Matthew Kerkhoff, options expert and editor of Dow Theory Letters, continues his 14-part educational series on understanding options and their role in investment portfolios. This series will run each Friday on MoneyShow.com through December, moving from the basics through increasingly more sophisticated strategies.

What if you could use your existing stock and ETF portfolio to generate extra income on the side, which you would receive in the form of a credit to your brokerage account each month? That’s the topic we’re going to discuss today in our ongoing options series.

Part 1 and 2: Understanding Put Options

Part 3: Understanding Put Options

Part 4: Factors that Affect Options Prices

Part 5: Portfolio Insurance (Part 1)

Part 6: Portfolio Insurance (Part 2)

Few would argue with the notion that we remain in a yield-starved environment. After falling for over three decades straight, interest rates remain near rock bottom lows, and this is causing problems for many individuals and institutions who need their investment portfolios to produce income.

With bond yields sitting roughly in a 2-3% range, many fixed income investors have turned to bond-equivalent stocks as a source of income. These are stocks in non-cyclical sectors of the economy that produce steady dividends, such as telecom, consumer staples and utility companies.

The result of this massive search for yield has been elevated bond prices, and elevated bond-equivalent stock prices, which leaves investors with few low-risk opportunities to obtain a decent yield.

But for sophisticated investors who are well versed in the use of options, obtaining income is not only achievable, it can be done in a very safe and consistent way.

Today we’re going to explore how to earn a steady stream of income by renting out stocks and ETFs that we already own. Specifically, we’re going to discuss how to sell covered calls.

As you know by now (or should, at least), call options provide the buyer with the right to purchase shares (100 per contract) at a specified price (the strike price) on or before a particular date (the expiration date).

On the other hand, the seller of a call option receives income (option premium) in exchange for providing the buyer with this right. If done correctly, the rights that are extended to call buyers can be used to effectively lower our risk in our existing equity positions.

This is important to understand and I want to take a moment to reiterate this. Many people automatically assume that using options entails additional risk. That can be the case, but it is often not the case. In the strategy we discuss today, we’re going to see that layering call options on top of our existing portfolio will actually help to reduce our risk, and offset potential losses.

Okay, so what exactly is a covered call strategy?

Also known as a buy/write strategy, covered calls entail owning shares of a stock or ETF, and then selling call options on those particular shares, which are hedged or “covered” by our underlying stock position. We make our money by collecting and keeping the premium that is paid to us by the option buyer.

In effect, what we are doing with a covered call strategy is selling away some of the potential upside of our stock or ETF shares, in exchange for a small but guaranteed return, that we receive today.

We previously we discussed the concept of time value and intrinsic value (if you missed it or are still unfamiliar with those terms please go back and read that section – it’s important!).

When it comes to selling covered calls, we’re going to want to sell out-of-the-money call options that expire roughly one month out. Why is this?

Our primary goal with this strategy is to gain income. The way we do that is by selling time value and then allowing that time value to collapse to zero.

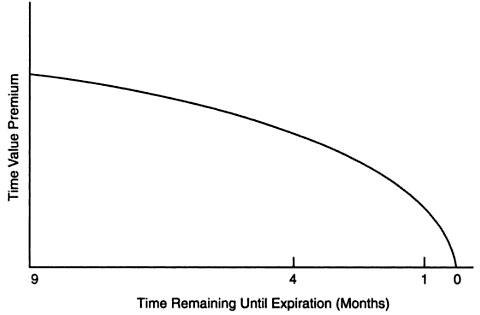

The chart below demonstrates how option time value erodes or “decays” over time. Notice that due to the exponential decline in time value as expiration approaches, we will get the most bang for our buck by selling options that expire roughly one month out.

We could choose to sell a call option that expires four months out, as an example, but during the initial three months of that contract the time value component would decay very slowly. In this situation we would receive more premium up front, but a much better option, as we’ll see, is to simply sell the one month out option four separate times. This will generate the most income for us and also set us up to receive the equivalent of a monthly paycheck.

Okay, now that we have an idea of the type of call option we want to sell, we can jump right into an example. We’re actually going to cover a few different examples between today and the next installment to demonstrate the versatility and effectiveness of this strategy.

To begin, since many of our subscribers invest in equities using an S&P 500 index fund, we’ll begin our discussion using SPY.

Let’s say, for the purposes of this example, that we own 100 shares of SPY, which, as of the time of this writing, is worth $24,179 (share price is currently $241.79). We want to sell a covered call that will allow us to collect income, while also maintaining our original position.

One thing to recognize is that selling a covered call is really just selling a regular call option. The only reason it’s considered a “covered” call is because we already own the shares that we would have to sell in the event the buyer of our call option exercised the contract (more on this later).

If we did not own shares of the underlying, we would be selling what’s called a “naked” call. This is a much riskier proposition and is not recommended for reasons that are beyond the scope of this article.

Using my ThinkorSwim trading platform, we can pull up a list of call option prices for SPY (shown below). Based on our discussion above, we know that we want to look at call options that expire roughly one month out, so I’ve already sorted the table below to show SPY calls that expire on June 16th (22 days away).

Here is what the option chain currently looks like:

We’re going to look at two possible scenarios here, using the contracts that are outlined in orange and purple.

First, let’s say that we are neutral to bearish on the market over the next 22 days. That is, we expect that SPY will trade at or below its current price between now and June 16th. If this is the case, then our best bet would be to look at the 242 strike price (outlined in orange). This is the lowest “out-of-the-money” strike price call option that is available.

Notice that if we sold this option, we would receive $1.73 per share (or $173) deposited into our brokerage account immediately. In terms of the value of our underlying portfolio (100 shares of SPY worth $24,179) this represents a return of 0.715% ($173/$24,179) - in just 22 days.

If we could earn a 0.715% return each month (which we can by continuing to sell one month out options), it would work out to a compound annual return of 8.9% … not too bad in this yield starved world, right?

Okay so where are the drawbacks and what are we giving up by taking this trade? As I mentioned before, a covered call strategy entails selling away potential upside in our shares in exchange for a guaranteed return. In this case, we would be selling away any profits on our 100 shares of SPY that accrue above $242 (our strike price) and before June 16th. Make sense?

So if you happened to be relatively certain that SPY would trade above $243.73 per share – which is the breakeven point of this trade ($242 strike price + $1.73 per share in option premium) before June 16th, then you would NOT want to sell this call option. Instead, you’d want to simply allow those “hoped for” gains to accrue to your SPY shares.

We’ll cover how to exit these types of trades in the next installment, but for now I want to point out why this strategy effectively lowers your risk when compared to simply owning 100 shares of SPY. When all you own are the shares, your risk involves SPY dropping in value. The max loss you could sustain (which is highly unlikely) would be if shares of SPY fell to zero.

Now imagine two scenarios, one in which you had sold a covered call and one in which you hadn’t. In the case where you only owned the shares, you’d be out the full $241.79 per share. But, if you had sold the covered call, you would have taken in $1.73 per share in premium, rendering your effective loss to be $240.06 ($241.79 - $1.73).

FREE 14-part guide to options: The Basics to In-Depth Portfolio Strategies

Here’s where it gets fun. If you continue to sell these covered calls, you’ll receive income each month and this will continue to offset your position in the underlying stock or ETF. Do this for long enough and you can effectively have paid for your original shares (collected enough premium to recoup your initial investment in the stock). If we were to assume that monthly SPY out-of-the-money call options would continue to pay $1.73 per share (in reality this changes based on market conditions) it would take 140 months (or about 11.5 years) to recoup the total investment of $24,179.

Okay, now let’s take a different approach to this same strategy and quickly go through one more example.

As you can see from the table above, we have many different strike prices to choose from. This time, let’s say that we are somewhat bullish on SPY over the next 22 days, and don’t want to give up all the profit above $242 per share.

In this case, we can choose a higher strike price, which will result in us collecting less premium income, but in exchange, we’ll get to profit on a continued rise in SPY shares. For this situation let’s assume we go with the $245 strike price (highlighted in purple).

Selling this contract, we’ll only receive $53 in premium income – about a third of our previous example. So what benefit do we receive in exchange for this lower premium? The answer is we get to keep more of the gains in our shares of SPY if they occur.

In this example, SPY could rise as high as $245 and those gains would still accrue to us, because the call option we sold doesn’t kick in until SPY rises above $245. That’s the new level above which profits would begin to accrue to the call buyer.

This is the type of call option we’d want to sell if we were bullish on SPY, but still wanted to obtain a modest level of income.

So, as you can see, you can customize this strategy to whatever parameters you are comfortable with, or expectations you have about market performance. Keep in mind that it can be very effective to use support and resistance levels when identifying the strike price(s) you wish to use.