Covered-call writers are frequently faced with scenarios when earnings reports are due out on securities where we have long-term bullish assumptions, states Alan Ellman of The Blue Collar Investor.

In October 2019, Mark shared with me a dilemma he was facing with Atlassian Corporation (TEAM). The October 2019 monthly contracts expired on 10/18/2019 but there was an earnings release due on 10/17/2019. This article will highlight how to manage such situations.

One-Year Price Chart of TEAM in November 2019

TEAM Price Chart Pre- and Post-Earnings

TEAM was an up-trending stock through the end of August and then declined and began consolidating until the earnings release (note the spike in volume). The initial market reaction caused a sharp decline in share price (red arrow on top) despite a favorable report but then quickly recovered (blue arrow). Why the decline and then recovery?

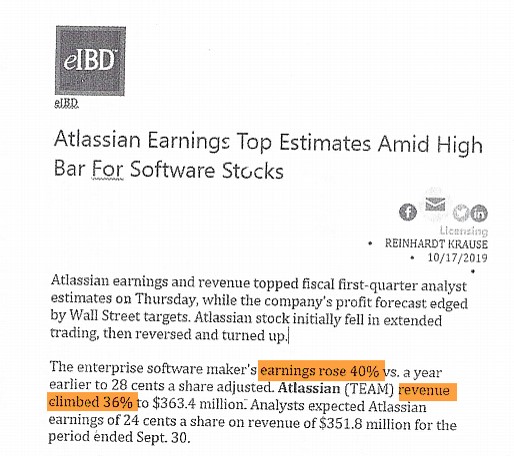

IBD Article Regarding Earnings Expectations of Software Companies

TEAM; IBD News Release

Outstanding earnings stats initially disappointed the market’s illogical expectations but then reality set in that this was, in fact, a quality report from a excellent company.

How to Manage Option-Selling Trades When Holding Stocks Through Earnings Reports/ Discussion

When we have long-term bullish assumptions on securities about to report earnings, we hold the stock through the report and start selling options after the report passes. In those circumstances (as with TEAM), when weekly options are available, we can sell Weeklys that contract month and skip the week of the report and then return to Weeklys or Monthlys whichever is preferred (Monthlys, for me).

Learn more about Alan Ellman on the Blue Collar Investor Website.