Matthew Kerkhoff, options expert and editor of Dow Theory Letters, continues his 14-part educational series on understanding options and their role in investment portfolios. This series will run each Friday on MoneyShow.com, concluding with the final segment on Friday, December 29th.

If you missed any of the prior installments or just want a quick refresher, they’re linked below.

Part 1 and 2: Understanding Put Options

Part 3: Understanding Put Options

Part 4: Factors that Affect Options Prices

Part 5: Portfolio Insurance (Part 1)

Part 6: Portfolio Insurance (Part 2)

Part 7: Rent out Your Stocks for Income (Part 1)

Part 8: Rent out Your Stocks for Income (Part 2)

Part 9 and 10: How to Get Paid to Buy Stocks

Part 11 and 12: How to Get Paid to Buy Stocks

As an investor, there’s a good chance you’ve spent your entire life trying to predict which way the stock market (or a particular stock or ETF) is likely to go. In fact, if all you’ve ever done is buy and sell regular shares of stock, then getting the direction right has been paramount to your success.

But what if there was a way to make money without having to get market direction right? What if you could set yourself up to profit regardless of whether the market moves in your favor, against you, or even doesn’t move at all? That’s what’s possible using vertical spreads (aka credit spreads).

So far in this series, all of the strategies we’ve discussed involve the purchase or sale of one type of option contract. We’ve covered buying puts as a form of portfolio insurance, selling covered calls to generate income from our stocks, selling puts to earn income while we wait for stocks to come back down to more reasonable levels, and buying deep-in-the-money calls to mimic the purchase of a stock using much less capital.

Today, we’re going to get a bit fancier. For the first time, we’re going to combine two different option contracts to create a position with a unique risk-reward profile. This type of position will enable us to profit under a wide variety of circumstances, and will clearly define both our risk and potential return.

Okay, so what exactly is a vertical spread?

This type of position entails the simultaneous purchase and sale of the same type of option (either calls or puts) at two different strike prices. The difference between the strike prices is known as the “spread” and is what gives this strategy its name.

Vertical spreads come in two types: there are “credit” spreads and “debit” spreads. A credit spread is a vertical spread that results in a net credit to your account when the trade is executed (this means you’re effectively an option seller – a good thing). A debit spread, on the other hand, results in a net debit from your account (meaning you paid money to enter this position, effectively rendering you an option buyer).

FREE 14-part guide to options: The Basics to In-Depth Portfolio Strategies

As you know by now, aside from a few exceptions (purchasing portfolio insurance and using deep-in-the-money calls to mimic a stock purchase), we generally always want to be option sellers. This is because we want to have the erosion of time value working in our favor, rather than against us.

So for this particular strategy, we’re going to focus specifically on “credit” spreads.

Credit spreads come in two varieties as well, with the difference being whether we use puts or calls … in one scenario we are making a generally bullish bet, and in the other we are making a generally bearish bet. Here are the two types of credit spreads:

1. Bear call option credit spread – a neutral or bearish option spread that uses calls to establish the position.

2. Bull put option credit spread – a neutral or bullish option spread that uses puts to establish the position.

Don’t worry if those names are confusing for now; the nature of this strategy will become much more clear as we walk through an example, which we’re about to do.

Vertical credit spreads can be used on any underlying security that has an options market. In this case, we’ll look at executing a vertical spread on Apple (AAPL).

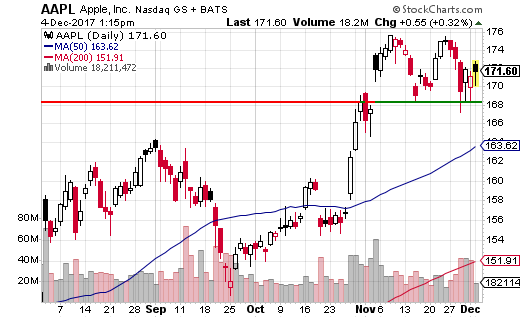

First, let’s begin by taking a look at the recent price action in AAPL. Using a bit of technical analysis, we can quickly determine whether we want to take a bullish or bearish position.

Wait a minute … didn’t I just tell you that one of the benefits of this strategy is that we can make money regardless of which way the market goes? Yes, I did. But now let me refine that statement. With this strategy, we can set ourselves up to profit under three conditions:

1. The stock price moves in the direction we expect it to.

2. The stock price doesn’t move much or at all.

3. The stock price doesn’t move heavily against us.

In other words, while this trade will be profitable under a wide variety of market outcomes, there are some outcomes that will result in us taking a loss. We determine these outcomes based on the specific option contracts that we choose when setting up the trade.

As a result of this type of payoff scenario, we want to approach these types of trades from a different mindset than we normally would. Instead of trying to predict where the stock is likely go, we want to instead try to predict where the stock (or market) is unlikely go.

Here’s how I would approach this using the chart of Apple above. First, I would take into account the fact that the Primary Trend of the entire stock market is bullish. That’s the backdrop that we are working with. Next, notice that both the 200-day moving average (red line) and 50-day moving average (blue line) are rising. This is another bullish indication and suggests that both short and longer-term momentum is bullish.

Since these factors are pointing towards Apple moving higher, not lower, we know that the proper trade here is going to be a bull put option credit spread. Since we are bullish (betting that AAPL won’t go significantly lower), we’re going to use puts to set up our credit spread.

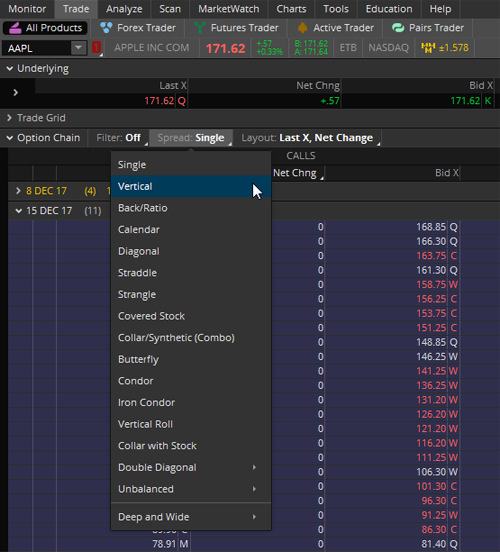

The fist thing to know about executing this type of trade is that even though a vertical spread entails the sale of one option and the purchase of another, these two trades are done within one transaction. In other words, you don’t buy one option first, and then sell the other … you simply switch your trading platform to give you pricing for “vertical” spreads.

Using my ThinkorSwim trading platform, this is what that would look like:

For all the previous strategies that we covered, we were looking at “single” options. But now, we’re going to look at “vertical” spreads, which allow us to see pricing for two option contracts simultaneously.

Once we’ve selected vertical spreads, we can examine the option chain to see what pricing looks like at various strikes. In the table below, notice that the left-hand column (which would normally show single strike prices) actually shows two strike prices. This is our indication that we are now looking at vertical spreads as opposed to single options.

By the way, just so you’re aware, in this case we are looking at option contracts that expire in December. Since this strategy also entails selling time value and allowing that value to decay over time, we again want to be selling front-month options. (Recall from our previous discussions that time value erodes fastest as the expiration date approaches.)

The next step is for us to choose the specific strike prices that we are interested in. For this, let’s take a quick look up at our Apple chart. In the chart, notice that there is recent support just above the $168 level.

Since we are bullish on AAPL, I’m going to take the stance (make the prediction) that AAPL is unlikely to trade below $168 by expiration on December 15th (11 days from now). Therefore, I’m going to select the appropriate option contracts that enable us to profit as long as AAPL remains above $168 per share for the next 11 days.

Looking at the option chain, notice that a strike price of $167.50 is the closest we can find to $168. In this case, since no $168 contract exists, we’ll use the $167.50 strike as our starting point.

In effect, what we are going to do is sell the $167.50 strike put for a credit to our account, then we’re going to simultaneously buy the $165 strike put to hedge away our downside risk (more on this in a moment). This specific contract is highlighted in the orange box.

In the table, notice that this vertical spread is currently trading for $0.44 (the halfway point between the bid and ask prices). What this means is we can simultaneously sell the 167.50 strike, buy the $165 strike, and by doing so, we will actually receive a credit to our account of $44 (minus any associated commission).

If we were to execute that trade, here is the what our resulting profit and loss scenario would look like:

- If AAPL remains bullish as we expect, then both contracts (the $167.50 strike we sold and the $165 strike we bought) will expire worthless, and we’ll receive our maximum profit which is the $44 we obtained in option premium to initiate the trade.

- If APPL just moseys around and stays near its current price ($171.58 per share), then both contracts will also expire worthless and we again get to keep our full profit, which is the premium we received up front.

- If we’re wrong about AAPL, and AAPL does trade down, as long it remains above our higher strike price at $167.50, we still get to keep all of the option premium we received.

In other words, AAPL can do whatever it wants over the next 11 days and as long as it remains above $167.50 at expiration (a high probability scenario), we get to keep the $44 in option premium that we received and will have no obligations that we must fulfill.

Now let’s explore the downside of this trade. As mentioned, the one way we will lose money is if AAPL does move heavily against us. In other words, if AAPL declines the roughly $4 per share between where it is now and our highest strike price ($167.50), then we will begin to accumulate losses.

But one of the beautiful things about vertical spreads is that we have already limited our potential loss even if this low probability event does occur!

Think for a moment about why we purchased the $165 strike put as part of this transaction … If you recall the section on buying portfolio insurance, we used the purchase of a put option to limit our downside risk. In this case, the $165 put option that we bought serves the exact same purpose.

Think of it this way. If we had sold the $167.50 put all by itself, we would have collected more premium income, but we would have also exposed ourselves to a decent amount of risk. After all, if AAPL experienced a big drop, we could be forced to purchase shares at $167.50 which may have a much lower market value.

But in this case, since we also purchased the $165 strike, we bought the right to resell 100 shares of AAPL at $165. This greatly limits our potential loss because now if AAPL experiences a big drop, we may have to purchase 100 shares at $167.50 per share, but (and here’s the important part), we have the right to sell those 100 shares for $165 per share.

This means that the absolute most we can lose on this trade is $206. That’s it! This is calculated by taking the difference between the two strike prices ($167.50 - $165), multiplying that by the number of shares each option contract represents (100), and then subtracting the option premium that we received up front ($44).

So to summarize, the most we can make on this trade is $44, and the most we can lose is $206. As long as APPL trades above $167.50, we’ll make our full profit, which is $44. On the other hand, if we did get the direction of Apple terribly wrong, then our profit would begin to erode as AAPL crosses below $167.50.

At a share price of $167.06 we hit our breakeven point (the $44 in option premium we collected offsets the $44 loss on the two contracts combined) and we continue to lose money as AAPL moves lower, until our maximum loss is reached at $165 and below.

I’ll elaborate much more on this strategy in the follow-up, but before we wrap things up I want to mention one last thing. Since the max liability on this trade (after receiving the premium income of $44) is $250, that’s how much capital needs to be set aside within your account to execute this trade. Therefore, that’s the base amount we would use to calculate our rate of return.

In doing this, we know that if AAPL remains above $167.50 for the next 11 days, we’ll earn $44 using $250 worth of capital. That works out to a 17.6% return in just 11 days. Not too shabby, eh?

Vertical spreads are one of the most consistently profitable option strategies out there and can be used in all types of market environments. In the final article, we’ll dig further into this lucrative strategy and also discuss how to exit these types of positions when the time comes.