Alan Ellman describes a profitable bear-market strategy using covered calls with cash secured puts.

Covered call writing and selling cash-secured puts are stock option strategies with primary goals of income generation and capital preservation. Most of us are conservative investors who seek to beat the market on a consistent basis while minimizing portfolio risk.

In the past few weeks, I have heard from many of our members (domestic and international) who are concerned about a severe market correction and want to be prepared in case a significant downturn takes place. A review of some of the management techniques we can implement in the event that the market corrects to a significant extent is useful at this time.

Sell in-the-money call strikes and deeper out-of-the-money put strikes

Using in-the-money strikes with covered call writing is our most commonly used approach to protecting ourselves against share depreciation. We are generating downside protection of the time-value (Theta) of the premium, a perk paid for by the option buyer, not us. If we sold a $30 call on a stock currently trading at $32 for $3, our initial profit is 3.3% ($1.00/$30.00) and that profit is protected by the intrinsic value ($2.00/$32.00) = 6.25%. In other words, our share price can drop by 6.25% and we would still generate a 3.3%, one-month return. Similarly, selling deeper out-of-the-money put strikes will provide more protection to the downside.

Use low-beta stocks

Our premium watch list gives beta stats and historically low-beta stocks tend to outperform in bear market situations. Use this as a secondary parameter as lower implied-volatility is more important than the historical-volatility reflected in beta stats.

Lower monthly goals using options with less implied volatility

As an example, lower your monthly goals for initial returns from 2% to 4% to 1% to 3%. This means that the implied volatility of the underlying securities is less and therefore results in lower risk.

Using ETFs instead of stocks

Exchange trade funds (ETFs) are usually baskets of stocks with some going up and some going down. As a whole, these securities have less implied volatility than individual stocks. In our weekly ETF Reports for premium members we also give implied volatility stats for our ETFs and you can tailor your portfolio to your personal risk-tolerance and overall market assessment. Here, too, I would lower my initial time-value return goal range to 1% to 2%.

Buy protective puts

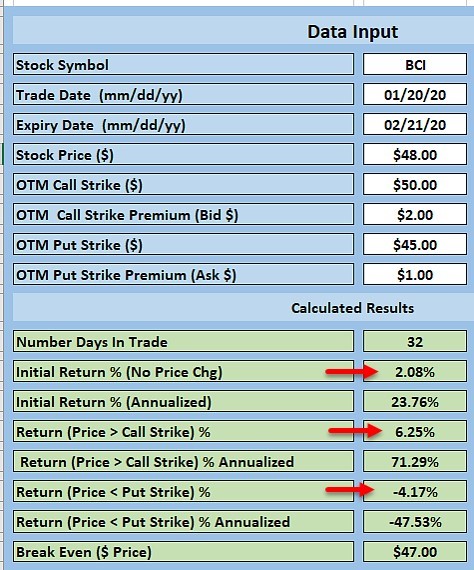

A put will give us the right, but not the obligation, to sell our shares at a certain price. When used in conjunction with covered call writing, the strategy is called the collar strategy. It usually is set up by selling out-of-the-money (OTM) calls and buying out-of-the-money puts. Here’s an example:

- Buy a stock we’ll call BCI that is trading at $42 at $48

- Sell the $50 OTM call for $2.00

- Buy the $45.00 OTM put for $1.00

Our initial options credit is cut in half, but we are protected against a catastrophic price decline below $45.00. Here’s what this trade looks like when using the BCI Collar Calculator:

Collar Calculations

- Initial time-value return is 2.08%

- Maximum return is 6.25%

- Maximum loss is 4.17%

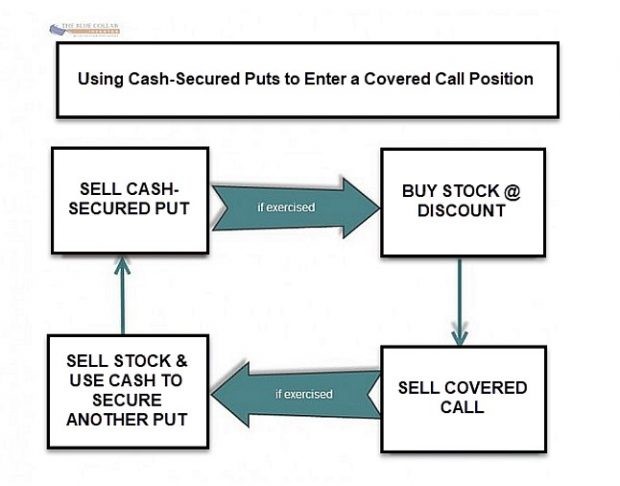

Sell cash-secured puts

We can enter our covered call positions “at a discount” if we are bearish on the overall market. Here’s an example:

- BCI is trading @ $42.00

- Sell the OTM $40.00 put for $1.00 = 2.6% return

- Each put contract is secured with $3900 in cash [($40.00 – $1.00) x 100]

- If there is a price decline below the $40 strike, we purchase our stock at a cost basis of $39 ($40 strike – $1 premium)

- We can now write a call on this stock and select a strike based on all the parameters detailed in my research. I call this the PCP Strategy or Put-Call-Put Strategy. To better visualize this strategy here is a diagram taken from the back cover of my book:

PCP Strategy Graphic

Discussion

One of the advantages of covered call writing is that it can be molded and modified to meet the challenges of current market conditions. An elite and educated option-seller, which is where we want all members of the BCI community to be, will change the strategy approach based on overall market assessment, chart technicals and personal risk tolerance. One size does not fit all.

Use the multiple tab of the Ellman Calculator to calculate initial option returns (ROO), upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). The breakeven price point is also calculated. For more information on the PCP strategy and put-selling trade management click here and here.