In currency trading, we need only concentrate on two things: the consensus rational and the potential for surprise to the consensus rationale, asserts Jack Crooks of Black Swan Capital.

Get Trading Insights, MoneyShow’s free trading newsletter »

Quotable

“Those who have knowledge, don’t predict. Those who predict, don’t have knowledge. “

—Lao Tzu, 6th Century BC

I shared this seemingly simple equation with you recently; and today I would like to add a few comments and delve deeper:

The currency equation of expected total return:

↑Expected Total Return = ↑Interest Yield + ↓Inflation + ↑Future Exchange Rate

This equation says the primary rationale for holding a particular currency is to maximize total return, and expected total return is a function of the real yield achieved (nominal interest rates minus the inflation rate) and the future exchange rate (that which we are trying to forecast).

Do rising real yields cause the exchange rate to rise? Or is it a rising exchange rate, impacting the fundamentals, which leads to rising yields?

In the real-world prices are driven by a tangled web of rationales which manifest into a complex array of feedback loops. I think this explains why it is so painfully difficult to determine which variables lead and which follow in a supposed correlation. The word “supposed” is used because correlation is not causality; and worst still, causality itself is suspect as Sir Karl Popper explains (below).

I could give you plenty of examples of when a currency’s relative yield dropped, yet the currency soared, and vice versa. It is rarely an A+B=C causation (though I plead guilty at times pretending it may be that simple).

In fact, if you were to stop and calculate the odds of forecasting correctly based on your inherent A+B=C causality mindset, you might start to question the efficacy of ever forecasting again.

“In chess, there are 400 different possible positions after the opening two moves. There are 72,084 move combinations after each player has made two moves and over 288 billion scenarios after four moves each. The Shannon Number, which represents a conservative lower bound of the game-tree complexity of chess (the total possible move variations), is thought to be between 10^111 and 10^123. By comparison, there are 10^81 atoms that make up the known universe. I think we can all agree that national and global markets and economies are far more complex than chess. So tell me again why you think you can predict what will happen next in the markets or in the economy….”

—Bob Seawright, The Prediction Game

Maybe we should stop looking for causality as a source of confidence for our forecasts; especially if our causality flows from deductive reasoning.

Why we cling to beliefs

Karl Popper, a German philosopher, referred to the black swan in his 1953 essay on The Problem with Induction. Induction application in the financial world is best known as “back testing.” Reading Popper gives one a deeper understanding of why we cling to beliefs so tightly and assume we can confidently project our expectations into the future and be confident we will be right.

Popper was fond of the philosopher David Hume and used his reasoning for much of the basis of his argument about induction, carrying it further. Popper wrote [my emphasis]:

But Hume held, at the same time, that although induction was rationally invalid, it was a psychological fact, and that we all rely on it. [We do rely upon it in our everyday life and it serves us well in lots of areas. But because “every moment in the market is unique” it serves us less well there.]

Thus, Hume’s two problems of induction were:

The logical problem: Are we rationally justified in reasoning from repeated instances of which we have had experience to instances of which we have had no experience?

Hume’s unrelenting answer was: No, we are not justified, however great the number of repetitions may be. [The point here again each moment in the market is unique; it’s may rhyme with the past, but there are differences.]

And Hume added it did not make the slightest difference if, in this problem, we ask for the justification not of certain belief, but of probable belief. Instances of which we have had experience do not allow us to reason or argue the probability of instances of which we have had no experience, any more than to the certainty of such instances.

The following psychological question: How is it that nevertheless all reasonable people expect and believe that instances of which they have had no experience will conform to those of which they have had experience? Or in other words, why do we all have expectations, and why do we hold on to them with such great confidence, or such strong belief?

Hume’s answer to this psychological problem of induction was: Because of custom or habit; or in other words, because of the irrational but irresistible power or the law of association. We are conditioned by repetition; a conditioning mechanism without which, Hume says, we could hardly survive.

Okay! I realize this is getting thick, hang in there, almost there.

Popper agreed with the first part of what Hume talked about; the logical problem. But Popper couldn’t accept the irrationality of the second part—the psychological problem.

It is here where we get to the black swan. Popper posed that yes we must use experience of past instances to advance our knowledge but we must accept the fact that just because so many past instances were effectively consistent, or the same, it does not therefore mean a theory based upon those past instances has been proven. The reason he says this is because there may be some future instance out there which invalidates all that has come before it, and it only takes one such instance to do that. Therefore, all theories can be falsified, but they cannot be proven simply by past experience.

…Or in other words, from a purely logical point of view, the acceptance of one counter instance to the view that, “All swans are white,” implies the falsity of the law “All swans are white”—that law, that is, whose counter instance we accepted. Induction is logically invalid; but refutation or falsification is a logically valid way of arguing from a single counter instance to—or, rather, against—the corresponding law.

This logical situation is completely independent of any question of whether we would, in practice, accept a single counter instance for example, a solitary black swan in refutation of a so far highly successful law. I do not suggest that we would necessarily be so easily satisfied. We might well suspect that the black specimen before us was not a swan. And in practice, anyway, we would be most reluctant to accept an isolated counter instance. But this is a different question. Logic forces us to reject even the most successful law the moment we accept one single counter instance. [Thus, can there ever be a market “theory”?]

The theory, or law, that all swans were white was falsified once a black swan living in Australia was discovered. Till then, everyone knew all swans were white. Done deal!

Of course, everyone knew Triple AAA-rated tranches of securities were safe—they had been in the past. Everyone knows municipal bonds will be fine because the default rate has always been low in the past. Everyone knows that gold is the only real money. Everyone knows inflation is a monetary phenomenon. Everyone knows the dollar must go down. Everyone knows that China will rule the world soon.

We could go on and on into infinitum with what everyone thinks they know. But interestingly, the things we seem to think we know often don’t even have the consistent instances of induction in their favor. We cling to ideas in the financial world that have been falsified before but seem to gather a second life. This isn’t even close to the word logical. But customs and habits are powerful motivators.

The Sufi summarizes Popper

“There is an old Sufi tale about a mullah (Nasruddin) who was discovered by a passer-by searching in the dust outside his house. What was he looking for, the stranger inquired? A key, said the mullah. Where did he drop it? “In the house” replied the mullah. Then why was he looking in the dust outside? Because here he was in bright sunlight, whereas in the house it was dark and difficult to see.

“It happens to us all the time. The solution to worthwhile problems is never out there in the open. The key to financial markets is elusive. It must be so, by definition. The price-discounting mechanism ensures that the majority are always looking out there in broad daylight, when the key is somewhere else, in the shadow.”

“Finally, one had to see if there were other relationships which had any predictive value for currencies like inflation, trade, money supply, oil prices, economic growth, et al. So far, the conclusion is that few such relationships and none of the relationships that most observers seem to rely on are useful for predicting the dollar.”

—John Percival, The Way of the Dollar

I think this is where the trend followers get it right. They don’t try to explain all (or any) of the reasons why prices are heading in a certain direction; they simply want to “ride the bucking bronco” for all its worth, to quote Dunn Capital Management’s founder Bill Dunn.

So, we started off with a seemingly simple and sensible equation. But in this short time, I think I have shown it is neither simple nor sensible.

So where does this leave us?

I am not sure where it leaves you. But it leaves me with a few conclusions:

“It’s tough to make predictions, especially about the future.”

―Yogi Berra

Currency trading, unlike other asset classes, is primarily a sentiment-driven vehicle. Sentiment analysis should be the primary focus of currency analysis. [Tao of Markets]

And though we should monitor things like yield differential and economic growth and capital flows closely, we should not attempt to forecast that stuff. Let others do all the forecasting. We need only concentrate on two things:

--the consensus rational

--and potential for surprise to the consensus rationale.

“Our success or failure will rest on our ability to anticipate prevailing expectations and not real-world developments.”

—George Soros, The Alchemy of Finance

If what you are doing (your edge) works for you, then don’t let anyone tell you what you are doing is flawed.

The upshot: Avoid, or at least be very suspect, of those who hold themselves out as experts. Experts, or gurus, have no better handle on what the future will hold than you do. The difference is the experts make a lot more predictions about the future; then they selectively highlight the ones which panned out; the ones that didn’t they hope will slide down the memory hole.

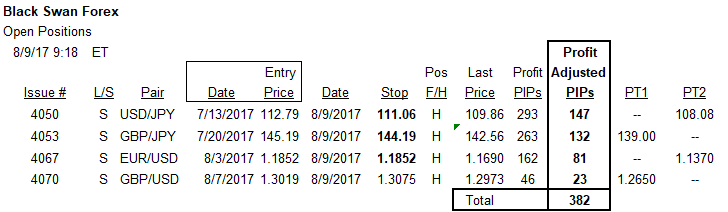

Our guesses about the future have been working out well lately. Our positioning (below) was primarily based on our expectation the crowd was becoming too bearish on the dollar (sentiment)…

*F=full position/H=half position

*F=full position/H=half position

View Currency Currents, commentary, and a sample of Black Swan Forex at Black Swan Capital here…