Matthew Kerkhoff, options expert and editor of Dow Theory Letters, continues his 14-part educational series on understanding options and their role in investment portfolios. This series will run each Friday on MoneyShow.com through December, moving from the basics through increasingly more sophisticated strategies.

In the last segment of our series, we began discussing the use of covered calls as a way to generate monthly income from a stock portfolio. In today’s installment of our ongoing monthly options series, we’re going to put the finishing touches on this strategy and discuss how to exit these types of positions.

If you missed any of the prior installments or just want a quick refresher, they’re linked below.

Part 1 and 2: Understanding Put Options

Part 3: Understanding Put Options

Part 4: Factors that Affect Options Prices

Part 5: Portfolio Insurance (Part 1)

Part 6: Portfolio Insurance (Part 2)

Part 7: Rent out Your Stocks for Income (Part 1)

Part 8: Rent out Your Stocks for Income (Part 2)

How often have you had your eye on a particular stock or ETF, wanting to initiate a purchase, but held off because the stock was too expensive at that moment?

Anyone who has spent time in the financial markets has bumped into this situation, perhaps hundreds of times. In fact, a common practice among investors is to keep a watch list of stocks or ETFs that they’d like to own, once those prices come down to more reasonable levels.

Well … if you’re going to be disciplined enough to wait for a better entry price on a stock or ETF, shouldn’t you get paid for it? I certainly think so, and that’s exactly what we’re going to cover today.

Using a relatively simple strategy, we can collect income while we wait for stock prices to come down to levels that make for more attractive purchases. This strategy is called “naked put selling” and it’s very popular among professional investors.

Before we get into the specifics of this strategy, I want to offer a quick warning: this strategy is only to be used on stocks or ETFs that you want to own. When you see how this strategy works, you may be tempted to use it on more volatile stocks that offer up higher levels of option premium. Don’t fall for this temptation. For a conservative investor, this strategy should only be used on stocks or ETFs that the investor already plans on purchasing once the share price falls to lower levels.

Okay, with that out of the way, let’s jump right in.

As I mentioned, this strategy entails the selling of so called “naked” puts. A naked put is exactly the same as a regular put, except that the seller of the put option does not own any, or enough of the underlying security to act as protection against adverse price movements.

Before you let this scare you, I want to point out two important facts:

1. This strategy entails no more risk than simply owning the stock or ETF in question (in both scenarios max loss occurs if the share price of the underlying stock or ETF goes to zero).

2. If you aren’t comfortable with “naked” options (even though in this case they’re no riskier than owning the stock or ETF itself), we can use a second put option to hedge away the bulk of this risk. This turns the strategy into what’s called a “vertical spread,” which is actually the fifth and final options strategy that we will discuss. (You can see this on our road map at the bottom of this article, titled “How to Make Money Even When You’re Wrong.”)

Now let’s walk through an example to see exactly how this strategy works.

Let’s say you’re a big fan of the iPhone and you’d like to own Apple stock, but you look at a chart and notice that Apple has had quite a run over the last year.

While you’d like to own 100 shares of Apple, you’re not ready to make that purchase until Apple shares fall back down to a more reasonable level. What do you do?

If you’re a savvy investor, you sell naked puts on apple to collect option premium while you wait for the shares to pull back for a better entry point. Let’s walk through that process now.

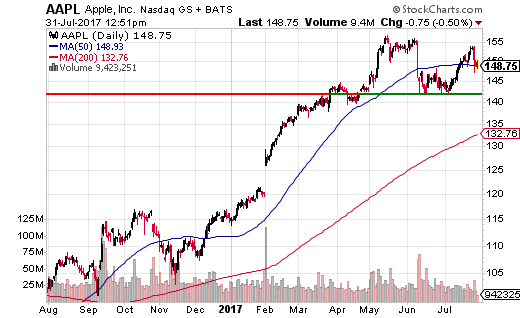

In the chart above, we can see that there is an area of support around the 142 level, where prices recently pulled back to before marching higher. You don’t have to use technical analysis to determine strike prices, but it can be a helpful way of identifying what type of price moves may be expected in the future.

In this case, let’s say that $142 also represents a level at which we’re comfortable purchasing shares of Apple. That would represent a 4.5% pullback in the share price from current levels.

At this point, we can consult our online brokerage account to see what put options on apple are trading for. Because this is another option strategy that entails selling “time value” and allowing that time value to decay over time, we’re again going to want to focus on front-month options … that is, we want to choose option contracts which expire in one month or less. (If you recall from our prior discussions, the time value component of an option’s price experiences exponential decay as the expiration date approaches. Therefore, by selling put options that expire roughly one month out, we can maximize the amount of premium we collect.)

So in this case, I’ve pulled up a list of put options on AAPL that expire in August (18 days from now). You can see these in the table below. The particular put option contract that we’re interested in (142 strike) is highlighted by the blue box.

As you can see, the August put option contract with a 142 strike is currently selling for about $1.32. Because each option contract represents 100 shares, we know that we’ll receive $132 in option premium when we go to sell this particular contract.

$132 might not sound like a lot of money, but let’s think about what we’re getting with this trade:

- Over the next 18 days, if Apple continues to trade above $142 per share, this put option contract will expire worthless. That means we will get to keep the $132, and will have no obligation to the seller after August 18th (remember that monthly options always expire on the third Friday of each month). Once this August contract expires, we could sell a September contract and repeat the process.

- If Apple does trade below $142 at expiration, then we have a couple of options here. We can either close out our naked put option at a loss by repurchasing the same contract, or we can allow our option contract to be “assigned.”

Assignment is the term for when an option contract is actually exercised, and the option owner takes possession of the underlying shares. In this case, by selling a put option with a strike price of $142, we’ve conveyed to the buyer of this contract that we will purchase 100 shares of Apple from them at a price of $142 per share, if they so desire.

Of course the only way they’re going to want to exercise this option is if the market price of Apple falls below $142 at expiration … otherwise, as mentioned earlier, this option will expire worthless.

Since our whole intention here was to get paid while waiting for a better entry price in Apple, we could allow the put option contract to be assigned, in which case our brokerage account would be debited for $14,200 (plus the assignment fee) and we would subsequently own 100 shares of Apple at a buy-in price of $142 per share.

If we were to go this route, the option premium that we collected ($132 for the 18 days in August) would be ours to keep. If we had repeated this process every month for a few months (or years) before we were finally assigned the Apple shares, all of that premium would be ours to keep as well. This means that the final buy-in price on Apple shares could be considerably lower (supplemented by option premium) if we continue to sell put option contracts as we wait for Apple shares to decline.

Also, as mentioned, if we decide for some reason that we don’t want to own 100 shares of Apple after all, we can simply close out the put option contract for a loss by purchasing an identical put option at the then current price. (Keep in mind this must be done prior to the expiration date or you will be assigned.)

In the follow up to this strategy (next month) we’ll discuss how to close out the position this way in more detail. For now, just understand that both options (closing out the original contract or being assigned the shares) will result in nearly identical profit and/or loss.

Wrapping things up, I want to go over a few more considerations regarding this strategy.

First, notice that we have a wide selection of strike prices to choose from. If we had wanted to go for more premium (and were willing to potentially buy Apple shares at a higher price) we could have chosen the 146 or 147 strikes, which would have resulted in nearly double the premium. On the other hand, we could have chosen a much lower strike price in exchange for less option premium.

Next, as mentioned in the introduction to this series, volatility plays a large role in option prices. The higher the volatility, the higher the option premiums. Recently market volatility has been exceptionally low, so option premiums have been suppressed. If and when volatility rises, it will increase the amount of premium option sellers can receive.

Lastly, for strategies such as this, it helps to have a way of identifying the return in percentage form in order to compare it to other returns. In this case, the way we generally approximate that is by looking at the option premium we receive in comparison to the cost of fulfilling the option contract.

If you were to actually make this trade in a retirement account, there’s a good chance your available trading balance would be reduced by the amount of money it would take to fulfill this contract, should you be assigned ($14,200). Therefore, even though that capital is technically still in your account, it has been set aside, and is most likely unavailable for you to invest elsewhere.

FREE 14-part guide to options: The Basics to In-Depth Portfolio Strategies

This means that your return would be calculated by dividing the option premium you received by this amount. Doing that we can see that selling the 142 strike price put would generate a return of 0.93% ($132/$14,200) in 18 days (if the contract expired worthless). That’s not bad considering we can repeat this strategy every month.

Getting Paid to Buy Stocks (Part 2)

We'vd been discussing how we can actually get paid to buy stocks. While that may sound counterintuitive, this strategy is quite popular among professional money managers, as it allows them to earn income while they patiently wait for lower equity prices. If you’re one of those investors who feels like you’ve been partially left behind by this bull market, this strategy may be for you.

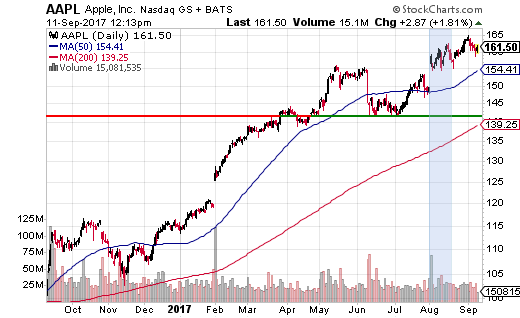

We walked through a hypothetical example in which we sold a put option on Apple shares (AAPL) which expired 18 days later on August 18th. Let’s see how that trade would have turned out now that we know how Apple’s share price did over that time period.

To refresh your memory, we decided to sell the 142 strike put, because we noted that there was strong support in AAPL shares near that level. At the time, a buy-in price of $142 per share would have represented a 4.5% pullback from current levels.

Here’s the chart we first examined prior to initiating that trade.

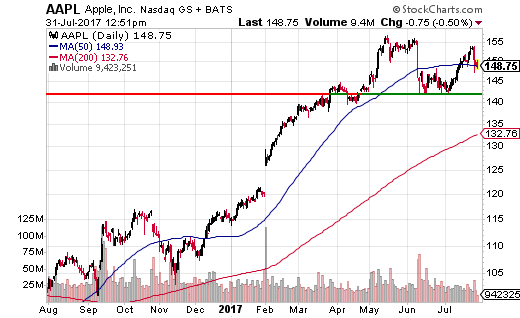

And here’s what happened to shares of AAPL in the month since then. In the chart below we can see the same support line at 142, and I’ve highlighted the action that corresponds to our August 142 strike put option contract in blue.

As you can see, AAPL continued to trade higher, remaining well above our strike price ($142) all the way until expiration on August 18th.

This means that the put option contract we sold expired worthless, and the $132 we collected in option premium from this trade is ours to keep. Again, while $132 may not seem like much in the grand scheme of things, this represents a 0.93% return ($132/$14,200) that we earned in just 18 days. If we did this every month, those small returns would begin to add up.

At this point, you may be wondering, “What happens to my account, and what do I need to do, when an option contract that I’ve sold expires worthless?” That’s a great question, and the answer is … nothing!

Whenever you sell an option contract, as we did in this example, the position will show up in your account and will somehow be denoted either “ITM” or “OTM.” Different trading platforms show this in different ways, but all of them will alert you quickly, at a glance, whether your position is in-the-money (ITM) or out-of-the-money (OTM).

If you recall from our introduction to this series, an option contract is considered in-the-money (ITM) when it has intrinsic value … that is, when the contract would have value if it were exercised immediately.

In this example, for our contract to be in-the-money (ITM), Apple shares would have had to trade below $142 per share on or before expiration (this is the only situation in which this option contract would have provided value to the buyer).

Since AAPL did not trade below $142 on or before expiration, this option was never in-the-money, meaning it never had any intrinsic value. Instead, the entire value of that put option was comprised of time value, and that time value eroded over the 18-day period, leaving us with a nice little return.

When an option expires out-of-the-money (regardless of whether we bought or sold that contract), we don’t need to do anything in our accounts on or before expiration day. These types of option contracts have no intrinsic value, and once their time period is up, they simply get removed from our accounts.

At the same time, if the option contract’s type required funds to be set aside to ensure that we would be able to meet the obligations of the contract, that money is released back into our accounts.

What do I mean with that last statement?

As I mentioned in the previous article, when you are the seller of an option contract you have an obligation to the buyer. In our example, that obligation was to purchase 100 shares of AAPL at $142 per share, if the buyer so desired.

In order to ensure that you can fulfill this obligation, most brokerage accounts will set aside enough capital from your account to meet this obligation. In this case, that sum was $14,200. Once the option contract that created this potential obligation has expired worthless, that capital is once again made available for you to invest. Make sense?

Okay, now that we know what happens, and what we need to do when an option contract expires worthless (or out-of-the-money), let’s talk about what happens when an option contract that we’ve sold expires in-the-money.

To do that, let’s adjust our example above and pretend for a moment that near the close of trading on August 18th, AAPL was trading at $140 per share.

In that case, our $142 strike price put option contract would be in-the-money (ITM) and this would be denoted in our account, alerting us that we must do something with this position, or else it will be automatically exercised (we will be “assigned” the 100 shares of Apple) upon expiration.

In a situation like this we have two options: We can either do nothing, and allow our option contract to be assigned – meaning our account will be debited $14,200 (plus the assignment fee), and we’ll own 100 shares of AAPL … or, we can close out the initial put option contract by purchasing another, identical contract, at the current market price.

Here’s how that would work. At expiration, we know that the time value component of our option’s price would have gone to zero. This means the price of our option contract at expiration would simply be its intrinsic value, and that’s easy to calculate.

If AAPL was trading at $140 per share on August 18th, then a $142 strike put option contract that expired that day could be purchased for approximately $200 [($142 - $140) x 100].

If for some reason we no longer wanted to own shares of AAPL, we could simply purchase another $142 strike price put option for $200. This would cancel out the same contract that we had initially sold, eliminating any associated obligation.

Had we decided to go that route, it would have cost us $200 (plus commission) to get ourselves out of the initial contract we sold. This means that our total loss on the trade would be approximately $68 ($200 minus the $132 in income we gained from selling the contract initially).

So as you can see, just because we enter into an obligation to purchase (or sell) shares via option contracts, doesn’t mean we ever have to actually purchase or sell those shares. Instead, we can always close out our positions by buying or selling the exact same option contract(s).

Earlier I mentioned that regardless of how you choose to close out a position (either by being assigned or by repurchasing/reselling the original contract) the profit/loss is about even. To see this, consider what our profit and loss would have been if we had done nothing and were assigned the shares.

In this case, we would have taken possession of 100 shares of Apple at a price of $142 per share. Since Apple was currently trading at $140 per share, this means we would have had an immediate paper loss of $200 on our Apple position. When you offset this by the $132 we earned in option premium from selling the initial contract, we end up with roughly a $68 dollar loss.

As you’re hopefully beginning to see, selling these so called “naked” puts to earn income while waiting for stocks to come back down to earth can be a great strategy. You can earn a solid income stream while taking on no more risk than you would if you simply owned the stock itself. And if you get into trouble somehow, you can always close out your original position by simply repurchasing another identical contract.

In my opinion, this is one of the best strategies to use when you feel like the market (or a stock) has left you behind. Instead of chasing the market higher, as most rookie investors do, you can earn a reliable income stream while you wait for those sky-high prices to come back down to earth. In this way, you are “managing” the market rather than chasing it.

As we wrap up our discussion on this strategy, I want to highlight the downside of selling naked puts, in case it wasn’t obvious during our discussion. This downside is no greater than simply owning shares of the underlying, but it’s worth pointing out anyway.

In general, when someone purchases a put option contract, they’re making a bearish bet. In effect, they’re buying insurance, just as we discussed in Parts 5 and 6 – How to protect your Investments with Portfolio Insurance.

As the seller of that insurance (as we were in this example), it means you are either neutral, bullish, or just mildly bearish, and aren’t expecting a MAJOR drop in the stock price. But big drops do happen, and therein lies your risk with this strategy.

Let’s say something very problematic occurred at Apple that caused AAPL to take a big hit, and shares were trading at $100 near expiration on August 18th In this case, our initial put option contract would have lost $4,200 in value [($142 – $100) x 100].

No matter how we closed out this position, whether by repurchasing the same contract we initially sold, or taking possession of the shares, we would still incur this loss. In a situation like this, buying AAPL at $142 per share (what we initially thought was a good discount when shares were trading at $148.75) turned out to be a bad move.

UT … and I want to keep drilling this in, had you been a regular shareholder of AAPL, you would have incurred exactly this same loss. So don’t let anyone convince you that selling “naked” puts is oh-so dangerous … because it’s no more risky (it’s actually less so, due to the option premium received) than simply owning shares of the underlying.

Also, as I mentioned previously, there is a very simple way that we can hedge away much of this downside risk. This will be discussed when we cover the next strategy in our series: How to Make Money Even When You’re Wrong.