For good reason, the covered-call strategy is one of the first option strategies that new traders start trading, explains Markus Heitkoetter of Rockwell Trading.

This is an effective strategy that options traders often use to provide income on stocks they already own.

Questions to Be Considered in This Article:

- What is a covered call?

- Should you trade it?

- Specific example

- Can you do it in a retirement account, e.g., IRA?

What Is a Covered Call?

A covered call is an options strategy used by traders to produce income on long stocks held in their portfolio. This strategy is used by traders who believe that stock prices are unlikely to rise in the short term. A covered-call strategy is defined as holding a long position in stock while simultaneously selling a call option on that same asset.

This strategy can provide income to a trader who is long-term bullish on stocks, but doesn’t believe there will be a significant increase in price immediately. A covered call will limit a trader’s potential upside profit if there is a significant move in the price of the stock upwards. This strategy provides little to no protection if the asset price moves downwards.

Covered-Call Example

For the specific example that we’re going to cover today, we’ll take a look at JP Morgan (JPM). If you were holding JPM stock in your portfolio before the pandemic, chances are that you are currently underwater.

As of writing this article, JP Morgan’s stock price is 96.46

DISCLAIMER

***For the purpose of full transparency, I do not own or hold any JPM stocks*** I typically only hold stocks between five and 25 days.

Stock Price Movement Recap

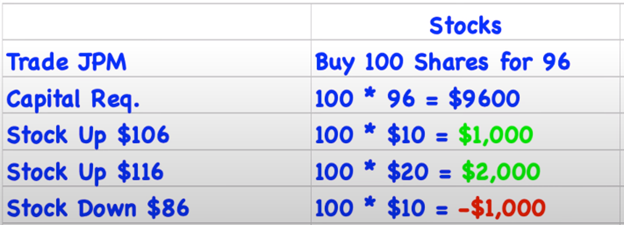

For this example, we’re going to assume that I own 100 shares of JPM. If I were to purchase 100 shares for $96 it would mean that the capital requirement for this position is $9,600. You’re probably familiar with the way profits move in relation to stock prices…but just to be safe:

Price action of bare stocks with no calls.

When the stock increased to $106, or $10, I would earn $1,000.

If the stock increased to $116, or $20, I would earn $2,000.

When the stock decreased to $86, or -$10, I would lose $-1000.

How Does a Covered Call Work?

- Sell one call option contract for every 100 shares of the underlying stock in your portfolio.

- The contract selected would ideally have a short expiration date of seven days.

- You would choose an “out of the money” call at a higher strike than the current price of the stock. When choosing this strike price, you would typically choose a price at least one standard deviation away from the current strike price. In other words, choosing a strike price that you do not believe the current strike price will exceed before the date of expiration.

What’s the Benefit of Having a Covered Call for the Stocks in my Portfolio?

MoneyShow’s Top 100 Stocks for 2021

The top performing newsletter advisors and analyst are back, and they just released their best stock ideas for 2021. Subscribe to our free daily newsletter, Top Pros' Top Picks, and be among the first wave of investors to see our best stock ideas for the new year.

It’s simple really. When you sell a call option contract, you will receive a premium. This strategy generates income when you don’t expect to profit from the movement of the underlying stock price.

JPM showing no signs of significant moves in the near future. In this example with JPM, I received a premium of $55 for selling a call option contract at the price of $116. Provided that the underlying strike price does not move above $116, the contract will expire worthless and I will keep the premium I collected by selling the options contract.

Let’s take a look at how a covered call will affect your portfolio with the same stock movements.

Price movement with the covered-call strategy.

If the stock increased to $106, or moves $10, I would earn $1,000 plus the $55.

If the stock increased to $116, or moves $20, I would earn $2,000 plus the 55.

If the stock decreased to $86, or moves -$10, I would lose $-1000 but keep the $55 for a total loss of -$945.

Why Does This Work?

If you take the entire amount of premium you received and divide it by the number of days between now and contract expiration, you come up with a number like this: $55 dollars in 7 = $8(ish) per day.

This covered-call contract is paying us $8 dollars per day.

If you take the $8 dollars, divide that by your total capital investment of $9,600 it equals 0.08%.

This may not sound too incredible, but…If we do some basic arithmetic and take 0.08% and multiply that by 360 trading days per year, you end up with a return of over 30%. This is in addition to what you earned from the growth of the stock. On some stocks, it’s possible to earn upwards of $20 per day. This could increase annual returns in excess of 40% to 50%.

Does this sound a little more exciting? YES! Should you trade it? ABSOLUTELY!

BUT…there is a risk associated with this strategy. If there is a large movement of the underlying stock price that surpasses the strike price of your call option contract, you will be forced to sell your shares at this price. This would limit your upside potential to the difference between the current stock price and the price of the call option contract.

Example: If the price of the stock went up to $117 (past the $116 call option) and the options contract expires, your stocks will be sold $117.

This means you would earn $1,100 + $55, or $1,155. In other words, you would lose $100 for every $1 the strike priced moved above your call option contract.

The silver lining is that you can probably buy your stock back the next day if you wanted to hold them long term. This type of trade can be taken inside of your retirement account such as an IRA, which provides you with another way to grow your account conservatively.

Learn more about Markus Heitkoetter at Rockwell Trading.