The market has three lifelines. With the Fed abandoning it, one lifeline is gone. The ECB and the GOP are the other two, asserts Don Kaufman, Co-founder of TheoTrade.

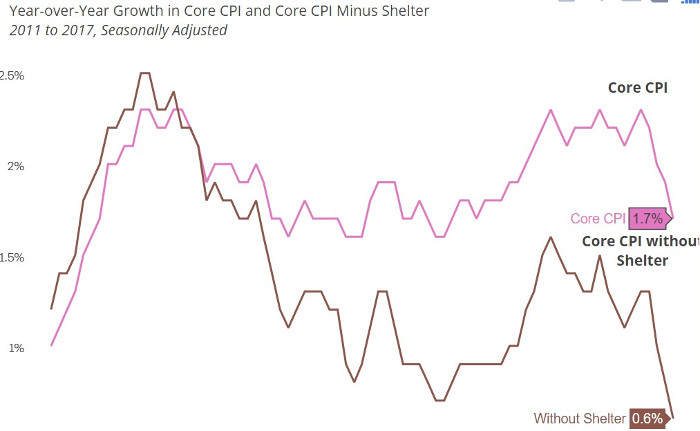

The chart below provides further evidence for the point I keep harping on: inflation is declining, yet the Fed is ignoring reality and focusing on the possibility of wage inflation in the future. This chart breaks down the difference between core CPI and core CPI without shelter.

Rent costs are the highest percentage of GDP ever. Without the increase in rent costs and housing prices, core CPI growth would only be 0.6%. This is the devil’s advocate approach to when Janet Yellen complains about the disinflation in telecommunication prices and drugs. I haven’t done specific research into those industries, but it does look like shelter price growth will decelerate because there was an overbuilding of apartments. If shelter prices decelerate, core CPI will crash.

The Fed keeps focusing on how wage growth could perk up. If jobless claims and the unemployment rate are low now, I don’t see where the balance will switch pushing wage growth higher. The labor market is already tight. There isn’t much room for it to get tighter if you look at the establishment reports. I think there are two reasons for the lack of wage growth which the Fed isn’t understanding. The first is that incremental capex isn’t providing many returns for firms, so they’d rather hold cash on their balance sheets instead of investing in paying workers more. Secondly, there aren’t enough qualified workers to work in the well-paid jobs, so they go unfilled. There are a lot of unskilled workers looking for jobs after the manufacturing sector hemorrhaged jobs in the past and the retail sector is hemorrhaging them now.

This is why the minimum wage became such a big political talking point. More workers are trying to raise a family on these low wage jobs because the other low-skilled jobs which offered higher pay are disappearing. Firms will always try to lower costs where they can. If workers aren’t adding to the bottom-line, they will be cut. It’s up to personal responsibility to get yourself a better education. The problem some of these people face is the cost of college. In the most recent data, college matriculation has dipped a bit because of these high costs. If you are an older American who lost your job in manufacturing, college expenses have become impossible to afford.

To be clear, when the Fed says it thinks wage inflation will increase, it’s saying wage growth will be so high, it will make up for the commodity deflation. The way I back into that assertion is that the Fed doesn’t have a case for why commodity prices will suddenly rally. Claiming that will occur would be more likely than a large jump in wage growth, but the Fed would look be painfully wrong as commodities have crashed.

When the Fed says wage inflation will go up, it doesn’t look that bad because it has merely been stagnant.

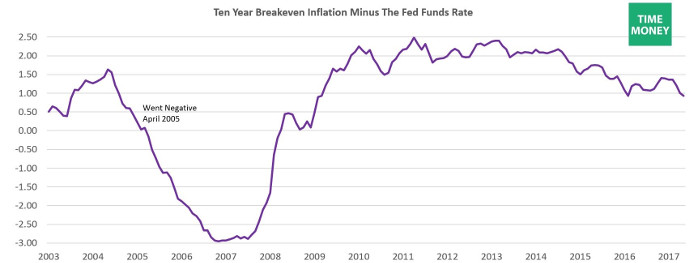

The chart below compares the 10-year breakeven inflation rate with the Fed Funds Rate. When the Fed Funds Rate gets above the 10-year breakeven inflation rate it means the Fed is hawkish. In the last two cycles, a hawkish Fed meant the cycle was over. The record corporate debt to GDP likely means that trend would continue in this cycle. With the difference currently at 0.93%, the Fed would either have to raise rates 4 more times or inflation would have to fall to its 2016 rate and the Fed would have to raise rates twice for this difference to go negative which would signal an impending recession.

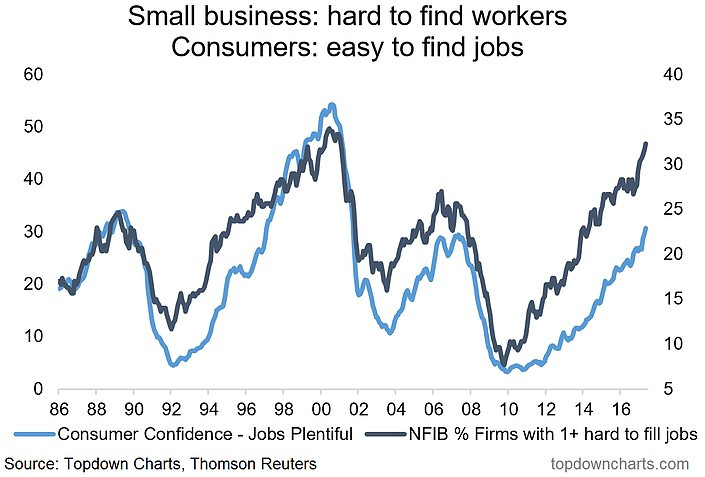

The chart below explains what the Fed is looking at regarding the labor market being tight. The consumers are saying jobs are easy to find at the same rate they were saying that in 2007, but wage growth is lower now. The NFIB survey asking small businesses if jobs are hard to fill is even higher than 2007 as it approaches levels seen in the early 2000s, even though wage growth is much lower than it was in the early 2000s. The fact that the “hard to fill” indicator has risen more than the “easy to find” indicator supports my point that workers aren’t qualified for the jobs available.

Unlike in past cycles, where the hard to fill indicator meant wages were going up, now it means there are a lot of well-paying jobs where the employer doesn’t find anyone to do the job. Some of the workers who aren’t qualified for these great jobs may be the ones saying jobs aren’t easy to find. The easy to find indicator is remarkably low if you compare it to how tight the jobless claims metric is saying the labor market is.

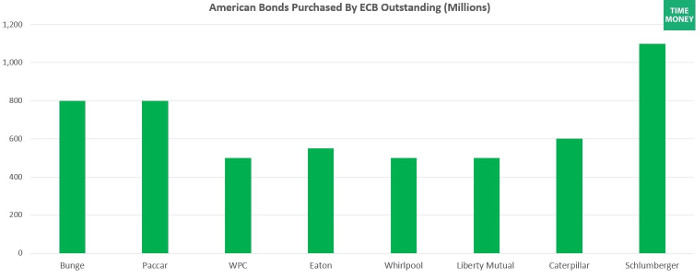

Speaking of the central banks acting irrationally, I want to touch on a point I didn’t mention in my last article about the ECB’s bond-buying program. Just like how the Swiss Central Bank is getting involved with American markets by buying stocks in its largest firms, the ECB has purchased some corporate bonds of American firms. With the ECB searching for yield, it may start to buy more American corporates.

The chart below shows the firms they have picked so far. While the ECB has only bought 11% of the potential bonds in its universe, its practice is encouraging investors to speculate in bonds, driving spreads to the tightest rate since 2007. The ECB indirectly influences the American market by buying its European bonds because investors flee to the higher yields American firms have. This new process of buying American bonds makes the effect direct. If the ECB extends its program in December, it will be a proxy for the Fed as the Fed’s unwind will be a mirage.

Conclusion

The disinflation is back, but the Fed is still using the reflation trade of 6 months ago and future potential wage growth increases as a reason to be hawkish.

The financial conditions will depend on what the ECB does with its $60 billion per month bond buying program. If the ECB ends the program and the fiscal policy stimulus the GOP is promising doesn’t get done, the market could crash in 2018.

The market has three lifelines. With the Fed abandoning it, one lifeline is gone. The ECB and the GOP are the other two.