I recently sifted through many solar stocks looking for those that would benefit from the Inflation Reduction Act, which was left untouched by the debt ceiling negotiations. My favorite pick is Canadian Solar (CSIQ), writes Sean Brodrick, editor of Resource Trader.

The IRA provides economic incentives to manufacture solar materials in the US. It increases the tax credit to 30% (from 26%) for installations completed after Dec. 31, 2021, and that’s good until Dec. 31, 2032.

I found some companies that will benefit. However, none of those stocks with US solar manufacturing are giving “Buy” signals yet, though many are close.

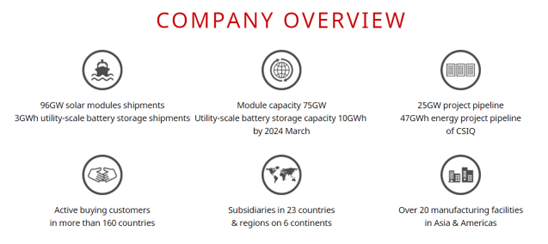

One that is already quite bullish is Canadian Solar. It’s a $2.8 billion market cap company that’s headquartered in Canada. It manufactures solar panels in Ottawa and has global operations, though most of its manufacturing is in China.

So, why is Canadian Solar looking so bullish? I can think of a few reasons …

• It’s inexpensive: Canadian Solar trades at just 1.37x book value, 0.81x earnings growth and 0.35x sales. Cheap, cheap, cheap!

• Sales are booming: In the most recent quarter, the company’s shipments increased 66% year over year. And the company's sales are likely to rise more than 40% this year as global demand shifts into higher gear.

• Earnings are ramping up, too: Canadian Solar’s earnings rose 198% last year to $3.37 per share. This year, they’re forecast to rise another 68% to $5.68 per share.

• It’s in the right part of the market: Canadian Solar focuses on large-scale utility projects, and demand for those is worldwide and increasing. In the US, 29 gigawatts of total solar capacity should be added this year. Europe is pouring money into solar as it tries to keep up. And globally, annual photovoltaic installations are forecast to increase by 15% until 2026, and capacity is expected to rise 24% until 2031.

Canadian Solar ended the most recent quarter with a 25-gigawatt backlog of projects. The company is ramping up manufacturing capacity to meet that demand.

Recommended Action: Buy CSIQ.