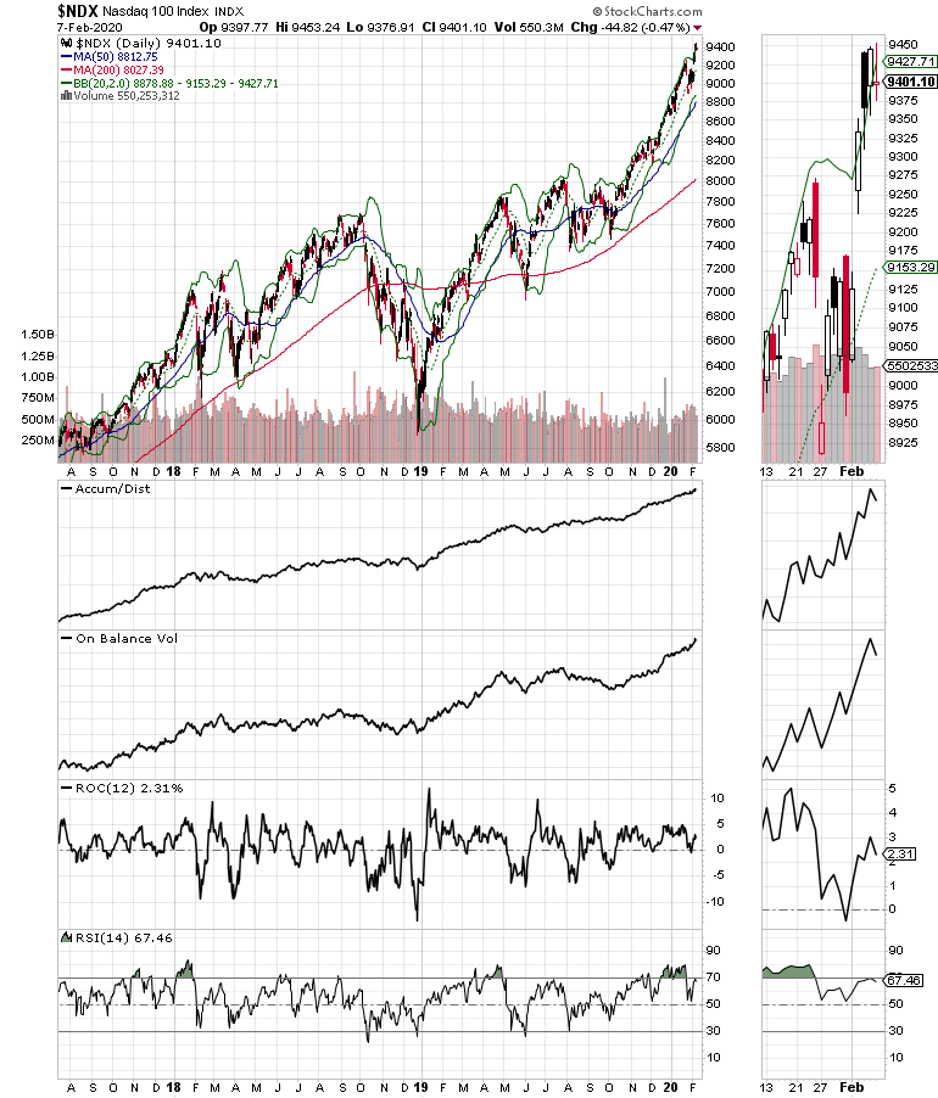

The New York Stock Exchange Advance Decline line failed to make a new high last week despite a new high on both the Nasdaq 100 (NDX) and S&P 500 (SPX). This is a technical divergence and until proven otherwise should be viewed as a potential sign that the market has made an important top (see chart).

Moreover, the On Balance Volume (OBV) and Accumulation Distribution (ADI) indicators for both SPX and NDX may have started to roll over although it’s still a tough call since a couple of good days this week could change everything again.

Furthermore, there are two additional findings in the NYAD chart which support the case for the divergence. First, the rate-of-change (ROC) indicator failed to climb above the zero point on the recent bounce. This confirms a loss of upside momentum, which is evident in the lack of a new high for NYAD. Second, the relative strength index (RSI) failed to get back to above 70, confirming that the broad market is starting to weaken even as the major indexes made new highs.

Finally, NYAD ended last week at its 20-day moving average. If the line breaks below that short term support level it may well test the more critical 50-day moving average. A decisive break below the 50-day line is a serious breach and would likely signal an acceleration of the selling. As a result, until this technical situation is remedied the odds of the market stalling out are higher than of it making new highs and investors should be considering hedging, raising cash or both.

Be Prepared for More Volatility

The Coronavirus has created a dangerous background for the MEL ecosystem. The potential for the virus, due to quarantines in China, to cause supply chain disruptions, triggering a further slowing of the global economy, along with the immeasurable cost of lives lost may be the catalyst that finally disrupts the longest bull market in history.

At the same time, it’s crucial to keep in mind that any sign of good news could reverse the current negatives in the market and start a new up leg. Remain cautious and explore implementing a hedging strategy.

I have an open long position in GILD as of this writing.

Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here.