Our covered-call writing and put-selling positions can be radically impacted by corporate events, explains Alan Ellman of The Blue Collar Investor.

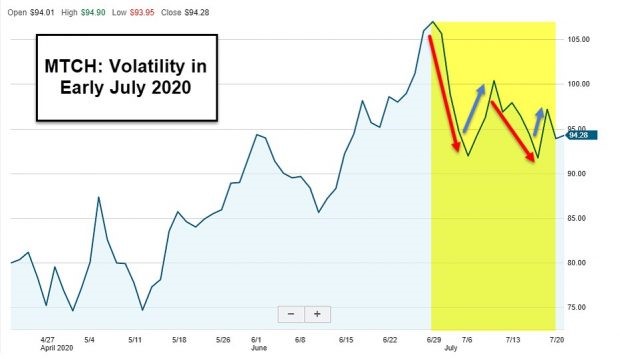

In July 2020, Match Group, Inc. (MTCH) showed extreme price volatility due to two corporate events, a spinoff and a stock split. Price dropped from $105.00 to $95.00. They also resulted in option contract adjustments. The loss was severe but not quite as extreme as it initially appeared. On July 1st, IAC/InteractiveCorp. (IAC) was spun off and there was an unusual stock split.

MTCH Price Chart in July 2020

MTCH Price Chart in July 2020: Yellow Field Shows Extreme Volatility

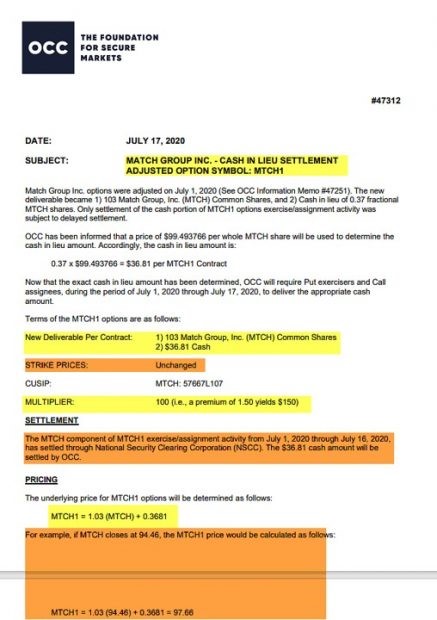

MTCH Stock Split: Second Corporate Event After Spinoff

MTCH Stock Split July 2020

- For every 100 shares of MTCH owned, 103 shares would be delivered

- $36.81 per contract would also be delivered

- If MTCH is trading at $95.00, the actual value becomes: ($95.00 x 1.03) +$0 .3681 = $98.22

Discussion

When stock price has extreme movements, we need to investigate the causes. In some cases, corporate events like spinoffs and stock splits account for most of that movement. In this case of MTCH, the spinoff was not well-accepted in the investment community and the stock split created an additional price change that was mitigated by the new deliverables.

Learn more about Alan Ellman on the Blue Collar Investor Website.

MoneyShow’s Top 100 Stocks for 2021

The top performing newsletter advisors and analyst are back, and they just released their best stock ideas for 2021. Subscribe to our free daily newsletter, Top Pros' Top Picks, and be among the first wave of investors to see our best stock ideas for the new year.