Matthew Kerkhoff, options expert and editor of Dow Theory Letters, continues his 14-part educational series on understanding options and their role in investment portfolios. This series will run each Friday on MoneyShow.com through December, moving from the basics through increasingly more sophisticated strategies.

In the last segment of our series, we began discussing the use of covered calls as a way to generate monthly income from a stock portfolio. In today’s installment of our ongoing monthly options series, we’re going to put the finishing touches on this strategy and discuss how to exit these types of positions.

If you missed any of the prior installments or just want a quick refresher, they’re linked below.

Part 1 and 2: Understanding Put Options

Part 3: Understanding Put Options

Part 4: Factors that Affect Options Prices

Part 5: Portfolio Insurance (Part 1)

Part 6: Portfolio Insurance (Part 2)

Part 7: Rent out Your Stocks for Income (Part 1)

Selling covered calls is an excellent (and safe) way to generate extra income from a stock portfolio. Because the calls are “covered” by stock positions that we already own, this strategy actually reduces our overall risk and can provide us with a steady stream of income.

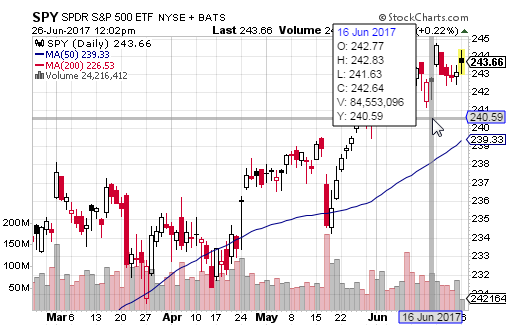

Last month we walked through an example where we sold a covered call on SPY that expired roughly one month (22 days) out. Let’s follow up with that example and see how market action between then and now would have affected the outcome of that trade.

Back on May 25th, SPY was trading at $241.79 per share. We looked at selling the June $242 call as well as the June $245 call. (For more specifics on why we chose those two strike prices please see the prior article.)

Those June calls recently expired on June 16th (recall that monthly options always expire on the third Friday of each month). On that day, SPY closed at $242.64.

For illustration purposes, SPY did us a favor by closing in-the-money on one of our example call options (the $242 strike price) and out-of-the-money on the other ($245 strike price). This is helpful because it will allow me to demonstrate how to close out both types of positions.

Let’s begin with the $245 strike price (out-of-the-money) call because it’s a bit simpler.

Recall from last month’s article that part of the reason we considered selling the $245 strike price call (instead of the $242) is because we were more bullish on SPY, and were willing to give up some of our option premium in exchange for the ability to profit on a continued rise in SPY.

As it turns out, SPY did continue to rise from $241.79 (on the day of our trade) to $242.64 at the close of expiration on June 16th. Because the covered call that we sold in this example had a strike price of $245, it closed out-of-the-money, and therefore expired worthless. Here’s what that means:

1. Because we only sold away the potential upside above $245 per share (our strike price) it means that the $0.85 per share gain that accrued in SPY ($242.64 - $241.79) was ours to keep. The value of our 100 shares of SPY rose by $85.

2. When we originally sold the $245 covered call, we received $53 in option premium income. This premium is ours to keep, because SPY was not worth more than $245 at the close of expiration on June 16th.

This means that our total gain over that time period was $138 ($85 + $53). Had we NOT sold the covered call, our profit would only have been $85.

If you had watched the value of the $245 strike price call option during the 22 days that elapsed between the day we initiated the trade and expiration, you would have seen it continually bounce around as it slowly went from $0.53 (representing the price at which we sold it) to $0.

Recall that the goal with a covered call strategy is to sell time value, and then allow that time value to erode to zero over time. This is exactly what happened with this trade. We sold $53 worth of time value back on May 25th, and that time value went to zero over the subsequent 22 days. Because SPY was not trading above $245 at expiration, there was no intrinsic value in this option. That, combined with no time value either, rendered the option completely worthless at expiration.

When selling covered calls, this is the ideal situation. We want the covered calls that we sell to expire worthless. If they do, then we don’t need to do anything in our brokerage accounts to close out the trade. The option will simply expire worthless, and the position will be removed from our account following expiration.

Now let’s take a look at the other scenario we considered, which was selling the $242 strike price call instead of the $245.

Our justification for doing this at the time was a neutral to bearish outlook on SPY in the near-term. This is why we opted for the lower strike price which provided more premium income, but allowed us to profit less on an upward move in SPY.

Since SPY closed at $242.64 at expiration, this option contract finished in-the-money (meaning it had intrinsic value). Here’s what that means in terms of our profit and loss:

FREE 14-part guide to options: The Basics to In-Depth Portfolio Strategies

1. First, because we sold the $242 strike, it means we sold away the potential for any profits above that level. This means that our underlying position of 100 shares of SPY only appreciated by $21 (($242 - $241.79) x 100). Above that level, all profits accrued to the buyer of our call option.

2. Next, we need to determine our profit and/or loss on the call option. Because SPY finished above our strike price of $242, this option contract had value at expiration (the time value component had gone to zero but intrinsic value remained). The intrinsic value of the option at expiration would have been $0.64 per share ($242.64 - $242) or $64. In effect, this is what we would owe the buyer of our call option, but recall that we collected $173 in premium when we sold the call. Altogether, this means we would have had a $109 ($173 - $64) profit on the call option.

This means that our total gain over the time period in question was $130 ($21 + $109). Again, if we hadn’t sold the call option, our gain on SPY alone would have been $85.

In both of these scenarios, selling the covered call was beneficial in that it added value to our portfolio. This is not always the case with covered calls, but it is often the case. Done correctly, selling covered calls can result in a strong 60-80% win rate. And perhaps the best part is that when you don’t “win” and a covered call strategy works against you, you don’t actually lose money … you simply miss out on additional profits beyond what you received in the form of premium income. Not bad, right?

At this point, I want to circle back and discuss how to exit a covered call position that is in-the-money (as in the example of our $242 call). This is important, and the process/thinking here can be applied to closing out any in-the-money option positions, regardless of the strategy.

If you had been watching your account on June 16th (the day of expiration) you would have noticed that the value of the $242 call would have been trading at the current SPY price minus $242. In essence, because all the time value had eroded to zero by expiration, the value of the option represented intrinsic value only, which is equal to the current SPY share price minus the strike price.

Because this option still had value, allowing it to “expire worthless” as in the case of our $245 call example, was not an option. In this scenario there are two ways to close out the position, one complex and costly, the other simple and cheap.

Had you done nothing in your account by the close of expiration on June 16th, the call option would have been “assigned.” This means that in order to settle the covered call position, your broker would have actually sold 100 of your SPY shares at the strike price ($242) and credited the proceeds to your account. You most likely also would have incurred an “assignment” fee of somewhere around $20-$30.

By fulfilling your obligation to the call buyer in this way (you effectively allowed him to purchase 100 shares at $242 per share, as per the obligations of the contract) the call option is satisfied and removed from your account. At this point, if you wanted to reinstate your SPY position, you would have to repurchase 100 shares at the then-current price, and pay any associated commission costs.

This is the complex and costly way of closing out an in-the-money covered call position. Generally speaking, you are going to want to avoid this approach whenever possible. The easier (and cheaper) way of exiting this position is simply to buy back the call option that you had originally sold.

In this case, we know that there was $64 of intrinsic value in the $242 call option at expiration. This means that just before expiration (close of trading on June 16th) you could have purchased the same $242 call option for roughly $64 plus commission. This would have canceled out the original call option that you sold, removing it from your account.

It’s important to understand that both ways of settling this trade (either through assignment or by closing out the original option position) result in the same outcome in terms of profit/loss. The only real difference comes down to ease of use, and associated commissions/fees (assignment will always be more expensive).

In the prior installment I mentioned that covered calls are a great strategy for creating monthly income because we can continually sell one-month out options, allowing that time value to erode. Now that the June option has expired, we could easily go and sell a July covered call. The process would be identical to what we discussed previously.

For those of you who can see the merits of this strategy, but remain apprehensive to actually trade options, there is another alternative I wanted to make you aware of. Over the last few years a number of funds have come out which employ this strategy.

Our “Income Investor” specialist at Dow Theory Letters — Carla Pasternak — recently highlighted the Eaton Vance Tax Managed Buy-Write Opportunities Fund (ETV). This closed-end fund is actively managed and writes covered calls on a portfolio of S&P 500 and Nasdaq 100 stocks. It offers an 8.70% yield based on today’s share price, which is paid monthly.

Another ETF that I like is the Horizons Nasdaq 100 Covered Call ETF (QYLD). This fund — formerly Recon Capital — invests in the Nasdaq 100 and writes monthly covered calls on the index to earn income. It currently sports a 7.63% yield and also pays a monthly dividend.

The primary difference between the two funds is that ETV is actively managed while QYLD tends to operate on a programmatic approach for writing its options. As a result, ETV has a higher expense ratio at 1.09% vs. QYLD’s 0.60%.

There are other options as well if you take the time to look around. If you do decide to go this route, keep in mind that covered call strategies tend to do well in neutral, down, and mildly bullish markets. During periods of strong market performance, a covered call strategy will underperform the broader market, as it consistently sells away upside to other investors in order to lock in small but sustainable profits.

Subscribe to Dow Theory Letters here…