On many occasions the currency market acts first, then the others follow suit. Thus, markets trading near significant highs (namely oil and stocks) could be particularly vulnerable to a resurgence of the greenback, asserts Carley Garner, Senior Strategist for DeCarley Trading.

Get Trading Insights, MoneyShow’s free trading newsletter »

U.S. corporations and commodity producers have enjoyed a relentless decline in the greenback throughout 2017 but nothing good lasts forever.

Taking a step back to look at a weekly chart of the dollar reveals the downtrend has reversed precisely where it should have based on conventional technical analysis.

Further, it will likely see an upswing as the pendulum reverts back toward an equilibrium level and as is normally the case, it will likely overshoot that level.

Advertisement

Remember, market prices are the result of the collective opinions and reactions of humans which tend to be emotional creatures. Things are never as bad as they seem near the lows and they aren’t as great as they seem near market highs. Reality lies somewhere in the middle. In this case, the dollar is probably more valuable than the market has accounted for at this time.

Weekly US Dollar Index Futures chart

The December U.S. dollar index futures contract forged a fresh multi-year low on September 8 in dramatic fashion.

It was the victim of a high-flying euro currency and the communal opinion that the greenback was no longer a safe-haven currency. Yet, as previously mentioned, markets tend to overreact before cooler heads prevail. In hindsight, it is clear the 91.00 area offered massive trendline support.

In addition, the move to such levels left weekly oscillators such as the RSI (Relative Strength Index) at dramatically oversold levels. In short, there was nowhere for the dollar to go but up (it is a lot easier to see this after the fact than it was for those caught on the wrong side of the move to see in real-time).

Now that the tides have begun to turn we believe the momentum will continue. The dollar index likely won’t run into meaningful resistance until it reaches the high 90s and if emotional trade takes hold we wouldn’t be surprised to see a full retest of the 100 area.

What will a stronger dollar mean?

Fluctuations in the currency markets are often overlooked and underestimated by both commodity futures and stock traders.

This is a big mistake. Ebb and flow in the dollar value has a direct and nearly unavoidable impact on the value of stocks and commodities. For example, over the previous 180 trading days the correlation between the U.S. stock indices and the U.S. dollar index futures has been a negative 88% relationship. This means that almost 90% of positive closes in the stock indices have been met with negative closes in the dollar, and vice versa.

As you’ve probably realized, if the dollar does begin making its way higher it will be a major headwind for the equity markets.

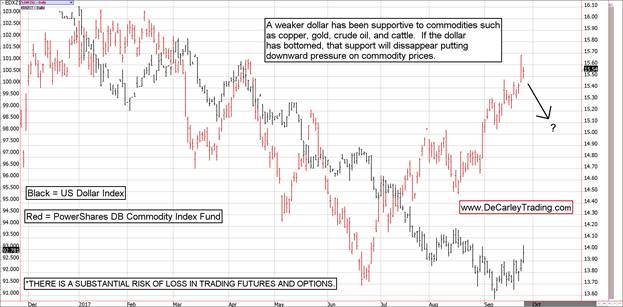

On the commodity side of things, the impact of a stronger dollar varies by commodity but most of the commonly tracked commodities suffer at the hands of a stronger dollar.

Specifically, copper and gold futures have traded inversely to the dollar 65% - 70% of the time this year.

Crude oil, on the other hand, has been reacting to natural disasters and OPEC headlines, which has weakened the historically negative correlation it has with the greenback. In fact, when looking at the last 180 trading days oil and the dollar have been moving together. Nevertheless, narrowing the data to the most recent 30 trading sessions the two markets are negatively correlated by about 35%. In short, despite recent deviations from the norm, a significantly stronger dollar will likely work against the oil rally, or at minimum give it pause.

Conclusion

Whether you are trading stock indices, commodities, or both, understanding the correlation between currencies and asset prices and reacting accordingly can make a significant difference in trading account performance. On many occasions the currency market acts first, then the others follow suit. Thus, markets trading near significant highs (namely oil and stocks) could be particularly vulnerable to a resurgence of the greenback.

There is a substantial risk of loss in trading commodity futures, options, ETFs. Seasonal tendencies are already priced into market values.

Subscribe to e-newsletters by Carley Garner at www.DeCarleyTrading.com.