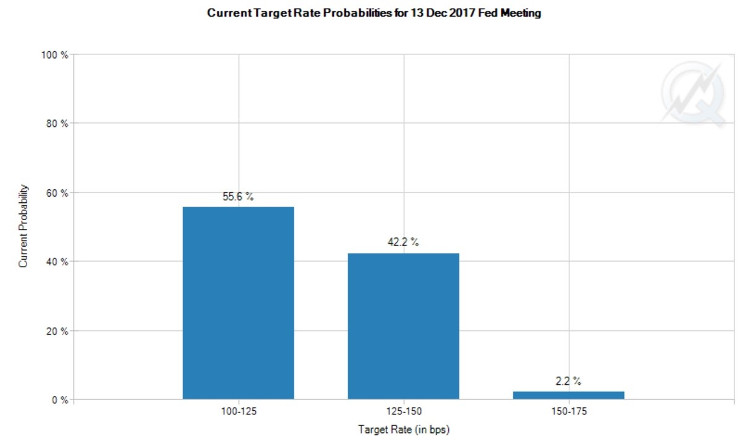

The market is pricing in a 44.4% chance of at least one hike. If Yellen hikes, she will be known as more of a hawk and if she doesn’t she will be thought of more as a dove, asserts Don Kaufman, Co-Founder of TheoTrade.

Get Trading Insights, MoneyShow’s free trading newsletter »

Jackson Hole is a town in Wyoming which hosts an annual conference in late August hosted by the Kansas City Fed. The conference is held there because chairman Volcker liked fly fishing. In the last 10 years, the conference has gone from a meeting place for academics to a media frenzy.

The reason for this change is the advent of forward guidance. The Fed didn’t even make statements in the past. Now it makes statements which have more importance than policy changes. The reason is only a certain number of changes can be made at one meeting, but guidance affects policy for many meetings. Each public appearance by a FOMC member moves markets. This change can be interpreted in two ways.

The first is the Fed has become more transparent. Many critics of the Fed have said in the past that the Fed needs to tell the world what it’s thinking to avoid shocks. It holds a lot of power, so many want to know what it thinks of the economy to better guess where policy will go.

The other benefit is that the market can push back on policy which it feels goes too far before the decisions are made. The stock market sold off in 2015 and 2016 at the prospect of accelerated rate hikes, preventing them from occurring. In a sense, the market controls what the Fed can do. That gives some investors satisfaction because it means the Fed won’t go rogue. On the other hand, always appeasing the stock market isn’t a great idea because the market might want perpetually easy conditions which could cause asset bubbles.

Looking at the negative side of this open mouth policy, the Fed can end up talking too much, confusing investors. There are members of the FOMC with different opinions on policy, so there won’t be a consistent message.

The market can adjust for members’ biases, but it’s easy to mess up. One wrong word and the market can rise or fall. That’s not a free market. It’s a market that ignores the fundamentals of the economy and focuses on the Fed. That can lead to a deadly spiral because if the market only focuses on the Fed and the Fed tries to appease the market, then we have circular reasoning which leaves out the economy and corporate profits.

Jackson Hole is usually important unless there isn’t a major speaker. This time Draghi and Yellen spoke on Friday, so it is important.

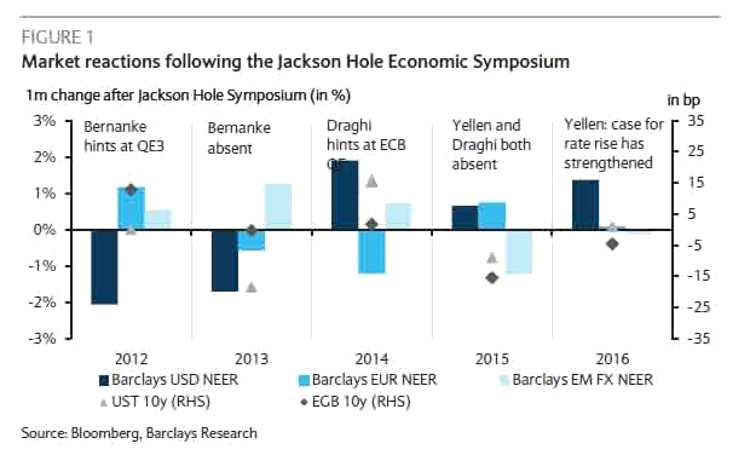

The chart below shows the historically significant policy changes made at the Jackson Hole Economic Symposium. As you can see, last year was important because Yellen hinted at the possibility of more rate hikes. That translated into a late 2016 hike and two more hikes in early 2017. Since then we’ve seen a pause in hikes as the market prepares for the start of the unwind.

The most important aspect of Yellen’s speech might be the fact that she probably will be done with her job in 6 months. This is probably her last Jackson Hole event as chair. There is a human element to leaving a job which you worked your whole life to get. She’s about to go from one of the most powerful people in the world to someone with almost no influence if Trump pushes the Fed in a different direction.

After the Fed starts to unwind the balance sheet in October, I think the discussion will mainly be on who Trump could appoint. While Trump’s volatile tweets haven’t affected the market much, they could have a major impact if he says something on monetary policy which spooks the market. That’s something to watch for in the winter.

In my opinion, we know everything about what the Fed will do with the unwind except what the terminal balance sheet will be. The end of the unwind will be in 2-4 years. The other policy discussed will be the potential rate hike in December. Oddly, the market thinks there’s a possible rate hike coming in December, but gets cautious in 2018.

The chart below shows that the market is pricing in a 44.4% chance of at least one hike. The market will change these odds if Yellen indirectly addresses it. This is her last major decision, so whatever it is will put a final stamp on her legacy. If she hikes, she will be known as more of a hawk and if she doesn’t she will be thought of more as a dove. The other obvious legacy item for her is the fact that she started the unwind. She started the policy change, unlike Bernanke who didn’t get any hikes in before Yellen took the helm in 2014.

Normally, changes at the Fed don’t have huge divergences. The transition from Bernanke to Yellen was very smooth because both were on the same page.

The next transition probably won’t be as smooth because Trump is a populist who hates technocrats. Yellen may alter her decision-making process based on this change. The problem for her is she doesn’t know if the next chair will be a hawk or a dove. The only thing she knows is he/she will rein in regulations. That won’t move markets because her time as a regulator is almost done.