Recommended trade: Buy EEM at $44 or lower and write covered calls expiring on 11/17/2017. Choose the strike price with the most time value. At-the-money calls should fetch at least $1.07, asserts Marvin Appel, MD, PhD, of Signalert Asset Management.

Get Trading Insights, MoneyShow’s free trading newsletter »

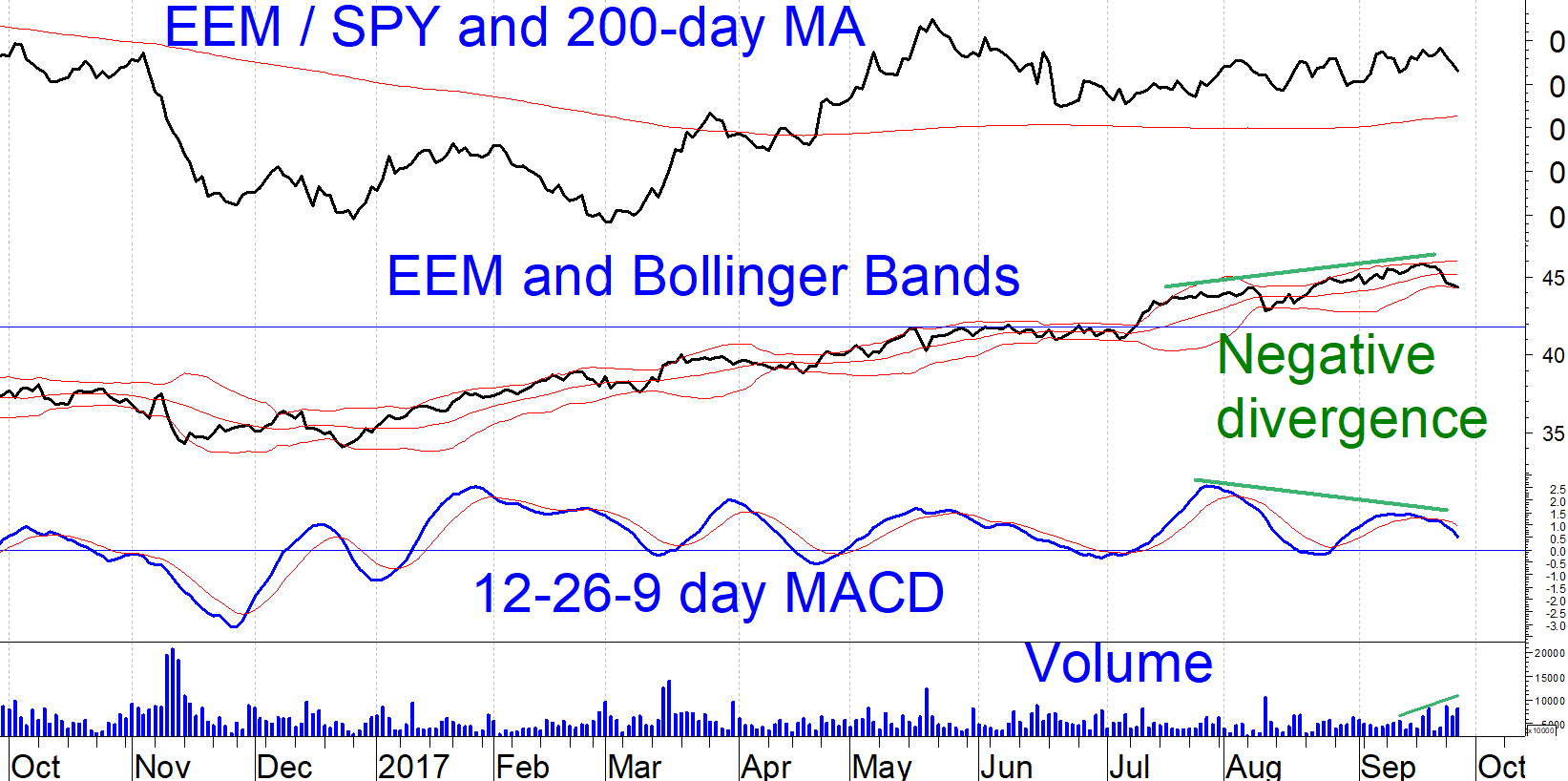

Emerging markets have sold off since September 19, with the iShares MSCI Emerging Markets Index ETF (EEM) off 3%. The chart above shows that EEM has fallen to its lower Bollinger band.

Advertisement

The recent decline is part of an intermediate-term loss of momentum highlighted by the negative divergence between EEM and its MACD. Specifically, although EEM made a new price peak in September, its MACD turned lower before matching its late July peak.

In the current overall favorable market climate, the negative divergence is not a sign of a significant impending correction. Rather, it suggests that EEM is in for a period of consolidation or limited further declines. I recommend bottom fishing with a covered call position.

The September 26 close at $44.50, at the lower Bollinger band, is a likely support area. The next potential support areas below that are $43, which is the area of the August 10 low, and $41.75-$42, which is area that was resistance for EEM in May and June.

Recommended trade: Buy EEM at $44 or lower and write covered calls expiring on 11/17/2017. Choose the strike price with the most time value. At current levels of option implied volatility, at-the-money calls should fetch at least $1.07.

Subscribe to investment newsletter Systems and Forecasts here…