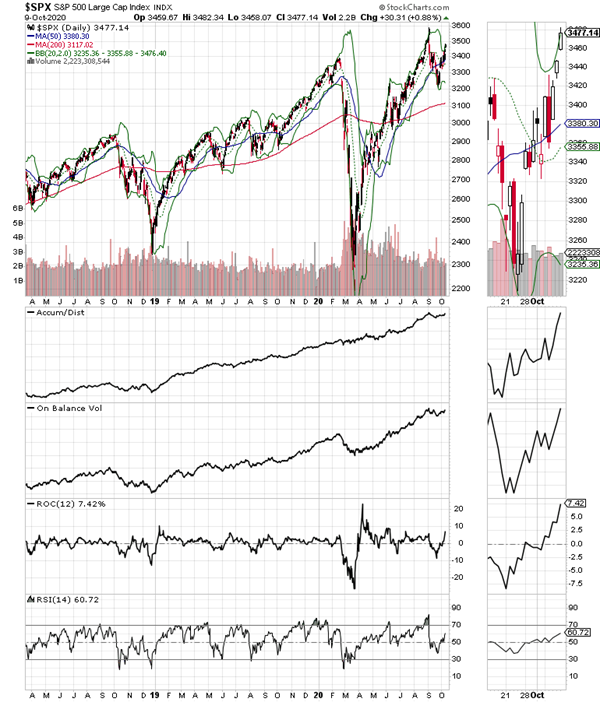

As I noted in my 9/27/2020 column, the “V” bottom that I thought was possible has materialized. Although the US stock market is still volatile with large swings influenced by daily news reports and politically related items, the uptrend is back until proven otherwise, states Joe Duarte on In the Money Options.

It’s Still All about the Fed and the Stimulus Packages

Of course, no matter where the news cycle is, when it comes to the stock market, there is only one real explanation for the upward bias; the Federal Reserve continues to put money into the banking system as it keeps interest rates near zero for at least the next two years. Even more important, regardless of the rhetoric in Washington, there is still the potential for yet another round of stimulus whether in a composite package or perhaps as separate bills or even through executive orders.

What it all boils down to is that as long as the Fed pumps money into the system, and there is some semblance of fiscal stimulus, investors who stay patient, pick well-vetted stocks, protect them with well-placed sell stops, and give them enough room to bounce around inside a broad upward leaning channel will more likely than not be rewarded.

Agilent Breaks Out on Covid Uncertainty as Texas Instruments Joins Semiconductor Rally

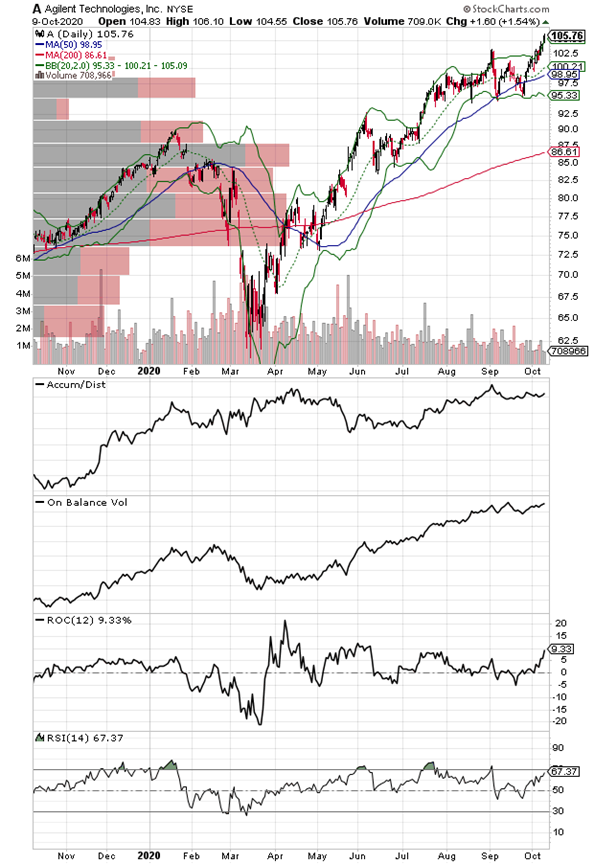

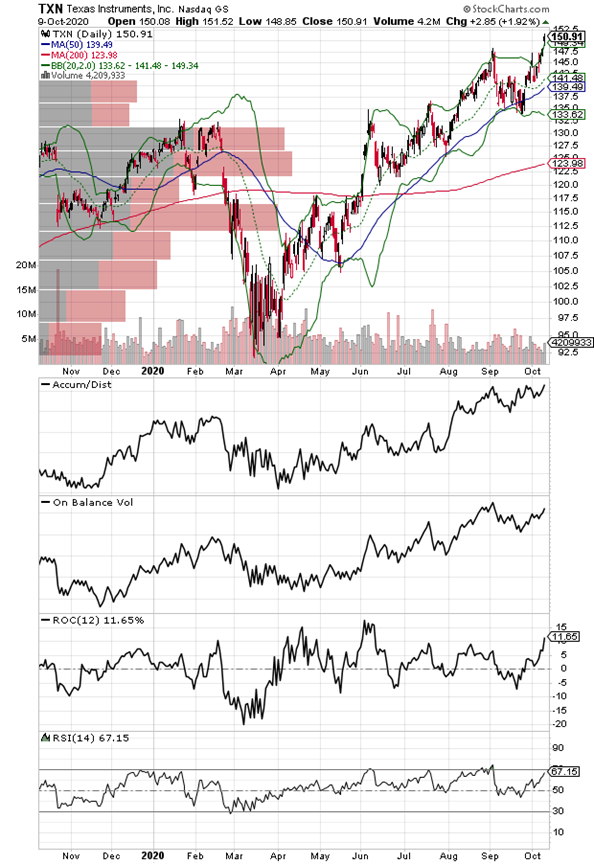

Shares of research equipment and chemical lab reagent company Agilent Technologies (A) delivered a quiet yet solid breakout last week as Texas Instruments (TXN) joined the chip sector rally on news of Advanced Micro Devices' (AMD) reported buyout of Xilinx (XLNX). Moreover, the common thread that binds the breakouts is the ongoing search to find treatments and to develop a reliable vaccine for the Covid-19 virus.

Certainly, the market is learning that a pandemic does not operate via an on and off switch. In fact, pandemics, as are all disease processes are purely chaotic nonlinear entities, meaning that they are by nature predictably unpredictable. That said, chaos eventually reaches the point where complexity moves in and things get somewhat organized. Unfortunately, the recent worldwide rise in viral cases, regardless of whether their outcome results in death, is proof that Covid-19 isn’t going anywhere for the next few months and perhaps longer.

At the same time, even though as President Trump’s presumptive recovery shows, there are some viable treatments for the virus. At the same time no one really knows what the long-term results of any “cure” or “recovery” are at the moment. In other words, given the fact that Covid-19 could have long-term effects along with the potential for repeat infections, the search for treatments will remain an active pursuit, likely after the initial vaccine becomes available.

Moreover, as there is no way to predict what will happen when the traditional flu season kicks in for 2020 and what that will mean for Covid-19, the odds of Agilent shares moving steadily higher remain fairly good as the demand for their products and services will remain steady or perhaps even rise dramatically should the pandemic spike significantly higher. This could be even more dramatic if there is an above average flu season simultaneously. Indeed, what that means is that investors are starting to price in what could be a much better than expected quarter when the company reports on 11/23.

Meanwhile TXN, which showed relative strength over the last few weeks when the market was very uncertain also broke out last week. As I noted above, the unifying fundamental reason for the breakouts in these two stocks is Covid-19. And while Agilent’s medical connection is quite obvious, many don’t realize the reach of TI’s chip portfolio whose products are included in just about every type of technological device available.

What that means is that as the Covid uncertainly remains in place, so will the demand for technology at all levels due to the work at home and related technical trends. Moreover, TI is a huge player in the automotive and industrial sector, which means that as electric cars gain market share and robotics increase their presence in the industrial sector, TI’s long-term prospects remain sound.

Finally, we can see by both charts that the technicals are improving with Accumulation/Distribution (ADI) and On-Balance Volume (OBV) turning up after the respective recent price consolidations in both stocks.

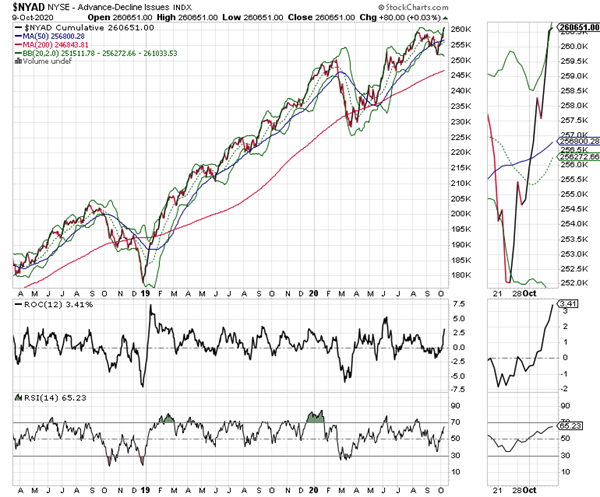

NYAD Makes New Highs Confirming Renewed Strength of Long-Standing Uptrend

The New York Stock Exchange Advance Decline Line (NYAD) made a new high on October 8 and October 9, confirming the reversal of the brief Duarte 50-50 Sell Signal in late September. Even more significant, stocks have picked up momentum and moved steadily higher.

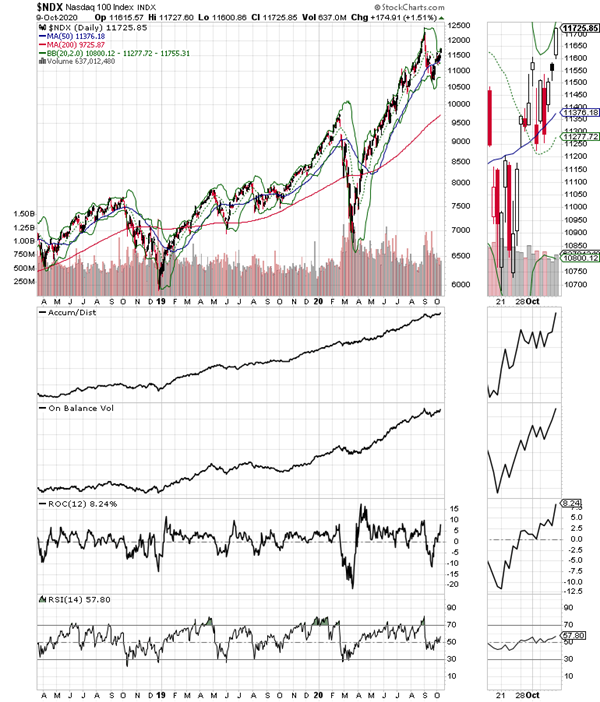

The S&P 500 (SPX) and the Nasdaq 100 (NDX) indexes are still well below their recent highs, but their recovery is fairly evident and is a sign that money is moving back into stocks.

Especially encouraging is the nice uptick in both the Accumulation Distribution (ADI) and On-Balance Volume (OBV) for both indices.

In fact, the potential for a wave of mergers in the semiconductor sector, if it materializes beyond the reported deal between Advanced Micro Devices and Xilinx should provide another excuse to move money into the technology sector over the short to intermediate term.

I’ve recently recommended two tech stocks, which are showing bullish signs of being accumulated. In the current climate, it is always possible that if a merger craze develops these two stocks could be targets.

I sometimes get subscriber mail that shares their concern when the market gets volatile. And I get it. Crazy markets, such as what we saw in late September are frustrating.

Yet, while it’s easy to get impatient in a volatile market, it’s just as important to look back and see how your investment plan has worked during volatile periods in the past. Moreover, it’s most important to see whether your account has more money in it now than what you had at the end of the prior year.

If you’ve survived volatile markets in the past, and your account shows a profit compared to what you had at the end of last year, then you’re on the right track. If you don’t meet those criteria, then you should consider revisiting your trading plan, whether that is a self-directed program or whether you subscribe to one or more investment services.

Be that as it may, as I’ve noted here many times, the key to the current market is whether the Fed keeps pumping money into the banking system and whether there is some sort of stimulus package for the real economy. And until that changes, or the New York Stock Exchange Advance Decline line (NYAD) tells us otherwise, the trend remains up. But just because the trend remains up, it doesn’t mean that anyone should squander their money, just throwing darts at the market.

As a result, it’s important to remember that every stock I pick is meticulously vetted and that sell stops are carefully placed in order to cut losses when a stock breaks down beyond repair. The same is true for my options picks, which are not just picked for profit potential, but also developed based on the type of market, which is currently unfolding and for their ability to help manage portfolio risk.

And in the current market, as I’ve noted here, there are some excellent opportunities to use the buy-write covered call option strategy. Above all, if there are no good stocks to pick, then there is no need to take risk in any market, whether the Fed is dropping money out of helicopters or not. The bottom line is that regardless of what Trump and Pelosi agree to or not regarding stimulus or anything else—sorry looking price charts should be a warning to all investors to be prudent.

Finally, investment is risky and sometimes even the legendary investors, of whose club I do not count myself as a member, lose money. So when frustration sets in, always remember that the key to success as an investor is to manage risk, pick stocks when the odds are overwhelmingly in your favor, and in that way you can stay in the game over the long term in order to realize profits.

I own shares of A, AMD, and TXN as of this writing.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.