With increased risk of a flash crash, investors may want to allocate their portfolios like well-run endowments, with the largest portion in hedged strategies, asserts Axel Merk, of Merk Investments. First of two parts.

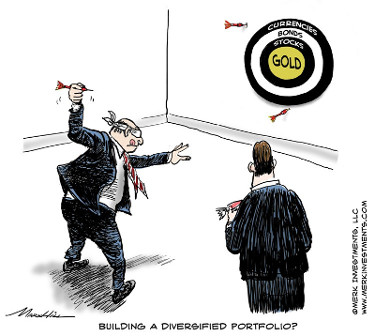

How does one construct a portfolio in an era of seemingly ever rising and highly correlated asset prices? Years of asset prices moving higher have changed both retail and institutional investors; it has changed the industry; and, in my humble opinion, those changes spell trouble. The prudent investor might want to take note to be prepared.

I allege that for many, investing is no longer about prudent asset allocation, but about expressing themes. If you like green technology, you tilt your portfolio towards green energy. If you are socially conscious, there’s an ETF for that. I have no problem with anyone allocating money to any specific theme. However, has anyone else noticed that it doesn’t matter what theme you allocate money to?

Investors are all playing the lottery and guess what: everyone’s a winner!

Now, clearly, that’s an over-simplification, as not every industry does well all the time. Just ask those who invested in MLPs (master limited partnerships) in pursuit of income from fracking. Let me rephrase: the more of a monkey you have been, i.e. the less you have been thinking, the better you’ve likely performed over the past nine years. “Buying the dips” has been a consistently profitable strategy.

That has created numerous oddities:

- Take the investor who diversifies, rebalancing part of a portfolio to near zero-income generating fixed income. Advisors pursuing such strategies have seen their clients take money away, as they are not willing to pay a management fee for essentially holding cash.

The problem: cash is discarded even if it may be a prudent investment choice.

- Take the investor who diversifies, rebalancing part of a portfolio to alternative income streams.

The problem: Anything that generates an income in a zero-income environment is, almost by definition, risky. That is, both stock and fixed income securities in such a portfolio are so-called risk assets, i.e. I believe they are likely to move in tandem, not providing desirable diversification in a downturn.

- Take the prudent investment advisor who has allocated part of a portfolio to true alternatives, such as long/short equities or long/short currencies. While providing diversification, such portfolios have likely underperformed during the relentless rise of equities. Worse, when the markets have had a hiccup, such as in early 2016, many of those portfolios still lost money, as the volatility of risk assets overwhelmed the cushion provided by the alternatives. Read: clients have been abandoning advisors, lured by competitors showing how great their performance has been, investing 100% in equities since the spring of 2009.

The problem: Those solicitations conveniently skip the inconvenient fact that their clients lost huge in 2008.

- Take the investor who wants to participate in the upside, but be protected on the downside.

The problem: they spend a small fortune buying insurance, even when they might be better off just holding a cash buffer (again, advisors don’t hold cash, as clients would withdraw that cash at some point).

- If many want to buy insurance, someone needs to write insurance. The one thing more profitable than buying stocks may well have been to write insurance. Funds that “sell volatility,” amongst others, have been amongst the best performers in the first quarter. Mind you, we do not recommend you touch any such product with a broomstick unless you know exactly what you are doing and able to stomach some serious losses. The theory behind many of these funds is that you collect what amounts to an insurance premium when volatility is low; the periods when you have to pay up are short and intense, but those setbacks are ultimately temporary.

The problem: Earlier this year, one such fund was in the news for substantial losses, not because volatility spiked, but because portfolio management got cornered when they tried to roll derivative contracts. Let’s just say: something that looks too good to be true, may well be. Interesting things may well happen (read “contagion”) if and when these positions unwind.

- Active management is dead. Long live passive investing. Never mind that anything but an index fund on the broad market is an active investment choice. The point being that you don’t want to pay some smart cookie to try to beat the market. That’s because those so-called experts were wrong in 2008 (and many times since). What can they possibly know? Besides, your favorite green tech investment fund is doing just fine, thank you very much.

The problem: Cautions provided by active managers help one frame possible risk scenarios. Managing risk is important, even if many risks never materialize.

- Active managers are leaving the industry. Who needs anyone skilled in navigating rough waters when you have robots providing liquidity?

The problem: it may be helpful to have a captain on board when the auto-pilot fails.

- Brokers are increasingly hand-holding relationship people, with portfolio allocation decisions being made by a small group creating model portfolios. After all, why risk your job trying to go out on a limb for your client?

The problem: there’s nothing wrong per se with this trend, except that it increasingly concentrates investment decisions for huge amounts of money into very few people. We hope they are smart. Importantly, we hope investors understand who makes the investment decisions and what the conflicts are. Let’s just say: when something goes wrong, class action lawyers will have their day in court.

- An increasing number of investors are skipping advisers altogether. After all, why not cut out the middle man if they don’t know any better than you do?

The problem: there’s no problem with do-it-yourself investing except, just as professionals, investors owe it to themselves to make prudent investment decisions. We think that many individual investors do a better job than some professional investors these days in allocating their money. That said, that’s a very low bar.

- If you have enough money, you allocate some money to venture capital. At least you have something to talk about at cocktail parties. It might help if you knew what your venture capital fund invested in, but let’s not get distracted by details.

The problem: no problem if you can afford it. May I suggest, though, that you first try to understand your overall portfolio, before you dabble in illiquid investments?

What could possibly go wrong?

Quite simply, markets do go down, not just up. In my view, there is an increased risk of a flash crash in an environment where we are ever more dependent on automated liquidity providers that might withdraw liquidity the instant there’s an anomaly in the market. (Read: if you place a market order to sell a security, don’t complain if the market price is dramatically below the most recent trade on an exchange.)

While regulators may be all over flash crashes and possibly bail you out by canceling your order, a more pronounced decline is something you might want to prepare for as well. We hear pundits proclaim that we cannot have a bear market unless there’s a recession. There are couple of problems with that:

- First, it’s not true. There was no recession during the October 1987 crash.

- Second, we often don’t know whether there’s a recession until we are well into it; there have been instances when we didn’t know there was a recession until it was over.

- Third, we’ll only know we are in a “bear market” when the market is down 20%. That’s kind of late to prepare for a bear market. Except, of course, if the market tumbles much more than that, such as the Nasdaq after 2000; or the S&P 500 in 2008.

Next week: Is there a better way?