Alan Ellman breaks down what happens when a company decides to execute a reverse stock split.

Contract adjustments to the terms of our covered call writing and put-selling options are due to corporate actions like mergers and acquisitions, special dividends and stock splits. This article will highlight the contract alterations resulting from a reverse stock split.

What is a reverse stock split?

This is a reduction in the number of a public company’s outstanding shares and a corresponding increase in the value of those shares. For instance, it could double and immediately if you owned 100 shares worth $10, instead you would have 50 shares worth $20. This results in making the shares look more attractive to institutional investors who may have minimum price requirements and also may address exchange de-listing concerns due to low prices. These actions are made by the underlying companies while the corresponding adjustments to option contracts are made by the Options Clearing Corporation Securities Committee.

Option symbology components: INTC200619C00065000

- INTC: Option ticker symbol

- 200619: Expiration date- June 19, 2020

- C: Call option

- 00065000: $65.00 strike price

Contract definitions

Multiplier: The number used to calculate total premium, generally 100. If a premium is listed at $2.00 with a standard multiplier, the cost to buy the option is $200

Deliverable: Defines the unit of trade (stock, cash) that changes hands on exercise. It is usually 100 shares of stock.

Types of contract adjustments for reverse stock splits

- Deliverables are decreased

- Option symbol changes

- A new class of options is listed after the split using standard terms

Adjustments are NOT made for the following components

- Number of contracts in account

- Strike prices

- Multiplier (still 100)

Real-life example with Alerian MLP ETF (AMLP)

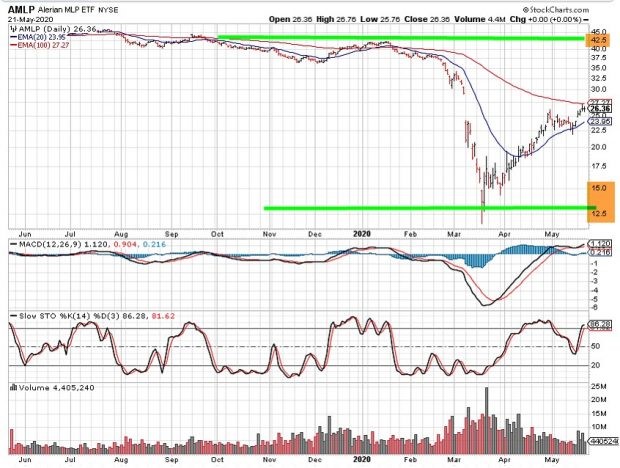

AMLP Price Chart 2019 – 2020

From February through March, the price of AMPL declined from $42 to $12 (post-split prices) triggering the company’s decision to institute a 1-for-5 reverse stock split.

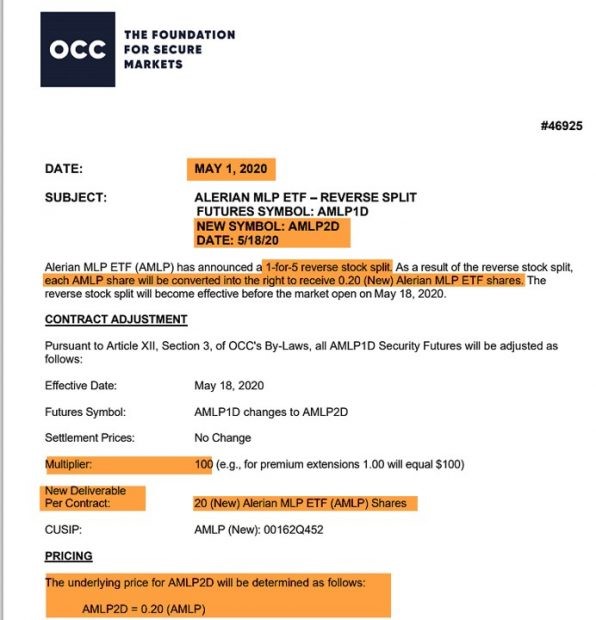

Options Clearing Corporation Announcement of AMLP’s 1-for-5 reverse stock split

AMLP 1-for-5 reverse stock split announcement

Note the following:

- For each share owned, 0.20 shares will be owned post-split effective May 18, 2020 (deliverables change)

- Stock symbol temporarily changes from AMLP to AMLP2D (ticker symbol changes)

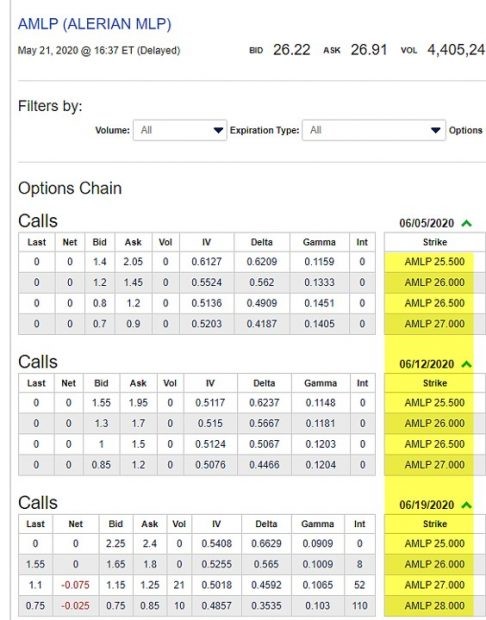

New option-chains reflect the price increasing fivefold with ensuing standard contracts

AMLP Option-Chain

The post-split option-chain shows near-the-money strikes in the $20s, which means pre-split, the prices would have been in the $5.00 to $5.50 range.

Discussion

Reverse stocks splits are generally initiated when share price substantially declines. The value of the stock remains unchanged, but companies feel that they will benefit from this cosmetic enhancement. The components of option contracts that are adjusted are the ticker symbol and number of shares delivered.

Use the multiple tab of the Ellman Calculator to calculate initial option returns (ROO), upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). The breakeven price point is also calculated. For more information on the PCP strategy and put-selling trade management click here and here.